Automotive Market in India – A Fresh and Unique Analysis

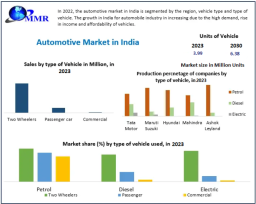

The Automotive Market in India, recorded at 3.99 million units in 2023, is poised to reach 6.38 million units by 2030, expanding at a CAGR of 6.94%. India is one of the world’s fastest-growing automobile hubs, supported by a young population, rising disposable income, evolving mobility needs, policy reforms, and technological advancements in both conventional and electric vehicles.

Overview of the Automotive Market in India

The Indian automotive sector includes the manufacturing, distribution, and sale of motor vehicles such as passenger cars, two-wheelers, commercial vehicles, and three-wheelers. Vehicles in India are diversified based on function, size, fuel type, and design. With rapid economic growth and increasing urbanization, the country has witnessed strong demand for mobility solutions across urban and semi-urban regions.

The market is shaped by:

Comprehensive market assessments — including SWOT, PESTLE, and Porter’s Five Forces — highlight the sector’s potential for sustained expansion despite regulatory and environmental challenges.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/86126/

Market Dynamics

India’s expanding middle class and a young consumer base have significantly increased vehicle ownership. Two-wheelers remain the mobility backbone, while demand for compact cars and SUVs continues to rise due to convenience, affordability, and aspirational lifestyles.

India’s rapid urban growth has boosted the requirement for efficient transportation. As cities expand, consumers prefer personal vehicles for convenience and safety, contributing to stronger automotive sales.

Policy initiatives under FAME II, Make in India, and Atmanirbhar Bharat encourage domestic manufacturing of vehicles and components, including lithium-ion batteries, EV drivetrains, and software systems.

Additionally, the Automotive Mission Plan 2016–2026 provides a roadmap to strengthen India as a global automotive manufacturing hub.

India has emerged as a key exporter of two-wheelers, compact cars, and commercial vehicles. Between April and June 2021 alone, exports reached 1.41 million units, highlighting India’s growing global footprint.

Adoption of electric vehicles, ADAS systems, autonomous-driving components, and connectivity solutions requires high investment. This increases the cost of production and limits mass affordability.

Large Indian cities face severe air pollution, prompting stricter norms such as:

While these policies improve safety and sustainability, they also increase manufacturing costs.

Rural regions still lack proper road infrastructure, limiting the smooth penetration of vehicles. Road safety measures and enforcement need improvement, especially for commercial transport sectors.

India accounts for 40% of the global US$31 billion engineering and automotive R&D spend. The focus is shifting toward:

Growing environmental awareness and government subsidies are encouraging EV adoption. The rise of wiring harnesses, sensors, battery packs, and control units is driving demand for localized auto component production.

IoT-enabled cars, telematics, advanced diagnostics, and remote vehicle control features are becoming integral to new vehicle launches, supporting the growth of India’s connected car ecosystem.

Rising Air Pollution and Regulatory Pressure

India’s air pollution levels remain among the highest globally, especially in cities like Delhi, Mumbai, and Kolkata. To combat this, the government has:

With India projected to become the world's most populous nation, traffic volume and vehicle density are increasing, pushing the need for efficient, cleaner mobility platforms.

Segment Analysis

Two-wheelers account for the largest share due to:

Top players: Hero MotoCorp, Bajaj Auto, Honda Motorcycle, TVS Motor

Demand is led by motorcycles, followed by scooters and mopeds.

Urbanization, increasing income levels, and lifestyle changes are boosting sales of:

SUVs remain the fastest-growing category driven by comfort, safety, and versatility.

Growth is fueled by expansion in logistics, construction, and e-commerce.

Segment includes:

Key manufacturers: Tata Motors, Ashok Leyland, Mahindra & Mahindra, Eicher Motors

Petrol-powered vehicles dominate due to:

Preferred in:

Growing rapidly under government push for clean mobility and rising fuel prices.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/86126/

Regional Insights

North India

West India

South India

East India

Competitive Landscape

India’s automotive market is highly competitive with strong domestic and global participation.

Key players include:

Tata Motors leads the passenger car and commercial vehicle space, while Maruti Suzuki dominates mass-market car sales. Global automakers such as Hyundai, Toyota, and Volkswagen are expanding manufacturing capabilities to strengthen their presence.

Conclusion

The Automotive Market in India is positioned for steady growth backed by economic development, technological innovation, and government-led initiatives. While challenges such as pollution, infrastructure gaps, and rising production costs persist, India’s push toward electrification, connected vehicles, and R&D expansion will shape the sector’s next phase.

The transition toward cleaner, smarter, and more efficient mobility is expected to define India’s automotive landscape through 2030.

| No comments yet. Be the first. |