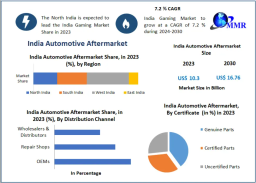

The India Automotive Aftermarket is entering a high-growth phase, supported by expanding vehicle ownership, rising consumer expectations, technological disruption, and increasing demand for quality replacement parts. Valued at USD 10.3 billion in 2023, the market is projected to reach USD 16.76 billion by 2030, growing at a CAGR of 7.2%. With India’s vehicle parc already touching 340 million units and expected to grow at 8% annually, the aftermarket sector is poised for long-term expansion.

India’s automotive aftermarket demand is intrinsically tied to the size and age of the vehicle parc. Two-wheelers and passenger cars—India’s dominant mobility categories—are set for robust expansion over the next few years:

Two-wheeler parc: Expected to rise from 257 million to 365 million units.

Passenger vehicle parc: Projected to increase from 47 million to over 72 million units.

This exponential rise is bolstered by strong sales momentum. As of January 2024, total automotive sales grew 15% year-on-year, creating a larger base of vehicles requiring periodic maintenance, repair, and enhancements—feeding directly into aftermarket demand.

Find out where the real opportunities lie! Get your free report sample today by clicking here:https://www.maximizemarketresearch.com/request-sample/29939/

India’s pre-owned car market is undergoing a structural transformation, growing at a projected CAGR of 17.5% by FY2030. Organized players and digital platforms have brought transparency and trust to used-vehicle transactions, increasing vehicle refurbishment and maintenance activities.

This shift is generating significant incremental demand for:

Replacement parts

Diagnostics and servicing

Tires, batteries, filters, and brake components

Cosmetic upgrades and accessories

As more customers choose used vehicles over new ones, the aftermarket will witness increased spending per vehicle.

The Indian aftermarket ecosystem is not only expanding domestically but also tapping into lucrative global opportunities. Ten major markets—Indonesia, Latin America, Poland, Brazil, Columbia, Bangladesh, and emerging African nations—are identified as high-potential export destinations.

Demand from these regions is driven by:

India’s competitive manufacturing costs

Global supply chain diversification

Strong acceptance of Indian components in emerging markets

This global focus is expected to accelerate revenue generation for established Indian players in tires, batteries, lighting, and engine components.

A notable trend is the migration from traditional sales channels to digital-first distribution models. E-commerce and online B2B marketplaces are now key enablers for rapid distribution of replacement components.

OEMs are forming strategic partnerships with online platforms—e.g., Bosch’s collaboration with TMall, which generated $290 million in GMV—to reach a wider customer base and streamline logistics.

The dominance of wear-and-tear parts is gradually reducing, as improved product quality extends replacement cycles. Meanwhile:

Demand for diagnostics, predictive maintenance, and software-driven services is rising rapidly.

Connected vehicles are enabling real-time monitoring through IoT sensors.

Data-driven servicing is emerging as a major revenue stream.

The rise of electric vehicles and advanced driver assistance systems (ADAS) is reshaping the aftermarket landscape.

Emerging opportunities include:

EV charging accessories & retrofits

Battery management systems

ADAS calibration services

Sensor replacement and diagnostics

Technological complexity is increasing dependency on specialized aftermarket players.

With strong rural demand, improved agricultural income, new model launches, and positive economic sentiment, two- and three-wheelers, passenger cars, and tractors are witnessing steady sales growth. Every new vehicle added to the streets guarantees recurring aftermarket revenue for 8–15 years.

Increasing urban commutes, rural connectivity projects, and logistics expansion are leading to higher annual vehicle running—driving faster part replacements.

Consumers are opting for premium, certified, and branded aftermarket parts, raising the value per repair and boosting revenues of organized players.

Despite enormous potential, the market faces challenges due to a stringent regulatory framework involving:

Emission and safety standards

BIS and AIS certifications

Manufacturing compliance

Frequent regulatory updates

While these regulations ensure product safety, they also increase compliance costs and deter smaller participants, potentially reducing innovation.

Technological advancements are creating multi-billion-dollar opportunities through:

Remote diagnostics

Predictive maintenance

OEM-grade telematics-based servicing

Charging solutions

EV-specific lubricants

Battery recycling services

Consumers are increasingly adopting aftermarket ADAS features such as lane assist and collision alert systems.

These innovations support:

Custom accessories

Rapid prototyping

Performance enhancements

The aftermarket is evolving from a parts-replacement ecosystem into a technology-driven vehicle enhancement industry.

The tire segment dominated in 2023, supported by:

India’s massive two-wheeler base

Frequent tire wear due to road conditions

Rapid expansion of commercial logistics

Major players are investing heavily in product innovation and distribution expansion.

Batteries

Brake parts

Filters

Body parts

Electronic components

Exhaust and turbocharger systems

Find out where the real opportunities lie! Get your free report sample today by clicking here:https://www.maximizemarketresearch.com/request-sample/29939/

Delhi-NCR, Uttar Pradesh, Punjab, and Haryana lead the country due to:

Highest vehicle density

Thriving logistics industry

Strong two-wheeler and passenger car demand

Maharashtra, Gujarat, and Rajasthan witness strong aftermarket demand due to:

Industrial hubs (Gujarat)

Automotive clusters (Pune, Aurangabad)

High disposable income in urban centers

Both regions are expanding steadily, supported by ongoing urbanization and rising penetration of organized service centers.

Bosch India

TVS Group

Mahindra & Mahindra

Exide Industries

Tata Motors

Minda Industries

Amara Raja Batteries

Ashok Leyland

Hero MotoCorp

Maruti Suzuki

Motherson Sumi Systems

JK Tyre & Industries

Lumax Industries

Sundram Fasteners

WABCO India

Gabriel India

Ceat Ltd.

SKF India

MRF Limited

Apollo Tyres

These companies dominate categories such as tires, batteries, filters, lighting, suspension systems, and electronics.

The India automotive aftermarket is transitioning from a fragmented, replacement-driven ecosystem to a structured, technology-enabled, high-value industry. With rapid vehicle parc expansion, rising digital adoption, technological innovations, and emerging export opportunities, the sector is on track to become one of the fastest-growing automotive aftermarkets globally.

As EVs, connected vehicles, and ADAS technologies penetrate deeper into India’s mobility landscape, the aftermarket will serve as a critical enabler, ensuring longevity, performance, and safety of the nation's growing vehicle fleet.

| No comments yet. Be the first. |