In a world recalibrated by stress, pollution, and digital overstimulation, personal care has emerged not just as indulgence but as essential ritual. Among the most elevated of these rituals lies hair and scalp care a category previously eclipsed by skincare, now entering a renaissance of its own. Fueled by a global craving for well-being, the market has transformed into a billion-dollar intersection of beauty, science, and lifestyle.

For more info please visit: https://market.us/report/hair-and-scalp-care-market/

Hair is no longer merely an aesthetic expression it’s a health barometer. Scalp health, once an afterthought, is now a primary focus, with consumers equating it to “skinification” of hair. With mounting studies linking poor scalp conditions to stress, hormonal imbalance, and environmental toxins, the shift from cosmetic treatment to curative care is reshaping demand dynamics.

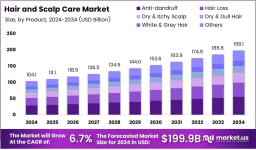

The global hair and scalp care market is poised to surpass USD 130 billion by 2030, growing at a compound annual growth rate (CAGR) of 6.7%. This surge is underpinned by the blending of wellness trends, scientific research, and digital commerce. Consumers are now discerning, investing in value-rich, problem-solving formulations rather than generic products.

Key growth catalysts include the ubiquity of urban stressors, increasing alopecia cases, and a boom in social media-fueled awareness. Rising disposable incomes, especially in emerging economies, also play a pivotal role. Dermatology and trichology have aligned closer with cosmetology, birthing a new generation of targeted therapies and evidence-based product lines.

However, the industry grapples with regulatory fragmentation, greenwashing claims, and misinformation. Ingredient safety debates particularly around sulfates, parabens, and silicones continue to divide opinion. Moreover, supply chain bottlenecks for organic raw materials and sustainable packaging challenge scalability for emerging brands.

The modern consumer’s cabinet is no longer limited to shampoo and conditioner. Scalp scrubs, detox masks, peptide serums, and growth-activating oils are becoming staples. Shampoos hold the largest market share, yet serums and pre-wash treatments are registering faster growth due to their potent efficacy and innovation-led design.

Market segmentation by concern has led to hyper-specific products that address unique scalp conditions. Anti-thinning formulas laced with caffeine and biotin are trending, while anti-inflammatory products using calendula and witch hazel cater to sensitive scalps. Dandruff remains the most addressed condition globally, with new-generation anti-fungal agents like climbazole taking center stage.

E-commerce has democratized access, enabling niche and indie brands to flourish. Direct-to-consumer (DTC) channels have disrupted traditional distribution, offering tailored experiences through quizzes and subscriptions. Salons and clinics remain trusted points of sale for therapeutic-grade products, while pharmacies are expanding their dermatology-oriented inventory.

Natural actives such as rosemary extract, argan oil, saw palmetto, and moringa are regaining favor. Yet, innovation isn’t limited to nature. Peptide complexes, stem cell extracts, and biotech-fermented ingredients are revolutionizing efficacy. Cold-pressed and microencapsulation techniques ensure ingredient integrity, giving rise to high-performance, clean formulations.

Customization is no longer a luxury it’s an expectation. AI-driven diagnostics and DNA-based assessments are personalizing regimens to the follicular level. Smart scalp sensors and machine learning are being leveraged by tech-beauty hybrids to predict hair fall patterns, recommend formulations, and monitor long-term results.

The scalp microbiome has emerged as a game-changer. Just as the gut biome revolutionized nutrition, understanding the scalp’s microbial flora is opening new avenues for prebiotic and probiotic formulations. Brands now focus on microbiota-balancing ingredients like lactobacillus ferment and inulin, targeting inflammation, sebum imbalance, and pathogen resistance.

In North America and Western Europe, clean label claims, sustainability, and ingredient transparency reign supreme. Consumers are willing to pay premiums for ethical sourcing, cruelty-free certification, and recyclable packaging. Functional luxury—where efficacy meets aesthetics—defines the leading brands in these regions.

Asia-Pacific is a hotbed of ancient wisdom and modern innovation. Ayurveda, TCM (Traditional Chinese Medicine), and K-beauty formulations converge to offer holistic hair rituals. India, China, and South Korea are fueling market expansion, with scalp oils, herbal infusions, and fermentation-based solutions driving regional preferences.

Latin America and the Middle East & Africa (MEA) represent nascent but rapidly evolving markets. Growing urbanization, increasing access to digital beauty platforms, and rising disposable incomes are stimulating product adoption. Consumers in these regions prefer hybrid solutions that combine hydration, UV protection, and humidity resistance.

For more info please visit: https://market.us/report/hair-and-scalp-care-market/

Legacy players such as L’Oréal, Unilever, and Procter & Gamble continue to dominate, but disruptors like Briogeo, Ouai, and Nutrafol are carving out cult-like followings. Midsize and indie brands are using influencer marketing, niche targeting, and clinical studies to outmaneuver giants.

Mergers and acquisitions are reshaping the terrain. Larger conglomerates are acquiring agile startups to access new demographics and innovative technologies. This has led to a flurry of hybrid offerings, combining pharmaceutical-grade actives with cosmetic elegance.

Looking ahead, the convergence of dermatology, wellness, and technology will define the next phase. Preventive care will outweigh reactive solutions, with users treating the scalp like facial skin cleanse, treat, protect, and nourish. The integration of wearable diagnostics and biofeedback tools could soon make daily hair care deeply personalized and adaptive.

The hair and scalp care market is no longer a subset of beauty it is a standalone ecosystem driven by conscious consumption, personalized science, and holistic health ideologies. As consumer expectations evolve, so must brands pivoting from cosmetic quick fixes to integrative, results-driven solutions that honor both scalp biology and emotional well-being.

| No comments yet. Be the first. |