The organic personal care sector in the United States has emerged from niche obscurity into mainstream relevance. Defined by products formulated without synthetic chemicals, parabens, sulfates, and petrochemicals, this market segment encapsulates a new era of conscious consumerism. A convergence of health awareness, environmental concern, and ingredient transparency is reshaping how Americans care for their bodies.

This burgeoning sector is no longer a fringe movement. It's a force. The surge in demand reflects not just a preference, but a paradigm shift. Consumers now demand integrity from labels and authenticity from brands.

For more info please visit: https://market.us/report/us-organic-personal-care-products-market/

The ascent of the US organic personal care products market is catalyzed by multiple interlinked factors. The rise in dermatological sensitivities, escalating allergic reactions to synthetic agents, and increasing incidences of hormonal disruptions have compelled consumers to question traditional formulations. Furthermore, the proliferation of social media wellness influencers has democratized information, amplifying demand for non-toxic alternatives.

Another potent driver is the accelerating adoption of sustainable lifestyles. Organic personal care products align closely with eco-centric values, as they minimize environmental impact during both sourcing and disposal. Organic certifications like USDA Organic, COSMOS, and Ecocert add a layer of credibility and appeal to a discerning audience.

Despite its upward trajectory, the market faces certain encumbrances. Price parity remains elusive organic products often come with a premium tag due to high-quality sourcing and rigorous certification requirements. Additionally, the lack of unified regulatory frameworks in the US for organic labeling in cosmetics creates grey areas, enabling greenwashing and consumer confusion.

The industry also grapples with scalability challenges. Sourcing organically certified ingredients in bulk while maintaining consistency is a complex endeavor, particularly for indie brands.

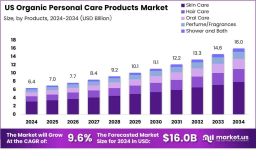

Skincare commands the lion’s share of the organic segment, driven by serums, moisturizers, and sunscreens infused with botanical actives like aloe vera, chamomile, and green tea extracts. Haircare follows closely, with sulfate-free shampoos and conditioners witnessing significant growth.

Organic cosmetics though historically niche are now gaining ground through cleaner foundations, mascaras, and lip tints devoid of artificial dyes and preservatives. Oral care too is evolving, with fluoride-free toothpaste and natural mouthwashes entering mainstream shelves.

Digital transformation has been a game-changer. Online platforms allow brands to directly connect with conscious consumers, offering transparency and story-driven branding. Specialty stores like Whole Foods and Sephora’s Clean at Sephora segment continue to anchor credibility.

Meanwhile, mass retailers are catching up, allocating prime shelf space to organic lines a testament to their growing commercial viability.

Consumers today seek simplicity less is more. Clean labeling has become not just a marketing tool but a prerequisite. Shoppers scrutinize ingredient lists, avoiding anything that sounds synthetic or unpronounceable. Minimalist formulations, often featuring fewer than ten ingredients, are gaining cult status for their perceived purity and efficacy.

Gen Z and millennials, digital natives with elevated social consciousness, are the torchbearers of the organic personal care revolution. They value brand transparency, ethical sourcing, and inclusivity. Their purchasing decisions are guided by social impact as much as by product performance, making them pivotal to market momentum.

Established players like Burt’s Bees, Dr. Bronner’s, and Avalon Organics continue to dominate with broad product portfolios and strong retail presence. Strategic collaborations with dermatologists and chemists have bolstered their formulations without compromising on ethos.

Multinationals such as L'Oréal and Unilever are acquiring or launching organic lines to tap into this growing segment, signaling the mainstreaming of what was once a niche vertical.

Indie brands like Herbivore Botanicals, Ursa Major, and RMS Beauty are rewriting the rules of engagement. Agile, innovative, and vocal about their values, they resonate with younger audiences craving authenticity. These disruptors prioritize small-batch production, artisanal formulations, and direct-to-consumer channels.

Innovation is not limited to formulations. Sustainable packaging solutions like biodegradable tubes, glass bottles, and refillable containers are rapidly becoming standard. AI-powered ingredient sourcing platforms and green chemistry techniques are further propelling innovation within the organic beauty value chain.

Investment activity in this sector has seen a marked increase. Venture capitalists and private equity firms are recognizing the untapped potential, leading to strategic investments and acquisitions. Collaborations between skincare brands and wellness influencers or eco-certification agencies are also driving brand visibility and trust.

For more info please visit: https://market.us/report/us-organic-personal-care-products-market/

The US organic personal care products market is projected to maintain a robust compound annual growth rate (CAGR) over the next decade. Skincare and haircare segments will remain growth anchors, while cosmetics and oral care are expected to witness accelerated adoption.

Government initiatives, such as increased regulation of cosmetic ingredients and clearer definitions around “organic” labeling, are expected to fortify consumer trust and level the playing field. Enhanced import policies for natural ingredients and tax incentives for sustainable practices could act as future catalysts.

The future of personal care in the United States is being reshaped by ethics, sustainability, and science. Organic products are no longer an indulgence—they are becoming the standard.

| No comments yet. Be the first. |