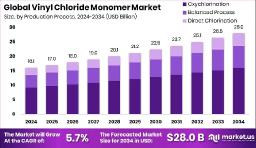

The vinyl chloride monomer market was valued at approximately USD 16.1 billion and is projected to reach USD 28 billion by 2034, growing at a CAGR of 5.7%. VCM is a vital industrial chemical mainly used to produce polyvinyl chloride (PVC), a plastic widely applied in construction, automotive, electrical, and packaging sectors. The increasing demand for PVC-based products especially in developing countries is pushing the VCM market upward.

PVC’s versatility and durability make it ideal for pipes, wire coatings, and medical devices. A large portion of VCM production nearly 80% goes directly into making PVC. North America, with its mature industries, is currently leading the market, holding a significant share of around USD 7.7 billion in 2024. Technological improvements like oxychlorination have also helped manufacturers produce VCM more efficiently and at lower costs, making it more accessible to a growing global market.

The VCM market is dominated by the oxychlorination production process, which accounts for over 57% of global output due to its cost-efficiency and lower environmental impact. Most of the demand for VCM comes from the PVC segment, especially in infrastructure and construction, which together contribute about 44.8% of total market usage. As cities expand and modernize, the need for PVC in plumbing, wiring, and building materials continues to rise.

North America remains a key player, thanks to its strong construction and industrial base. However, countries in Asia-Pacific are rapidly catching up with heavy investments in urban development and housing projects. While challenges such as strict environmental rules and fluctuating raw material prices exist, the long-term outlook is promising. New applications in medical and packaging industries and the push for sustainable PVC solutions will keep the demand for VCM strong in the years to come.

The global VCM market was valued at USD 16.1 billion in 2024 and is expected to reach USD 28 billion by 2034.

Oxychlorination is the top production method, making up 57.4% of total output due to efficiency gains.

PVC production consumes nearly 79.7% of all VCM, showcasing its leading role in this market.

Construction is the top application segment, using around 44.8% of total VCM-based products.

North America leads the market regionally, with a valuation of USD 7.7 billion in 2024.

Drivers

Increasing construction and housing development is boosting the need for PVC pipes, wiring, and other materials.

Growth in the automotive and electronics industries is driving demand for VCM-based PVC products.

Technological advancements like oxychlorination have made VCM production more cost-effective and efficient.

Rapid urbanization in emerging economies continues to fuel demand for VCM in infrastructure projects.

Opportunities

Recycling of PVC materials can open up eco-friendly market possibilities and reduce waste.

The growing healthcare sector is pushing demand for VCM-based medical products like tubing and containers.

Energy-efficient manufacturing processes can improve profit margins and reduce environmental impact.

Pharmaceutical and food packaging applications offer fresh opportunities for VCM-based materials.

Restraints

Environmental and health concerns surrounding VCM may lead to stricter regulations and higher compliance costs.

Volatile ethylene prices can affect the overall cost of VCM production and squeeze profit margins.

VCM’s classification as a hazardous material limits its usage and increases storage and handling costs.

Developed regions may experience market saturation, limiting further growth potential.

Trends

Asia-Pacific is emerging as a fast-growing region due to infrastructure and industrial development.

There is a growing preference for oxychlorination due to its lower emissions and efficiency.

PVC continues to dominate end-use applications, ensuring stable demand for VCM.

Investments in PVC recycling and circular economy practices are gaining momentum.

Companies are beginning to explore bio-based VCM alternatives as part of green initiatives.

| No comments yet. Be the first. |