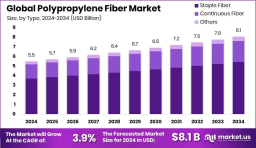

The global polypropylene fiber market is witnessing stable growth, with its value estimated at USD 5.5 billion in 2024 and projected to reach around USD 8.1 billion by 2034, growing at a CAGR of 3.9%. Asia-Pacific currently leads the market, holding about 41.2% of the global share. This regional dominance is driven by large-scale construction activity, strong healthcare demand, and a thriving textile industry. The product's popularity in civil engineering and infrastructure is also rising due to its high tensile strength and resistance to chemicals. Among product types, staple fiber holds the largest share about 67.4% in 2024 thanks to its cost-effectiveness, versatility, and moisture-resistant qualities. The growing use of polypropylene fibers in road construction, concrete reinforcement, and medical textiles is making a notable impact on market expansion.

The global polypropylene fiber market is witnessing stable growth, with its value estimated at USD 5.5 billion in 2024 and projected to reach around USD 8.1 billion by 2034, growing at a CAGR of 3.9%. Asia-Pacific currently leads the market, holding about 41.2% of the global share. This regional dominance is driven by large-scale construction activity, strong healthcare demand, and a thriving textile industry. The product's popularity in civil engineering and infrastructure is also rising due to its high tensile strength and resistance to chemicals. Among product types, staple fiber holds the largest share about 67.4% in 2024 thanks to its cost-effectiveness, versatility, and moisture-resistant qualities. The growing use of polypropylene fibers in road construction, concrete reinforcement, and medical textiles is making a notable impact on market expansion.

The market is expected to rise from USD 5.5 billion in 2024 to USD 8.1 billion by 2034, growing at a CAGR of 3.9%.

Staple fiber is the dominant product segment, making up 67.4% of the market share in 2024.

Healthcare applications lead among end-uses, accounting for 29.1% due to demand for hygiene products.

Asia-Pacific holds the largest regional share at 41.2%, driven by infrastructure growth and medical needs.

Drivers:

Strong global infrastructure spending, especially in developing regions, is increasing the need for durable, reinforced materials boosting demand for polypropylene fibers in concrete and geotextiles. Its excellent properties, like low moisture absorption and chemical resistance, make it ideal for multiple industries from textiles to construction. The healthcare sector’s rising consumption of non-woven products, including surgical masks and gowns, further supports market growth. The growing awareness of recyclable materials is pushing industries to favor polypropylene fiber for sustainable production processes.

Opportunities:

Emerging economies are undergoing rapid urbanization, opening up huge possibilities for polypropylene fiber in infrastructure and construction projects. Rising demand for hygiene-based non-wovens offers significant scope in medical and consumer care sectors.

Recyclable polypropylene fiber meets the rising demand for eco-friendly alternatives, especially in Europe and North America.

Technological advances in melt-blown fibers enhance performance, especially for filtration and protective medical wear. The shift toward modular and prefab construction boosts the market for fibrillated polypropylene fiber in advanced building systems.

Restraints:

Unpredictable pricing of raw materials like propylene can lead to increased production costs, affecting profit margins.

Strict environmental regulations on plastic usage and disposal could limit market potential and create compliance burdens.

Polypropylene faces growing competition from synthetic and natural alternatives, such as polyester and cotton fibers.

Its lower heat resistance compared to other materials restricts its use in high-temperature applications and industrial processes.

Trends:

Polypropylene fiber is gaining traction in healthcare due to rising demand for disposable personal protective products.

Manufacturers are investing in continuous yarn production, which offers uniform strength and superior textile quality.

Asia-Pacific is ramping up production capacities to meet local and export demand.

Advanced polypropylene fibers with antimicrobial or UV-resistant features are emerging in the market.

The push for sustainability is encouraging adoption of recycled polypropylene in several industrial applications.

| No comments yet. Be the first. |