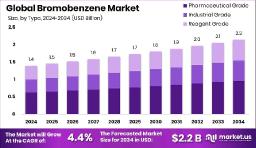

The global bromobenzene market is set to experience steady growth, rising from USD 1.4 billion in 2024 to around USD 2.2 billion by 2034, at a CAGR of 4.4%. A major factor driving this growth is its increasing use in pharmaceutical manufacturing, which makes up about 48.5% of overall consumption. High-purity bromobenzene (≥99%) plays a major role, holding a 67.3% market share, especially in precision-based chemical synthesis. Its application as a solvent is also notable, making up 36.1% of the market. With demand growing in sectors like agrochemicals and fine chemicals, bromobenzene remains an essential industrial compound. Asia-Pacific leads the market regionally, accounting for over 56.9%, mainly due to the rapid growth of chemical and pharmaceutical industries in China, India, and surrounding countries. With consistent demand and evolving applications, bromobenzene remains a reliable compound in the global chemical supply chain.

Bromobenzene, an aromatic organic compound (C₆H₅Br), is widely used as a solvent and intermediate in chemical production. It plays a key role in pharmaceuticals, where it supports the manufacturing of active ingredients. In 2024, pharmaceutical-grade bromobenzene held the largest share of the market at 44.8%, underlining its importance in drug development. The high-purity category (≥99%) dominated with a 67.3% share, essential for achieving accurate results in chemical reactions. Its use as a solvent, holding 36.1% of the market, supports various industrial and lab applications. Asia-Pacific emerged as the largest regional market, capturing 56.9% of global demand. This is largely driven by the region's expanding pharmaceutical manufacturing base and rising industrial activities. With demand rising for high-purity and pharmaceutical-grade chemicals, the bromobenzene market is expected to stay strong and resilient, supported by advancements in manufacturing technologies and the growth of emerging economies.

The market is forecasted to grow from USD 1.4 billion (2024) to USD 2.2 billion (2034) at a 4.4% CAGR.

Pharmaceutical-grade bromobenzene leads the market with a 44.8% share.

High-purity bromobenzene (≥99%) holds a dominant 67.3% market share.

Solvent applications account for 36.1%, showing its broad industrial use.

Pharmaceutical industry leads with 48.5% of the end-user market.

Asia-Pacific holds the largest regional share at 56.9%.

Drivers

Rising demand in the pharmaceutical industry is a major growth driver.

Asia-Pacific’s booming chemical sector increases consumption significantly.

High demand for high-purity compounds supports industrial applications.

Ongoing need for bromobenzene as a versatile solvent adds to demand.

Opportunities

Emerging economies are investing in pharmaceutical production, creating new market potential.

Cleaner, more efficient production processes offer cost-saving benefits.

Customized formulations and specialty uses can tap into high-value sectors.

Adoption of green technologies is becoming a competitive advantage.

Restraints

Environmental regulations on brominated compounds can raise production costs.

Price fluctuations in raw materials like bromine and benzene affect margins.

Handling and storage safety concerns limit wider adoption in some regions.

Infrastructure limitations may prevent some regions from entering high-purity markets.

Trends

Green and eco-friendly production methods are gaining traction.

Automation is improving manufacturing efficiency and consistency.

There's increasing demand for specialty grades in pharma and electronics.

Asia-Pacific remains a hotspot for industry growth and investment.

R&D is focusing on bromobenzene applications in high-tech sectors.

| No comments yet. Be the first. |