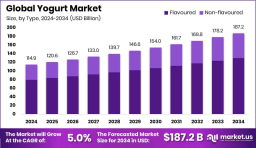

The global yogurt market was valued at approximately USD 114.9 billion in 2024 and is projected to reach USD 187.2 billion by 2034, growing at a 5.0% CAGR between 2025 and 2034. Europe holds a leading position with a USD 42.9 billion share in 2024, bolstered by strong dairy traditions and widespread health awareness. Yogurt itself is a fermented dairy product enriched with protein, calcium, and probiotics, available in varied forms like Greek, drinkable, frozen, flavored, and plant-based alternatives. Urban consumers increasingly favor yogurt as a healthy, quick snack that fits modern, on-the-go meals, appealing to those prioritizing gut health, protein intake, and overall wellness. With consumers shifting away from sugar-laden desserts and toward nutritious options, yogurt is finding a growing place in breakfast routines and fitness diets .

The global yogurt market, valued at USD 114.9 billion in 2024, is expected to reach USD 187.2 billion by 2034, with a steady CAGR of 5.0%. Europe remains the largest regional market, generating USD 42.9 billion in sales due to deep-rooted dairy consumption and heightened health awareness. Yogurt’s appeal stems from its nutrient profile rich in protein, calcium, and probiotics alongside its versatility in formats like Greek, drinkable, flavored, frozen, and plant-based. Modern consumers, especially in urban areas, are drawn to convenient, nutritious snacks that align with busy lifestyles and wellness goals. This shift, driven by a desire for gut-health benefits and lower sugar alternatives, has expanded yogurt’s presence across breakfast and snack categories. As a ready-to-eat, health-forward option, yogurt is well-positioned for continued growth

Market size: USD 114.9 billion (2024) → USD 187.2 billion (2034), CAGR 5.0%

69.3% share for flavored yogurt, reflecting strong taste-driven demand

Greek yogurt holds 32.8% share, popular for texture and protein benefits

Strawberry blend leads flavors with 23.5% market share

Supermarkets and hypermarkets account for 47.4% of distribution

Europe is the dominant region at USD 42.9 billion

Download Exclusive Sample Of This Premium Report:

https://market.us/report/global-yogurt-market/free-sample/

Drivers (what’s pushing growth):

Rising health awareness sees yogurt as a nutritious, probiotic-rich snack supporting gut and immune health.

Preference for quick, convenient on-the-go foods fuels demand for portable yogurt formats.

Protein-rich Greek yogurts attract fitness-focused consumers aiming for muscle support and satiety.

Consumers reducing sugar intake turn to yogurt as a healthier alternative to desserts.

Opportunities (where companies can expand):

Plant-based yogurts (e.g. almond, soy, oat) offer dairy-free options for vegans and lactose-intolerant consumers.

Flavored, low-sugar, and high-protein innovations can differentiate brands and draw in health-driven buyers.

Expansion in emerging markets can exploit rising incomes and improving cold-chain infrastructure.

E‑commerce and online grocery channels open direct-to-consumer opportunities with subscription and door‑delivery models.

Restraints (challenges facing the market):

High cold-chain and refrigeration costs limit distribution, particularly in remote and rural regions.

Perishability of yogurt makes logistics complex, increasing waste from spoilage.

Lack of cold-storage infrastructure in developing areas curtails market reach.

Regulatory shifts or ingredient restrictions could raise compliance costs and affect margin.

Trends (current consumer and industry patterns):

Mini snack pots and single-serve cups are gaining popularity for portable, portion-controlled snacking.

Flavored yogurt variety is expanding—fruit swirls, crunch coatings, and layered options are rising.

Greek yogurt continues to lead due to its high protein and dense texture appeal.

Steadily rising acceptance of plant-based yogurt is changing product portfolios and innovation focus.

| No comments yet. Be the first. |