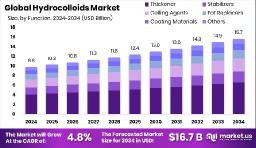

The global hydrocolloids market is witnessing strong and steady growth. In 2024, the market stood at USD 9.8 billion and is projected to reach USD 15.7 billion by 2034, growing at a CAGR of 4.8%. Hydrocolloids natural substances used to control texture and stability are widely applied in food, pharmaceuticals, and cosmetics. Gelatin is the leading type with a 24.6% market share, thanks to its versatility across various industries. Among functional uses, thickeners dominate with over 42% share due to their effectiveness in improving consistency and shelf life in foods like dairy, sauces, and bakery items. The food and beverage sector is the largest user of hydrocolloids, accounting for more than half of total demand.

Hydrocolloids, which include plant- or animal-based gums and proteins, are essential ingredients for improving product texture, thickness, and appearance. Beyond food, they are also used in cosmetics, personal care, and pharmaceuticals. Growing health awareness, demand for cleaner ingredients, and the rise of vegan lifestyles are encouraging the shift toward natural hydrocolloid alternatives. The Asia-Pacific region has become a major hub for market growth, contributing around USD 4.1 billion in 2024, driven by increasing food processing activities and consumer demand for packaged and healthy products. To meet new market needs, companies are developing customized hydrocolloid blends suited for vegan and allergen-free products. These innovations also support sustainability and regulatory compliance.

Hydrocolloids market to grow from USD 9.8 billion (2024) to USD 15.7 billion (2034).

Gelatin remains the top product type, holding 24.6% market share.

Thickeners lead by function, representing 42.4% of the total market.

Food and beverage applications dominate with a 53.2% usage rate.

Asia-Pacific region shows the fastest growth, valued at USD 4.1 billion.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/global-hydrocolloids-market/free-sample/

Drivers

Increasing demand for ready-to-eat and packaged food is boosting hydrocolloid use for better texture and shelf life.

Consumers are leaning toward clean-label and plant-based food, which supports natural hydrocolloid demand.

Gelatin continues to gain popularity due to its multi-use applications in food, pharma, and beauty care.

Asia-Pacific’s growing food industry is creating a strong base for regional market expansion.

Opportunities

Rising popularity of vegan and gluten-free diets opens doors for innovative hydrocolloid solutions.

Non-food industries like cosmetics and medicine present new areas for hydrocolloid application.

Clean-label movements are pushing companies to invest in natural, safe, and simple ingredient alternatives.

There’s significant growth potential in emerging regions like Southeast Asia and Latin America.

Restraints

Volatile raw material prices, especially for plant-based sources, can affect manufacturing costs.

Regulatory and labeling standards are becoming stricter, adding time and cost to product development.

Availability of synthetic stabilizers and alternatives may limit hydrocolloid usage.

Heavy reliance on gelatin is becoming a limitation as plant-based preferences grow.

Trends

Demand for natural and clean-label food products is driving hydrocolloid adoption.

Brands are focusing on eco-friendly and ethically sourced hydrocolloids.

Technological advancements are enabling better functionality with lower usage volumes.

Custom-blended hydrocolloids are emerging to suit specific texture and stability needs.

| No comments yet. Be the first. |