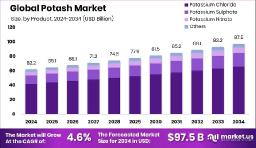

In 2024, the global potash market is stood at USD 62.2 billion and is forecasted to reach around USD 97.5 billion by 2034, growing at a 4.6% CAGR during the period. Potash—especially potassium chloride (KCl)—is a vital input for modern agriculture due to its ability to improve crop health and yield. Holding nearly 67.8% market share, KCl remains the top-selling product. The agriculture industry alone accounted for 84.6% of potash consumption in 2024, as farmers increasingly depend on nutrient-balanced fertilizers to meet food demand. The Asia-Pacific region led the market with a 42.6% share, backed by fast-growing populations, expanding farmlands, and large-scale food production in countries like China and India. With rising pressure to grow more food on less land, potash is becoming essential to achieving higher productivity and supporting sustainable farming methods worldwide.

Potash plays a key role in farming by boosting soil quality, improving crop resistance, and supporting healthy plant development. As global food demand grows and climate change threatens productivity, the need for potassium-rich fertilizers is expanding. Major industry players like Nutrien, BHP, and EuroChem are scaling up operations, building new facilities, and adopting greener mining practices. Nutrien, for instance, is developing a new terminal on the Pacific Coast, while BHP’s Jansen project in Canada is set to become a major supplier in coming years. The market is also shifting towards more sustainable solutions, including low-chloride and specialty potash fertilizers that suit organic farming and premium crops. As agricultural technologies evolve, precision application of potash is becoming more common, reducing waste and increasing effectiveness. Overall, the potash market is well-positioned to benefit from both technological advances and the global push toward food security.

The potash market is projected to grow from USD 62.2B (2024) to USD 97.5B (2034) with a 4.6% CAGR.

Potassium chloride (KCl) dominates the market with a 67.8% share due to its cost and efficiency.

Agriculture is the largest consumer, accounting for 84.6% of potash use.

Asia-Pacific leads the global market with a 42.6% share, driven by strong demand from China and India.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/global-potash-market/free-sample/

The ongoing rise in global food demand is pushing farmers to adopt high-performance fertilizers like potash to maximize output.

There's a shift toward balanced soil nutrition, increasing reliance on potassium-based inputs alongside nitrogen and phosphate.

Adoption of precision agriculture technologies helps farmers apply potash more efficiently, improving results.

Potash improves crop resilience, helping plants handle drought and poor soil conditions more effectively.

Precision farming is creating demand for advanced, tailored potash products that match exact crop needs.

Infrastructure improvements, like new export facilities, are expanding market access and reducing supply delays.

Product innovations, including potassium sulfate and nitrate, cater to organic and chloride-sensitive farming.

Eco-friendly mining practices could attract investments from sustainability-focused buyers and governments.

High costs of mining and processing potash make it a capital-heavy industry, limiting new entrants.

Price volatility, often tied to political or economic issues, can disrupt supply and margins.

Tight environmental regulations can delay mining projects and increase operating costs.

A growing shift toward organic fertilizers may challenge demand for traditional potash types.

Organic farming is pushing the market toward low-chloride options like potassium sulfate.

Asia-Pacific continues to dominate, thanks to growing population and food demand.

Companies are investing in sustainable mining, like BHP's Jansen project.

Export and logistics expansions are helping streamline global potash distribution.

Specialty fertilizers are on the rise, targeting high-value fruits and vegetables.

| No comments yet. Be the first. |