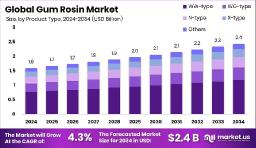

The global gum rosin market was worth approximately USD 1.6 billion in 2024 and is forecasted to reach around USD 2.4 billion by 2034, growing at a CAGR of 4.3% over the next decade.

Gum rosin, which is derived from pine resin, is widely used in the manufacturing of adhesives, rubber, inks, paper, and soaps due to its stickiness and chemical properties. With rising demand for natural and biodegradable materials, industries are increasingly turning to gum rosin as a replacement for petroleum-based resins. North America currently dominates the market, accounting for 48.3% of global revenue, thanks to its strong industrial base and consistent demand. The adhesives industry alone makes up nearly 38% of total usage, while WW-type rosin, Standard rosin, and Unmodified grades lead in product preference. Environmental concerns and sustainability goals are pushing this market forward, offering promising potential for future expansion and product innovation.

The gum rosin market is growing steadily, driven by increased interest in renewable and eco-friendly materials. From a value of USD 1.6 billion in 2024, the market is projected to touch USD 2.4 billion by 2034. This growth is linked to gum rosin's versatility in applications like adhesives, sealants, printing inks, and paper processing. North America holds the lion’s share of the market, but demand is rising globally, especially in developing economies. Among the types, WW-type rosin stands out for its purity, while Standard and Unmodified forms remain popular for their affordability and functionality. Environmental regulations are encouraging industries to shift away from synthetic alternatives, making gum rosin a favorable option. The growth of packaging, hygiene products, and online retail further fuels demand for rosin-based adhesives. As industries look for greener options, gum rosin is becoming an increasingly essential raw material with wide-ranging applications.

The market is projected to grow from USD 1.6 billion in 2024 to USD 2.4 billion by 2034 at a CAGR of 4.3%.

WW-type gum rosin leads the market with a 48.5% share due to its high purity.

Standard rosin accounts for 74.9% of the total by type, favored for its all-around utility.

Unmodified rosin makes up 54.6% of the market by grade, commonly used in traditional applications.

The adhesives sector is the largest consumer, making up 37.8% of total application use.

North America dominates globally, contributing 48.3% of total revenue.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/gum-rosin-market/free-sample/

Drivers

Rising environmental awareness is pushing industries toward bio-based alternatives like gum rosin.

Its broad use in adhesives, rubbers, inks, and papers ensures steady industrial demand.

Growing restrictions on synthetic resins are encouraging the switch to natural options.

The increase in packaging and hygiene product demand supports growth in rosin-based adhesives.

Opportunities

Development of green coatings and composites opens new product categories.

Innovation in eco-friendly adhesives will boost high-purity rosin demand.

Expanding production in Asia-Pacific and Latin America offers growth potential.

Wider application in electronics and sustainable packaging adds new revenue streams.

Restraints

Price fluctuations due to resin harvesting seasonality create supply issues.

Weather and labor dependency affect raw material availability and cost.

Low-cost synthetic alternatives may limit adoption in some sectors.

Complex forest-related regulations may slow sourcing and logistics.

Trends

Shift toward sustainable and biodegradable raw materials in industrial use.

Demand for high-performance, specialty rosin products is increasing.

Integrated supply chains are being built to ensure stable and quality supply.

Collaborations for greener solutions are gaining traction across industries.

Government policies in Europe and Asia are driving sustainable product development.

| No comments yet. Be the first. |