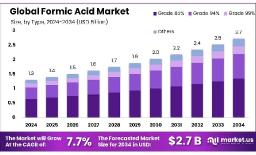

The global formic acid market is on track to grow steadily, with its value projected to increase from approximately USD 1.3 billion in 2024 to about USD 2.7 billion by 2034, expanding at a CAGR of 7.7%. Asia-Pacific is the leading region, accounting for nearly 48.3% of the market, worth around USD 600 million in 2024.

The 85% concentration grade dominates the market with a 49.3% share, offering the ideal balance between strength and cost. One of the largest uses of formic acid is in the animal feed sector, which holds a 38.8% market share, largely due to its preservative qualities and rising demand from livestock producers. Notably, innovation is gaining pace in India where researchers are exploring the use of non-precious metal catalysts to convert CO₂ into formic acid a promising step towards more sustainable production methods.

Beyond its primary use in animal feed, formic acid plays a critical role in leather processing, rubber production, textile dyeing, and chemical manufacturing. It acts as a preservative, pH adjuster, and a useful intermediate in multiple industrial processes. The market is also seeing growth from the agriculture sector, especially in cattle and silage preservation. However, competition from newer, more advanced additives like microbial enhancers poses a challenge.

The market is expected to reach USD 2.7 billion by 2034, growing at a 7.7% CAGR.

The 85% purity segment leads the market with a 49.3% share.

Animal feed is the largest end-use, making up 38.8% of total demand.

Asia-Pacific remains the top region, holding nearly 48.3% of the global market.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/global-formic-acid-market/

Drivers

Rapid growth in livestock farming is boosting demand for acid-based feed preservatives.

Strong industrial demand from leather, textile, and rubber sectors continues to drive usage.

Companies like BASF expanding capacity enhance supply reliability and access.

Rising demand in agriculture and pharmaceuticals supports consistent consumption growth.

Opportunities

Innovative CO₂-to-formic acid conversion technologies offer sustainable production paths.

New plant launches in the U.S. and Asia improve local supply and cost efficiency.

Green chemistry and eco-friendly sourcing are gaining momentum in developed countries.

Growing leather and textile demand in Asia opens fresh commercial channels.

Restraints

Alternatives like peptides and microbial enhancers may reduce demand in feed applications.

Transportation and supply chain delays can destabilize global pricing and delivery.

Raw material price swings can impact margins for manufacturers.

Environmental regulations may limit production in highly regulated regions.

Trends

More regional manufacturing setups aim to reduce dependency on imports.

Joint ventures for sustainable process development are emerging globally.

Feed acidifier blends are rising, though formic acid still holds ~27% of the segment.

Ongoing price fluctuations reflect sensitive supply-demand balance.

Conclusion:

| No comments yet. Be the first. |