2025-06-20

By: minhpjohnson

Posted in: news

2025-06-20

By: minhpjohnson

Posted in: news

Report Overview:

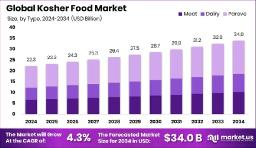

The global kosher food market is projected to grow from USD 22.3 billion in 2024 to approximately USD 34.0 billion by 2034, at a steady CAGR of 4.3% over 2025–2034. North America leads, holding about 47.3% of the market (~USD 10.5 billion) . Within product types, pareve (neutral, neither meat nor dairy) commands 45.3% of the market, while non‑vegetarian kosher food accounts for 56.5%, highlighting strong demand for meat‑based offerings.

Over half of kosher products are now sold through supermarkets and hypermarkets (46.7%), reflecting growing mainstream accessibility. Driven by both religious observance and non‑Jewish consumers seeking quality and safety, the market is further shaped by factors like urban migration and industry trends .

Key Takeaway

- Market expanding at a 4.3% CAGR, rising from USD 22.3B (2024) to USD 34B (2034)

- North America dominates (~47.3%, USD 10.5B in 2024)

- Pareve products lead (45.3% share)

- Non‑vegetarian kosher items form majority (56.5%)

- Supermarkets/hypermarkets carry nearly half of all kosher products (46.7%)

Key Market Segments

By Type

- Meat

- Beef

- Chicken

- Sheep and Goats

- Others

- Dairy

- Milk

- Cheese

- Butter

- Yogurt

- Desserts

- Others

- Pareve

- Eggs and Fish

- Plant-based Food

- Bakery and Confectionery

- Beverages

- Culinary Products

- Snacks and Savory

- Others

By Category

- Vegan

- Vegetarian

- Non-Vegetarian

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

DORT (Drivers, Opportunities, Risks, Trends)

Drivers

- Strong religious demand among Jewish communities in North America and Europe

- Quality and safety perception attracts non‑Jewish consumers

- Growth in plant-based, ready‑to‑eat kosher meals

- Expanding distribution via mainstream supermarkets

Risks

- Tariffs (e.g., 10% on beef imports from Uruguay, Argentina, Brazil; additional 7% on Israeli goods starting April 2025) could raise kosher food prices

- Rising production and labor costs may strain profit margins

Trends

- Urbanization driving adoption beyond traditional consumer bases

- Shift toward pareve and convenience-format offerings

Growth Opportunity

- Launch plant-based kosher products, aligning with health and convenience trends

- Expand ready-to-eat kosher meal lines to meet busy lifestyles

- Boost distribution through mainstream supermarkets and online platforms

Latest Trends

- More non-Jewish consumers choosing kosher foods for quality assurance

- Pareve products gaining momentum for flexibility in meal prep

- Meat-based kosher items remain strong, reflecting steady demand for kosher protein

- Tariffs introduced in April 2025 are reshaping cost dynamics across the kosher supply chain

Market Key Players

- Linde plc

- Air Liquide S.A

- Messer Group

- Yingde Gases Group Company Limited

- Buzwair Industrial Gases Factory

- BASF SE

- INOX Air Products

- Iwatani Corporation

- Taiyo Nippon Sanso Corporation

- Hangyang

- SOL Group

- Strandmøllen A / S

- Bhuruka Gases Limited

- Matheson Tri-Gas, Inc.

- Other Key Players

The kosher food market is riding a solid growth wave, thanks to steady demand among Jewish consumers and rising interest from non‑Jewish shoppers who value its quality and safety credentials. With a projected rise from USD 22.3 billion (2024) to USD 34 billion by 2034 (4.3% CAGR), expansion opportunities abound particularly in pareve and plant-based products, as well as ready to eat formats. Supermarkets and hypermarkets are crucial distribution channels that further fuel mainstream reach.

Still, recent tariffs and higher production costs could squeeze margins and challenge pricing. To stay ahead, companies should explore innovative product lines like vegan kosher prepared meals—and optimize logistics and local sourcing. By embracing convenience-driven products, expanding their retail footprint, and actively responding to tariff-related price pressures, kosher-focused firms can excel and secure a stronger foothold in this evolving, quality-conscious global market.