In the evolving theatre of mobility, a silent revolution brews beneath the chrome and circuitry—biometrics. The United States, a nexus of automotive ingenuity and technological ambition, stands at the forefront of this confluence. No longer confined to espionage thrillers or airport security, biometric systems are now embedded within dashboards and door handles.

From unlocking your car with a glance to customizing your driving environment with a whisper, the once-futuristic vision of seamless, sensor-driven experiences has shifted into the mainstream. This metamorphosis isn't merely aesthetic—it's a shift in how we perceive ownership, access, and safety.

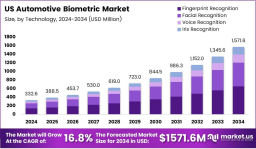

For more information please visit site : https://market.us/report/us-automotive-biometric-market/

Biometrics Behind the Wheel

Cameras tucked subtly into vehicle pillars are now capable of recognizing a driver’s face in milliseconds. This feature eliminates the need for keys or fobs, granting access based purely on physiognomy. Beyond security, facial analytics adjust seating, lighting, and infotainment settings tailored to the recognized user. It’s personalization driven by pixels.

Steering wheels equipped with fingerprint sensors and palm vein recognition add a new dimension of identity verification. These systems are being integrated not just for entry but to initiate ignition sequences, authorize in-car purchases, or activate driver profiles. Biometric tactility is redefining the handshake between man and machine.

The voice, unique in timbre and cadence, serves as both a password and a personality identifier. Voice biometric systems allow drivers to start vehicles, set navigation, or even make payments hands-free, while filtering out commands from unauthorized passengers. It’s control delivered through cadence and tone.

As vehicle theft techniques become more sophisticated, biometric systems act as formidable deterrents. Traditional keys and even smart fobs can be cloned—but fingerprints and faces? Much harder. Biometric entry systems are no longer conveniences; they’re necessities in urbanized theft-prone regions.

Biometrics are a natural companion to connected cars and autonomous driving systems. As vehicles become rolling computers, identity verification ensures that only authorized individuals interact with critical systems, especially as Level 4 and 5 autonomy looms. Biometric data feeds AI with contextual human cues—like fatigue, stress, or distraction.

In the US, data protection is climbing regulatory agendas. Legislators are encouraging secure-by-design principles, where biometric access control enhances compliance with both federal and state-level privacy frameworks. In-car biometrics contribute to GDPR-like readiness in cross-border vehicle systems.

Storing biometric data in vehicles raises red flags. Who owns this data? What happens if it’s breached? Consumers remain wary of continuous facial scanning or embedded microphones capturing unintended utterances. These concerns pose ethical quandaries that manufacturers must navigate delicately.

While luxury and premium models flaunt biometric integration, the technology remains expensive. Cost constraints inhibit widespread deployment in mid-range or budget vehicles, hindering democratization. Economies of scale are needed before biometrics become a showroom staple.

With each manufacturer opting for proprietary platforms, interoperability suffers. A biometric profile created in one vehicle brand often cannot migrate across others. The absence of universal standards slows market cohesion and consumer confidence.

Ford, GM, and Tesla are experimenting with facial and fingerprint authentication in select models. Cadillac’s high-end line hints at future-ready features that might become common in the next generation of sedans and SUVs.

Companies like Apple, Google, and Amazon are aligning with automakers to integrate biometric identity into infotainment ecosystems. Biometric startups are entering the supply chain too—introducing scalable modules and software SDKs for rapid adoption.

Pilot programs in cities like San Francisco and Detroit have seen ride-sharing fleets adopt fingerprint ignition and facial login, enhancing both user trust and operational security. These micro-deployments offer glimpses into mass rollout feasibility.

While convenience is alluring, many consumers remain cautious. Concerns about surveillance, data misuse, and consent must be mitigated with transparent policies and education. Trust is currency in the biometric economy.

Millennials and Gen Z are more receptive, conditioned by smartphone-based biometrics. Baby boomers, however, exhibit hesitancy, preferring traditional modes. This generational dichotomy impacts market segmentation and adoption strategies.

Once biometric features are proven secure, reliable, and beneficial—particularly in safety and customization—they will transition from luxury novelties to standard expectations. That tipping point is approaching fast.

Upcoming systems aim to gauge driver emotions—anger, fatigue, anxiety—and adjust cabin conditions or issue warnings accordingly. It’s not just about identity, but empathy embedded in machine intelligence.

Cars of the future may use combinations—face + voice + fingerprint—to ensure robust verification. These layered systems will create deeply personalized experiences, from music to mirror angles, unique to the user.

As smart cities rise and shared mobility surges, biometric tech will be pivotal in seamless transitions between vehicles. A single biometric profile could unlock scooters, sedans, or shuttles—all linked in an interoperable mobility network.

For more information please visit site : https://market.us/report/us-automotive-biometric-market/

Conclusion

The US automotive biometric market is steering toward a future where security, personalization, and convenience converge. It’s a journey guided by algorithms, but grounded in human identity. The road ahead is not just smart—it’s intimately aware of who’s driving

| No comments yet. Be the first. |