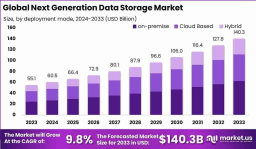

The Global Next Generation Data Storage Market is forecasted to grow from USD 55.1 billion in 2023 to USD 140.3 billion by 2033, registering a CAGR of 9.8% during the period. This expansion is fuelled by unprecedented data growth from emerging technologies such as IoT, artificial intelligence, 5G, and cloud computing. As businesses face demands for faster access, greater scalability, and stronger data protection, next generation storage solutions offer cutting‑edge architectures like object storage, NVMe-based SSDs, and hybrid cloud setups. These technologies support real-time analytics, high‑performance workloads, and efficient management of both structured and unstructured data, helping organizations gain a competitive edge.

Market value expected to almost triple by 2033, driven by explosive data generation.

Rising adoption of SSD and NVMe technology enhances speed, durability, and efficiency.

Hybrid and cloud storage deployments are gaining dominance due to scalability and flexibility.

Shift from block‑only architectures toward increased use of file‑ and object‑based storage.

Enterprises, telecom operators, government agencies, and cloud providers generate the highest demand.

Key challenges include high infrastructure costs, legacy integration, and growing data privacy concerns.

The market comprises Direct‑Attached Storage (DAS), Network‑Attached Storage (NAS), and Storage Area Networks (SAN).

SAN leads in adoption among large enterprises for its high performance, centralized management, and capability to support mission‑critical workloads.

NAS is preferred by collaboration‑driven environments for easy file sharing and management.

DAS remains relevant for localized, high‑throughput applications.

Trends indicate rapid expansion of software‑defined and hyper‑converged storage, enhancing scalability and reducing operational complexity.

Block Storage: Still dominant for database‑intensive and transactional workloads due to low latency and high efficiency.

File Storage: Suitable for hierarchical document management and collaborative work environments.

Object Storage: Witnessing fastest growth, ideal for scalable storage of unstructured data like video, IoT streams, and backups, leveraging rich metadata for advanced analytics.

On‑Premises: Favored by highly regulated sectors demanding full data control and compliance.

Cloud: Adopted widely by SMEs and global enterprises for cost‑effectiveness and elastic scalability.

Hybrid: The emerging default, offering agility and performance while maintaining security and governance via workload distribution between on‑premises and cloud environments.

Enterprises: Largest consumer group, managing massive datasets and analytics-driven workloads.

Government: Requires secure, compliant systems for sensitive public sector data.

Cloud Service Providers: High demand for multi‑tenant platforms ensuring scalability and uptime.

Telecom: Driven by exponential data loads from IoT, 5G, and streaming services requiring high‑speed infrastructure.

By Storage System: DAS, NAS, SAN

By Storage Architecture: Block, File, Object

By Deployment Type: On‑Premises, Cloud, Hybrid

By End User: Enterprises, Government, Cloud Providers, Telecom, Others

By Region: North America (largest), Europe, Asia‑Pacific (fastest‑growing), Latin America, Middle East & Africa

High capital expenditure for advanced storage setups, complexity integrating with legacy infrastructure, data sovereignty regulations, and shortage of skilled IT personnel constrain growth. Additionally, cybersecurity threats and rapid technology shifts add risk to long‑term investment decisions.

Strengths: High scalability, enhanced performance via SSD/NVMe, AI/analytics integration, suitability for big data and cloud environments.

Weaknesses: High upfront investment, integration complexity, limited skilled professionals.

Opportunities: Growth in hyperscale data centers, rising cloud adoption, emerging market demand, edge storage expansion.

Threats: Cyberattacks targeting storage platforms, rapid obsolescence of technologies, evolving and fragmented regulatory landscape.

The Next Generation Data Storage Market is evolving rapidly with NVMe adoption for ultra‑low latency performance and enhanced throughput. Software‑defined storage (SDS) and hyper-converged infrastructure are enabling flexible, centralized management, reducing costs and complexity. Hybrid cloud adoption is surging, combining cloud scalability with on‑premises security. AI-driven storage optimization and predictive analytics are improving efficiency and automating tiering. Sustainability is a rising priority, pushing development of energy‑efficient storage hardware. Edge storage is gaining importance to process and store data locally for IoT and 5G use cases, reducing latency and bandwidth needs while supporting real‑time decision-making in distributed environments.

Key market participants focus on innovation in NVMe and SSD-based solutions, AI‑powered storage management, and deep integration with hybrid cloud ecosystems. They are investing heavily in R&D to improve scalability, automate operations, and enhance cybersecurity capabilities. Strategic partnerships, mergers, and acquisitions are commonly used to gain technological advantages, expand into emerging markets, and strengthen value propositions for enterprise, telecom, cloud, and government sectors.

The Global Next Generation Data Storage Market will continue its strong growth trajectory through 2033. Organizations investing in hybrid, AI‑optimized, and secure storage architectures will be best positioned to manage surging data volumes effectively, meet compliance requirements, and gain a competitive edge in the increasingly data‑driven global economy.

| No comments yet. Be the first. |