Blogs

Intumescent Halogen-Free Flame Retardant Market Growth | Rising Demand Fuels USD 5.9 Billion Valuation

By AnandLondhe, 2025-08-18

Intumescent Halogen-Free Flame Retardant Market continues to demonstrate robust growth, with its valuation reaching USD 2.8 billion in 2024. According to the latest industry analysis, the market is projected to grow at a CAGR of 8.3%, reaching approximately USD 5.9 billion by 2032. This impressive growth trajectory reflects increasing regulatory pressure against traditional halogenated flame retardants and growing demand from safety-conscious industries.

Intumescent halogen-free flame retardants represent a critical advancement in fire safety technology, expanding when exposed to heat to form protective char layers while emitting minimal smoke and toxic gases. Their phosphorus-nitrogen and graphite-based formulations meet increasingly stringent global safety and environmental standards, making them indispensable across construction, transportation, and electronics applications.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/263331/intumescent-halogen-free-flame-retardant-market

Strategic Recommendations & Effect on Environment and Individuals

Companies in the Intumescent Halogen-Free Flame Retardant market should prioritize developing eco-friendly, high-performance flame retardant solutions for applications in construction, electronics, and transportation. Adopting halogen-free formulations reduces toxic emissions during fire incidents, contributing positively to environmental protection. For individuals, these materials enhance safety and health, minimizing exposure to harmful smoke and fumes while ensuring the reliability of fire-protected infrastructure and consumer products.

Market Overview & Regional Analysis

Asia-Pacific dominates the global market with a 38% revenue share in 2024, driven by China's massive infrastructure development under its 14th Five-Year Plan and India's booming construction sector. The region benefits from concentrated electronics manufacturing and rapidly evolving fire safety standards that increasingly align with international norms. Governments across Southeast Asia are accelerating adoption through building code reforms and incentives for sustainable materials.

North America follows with the fastest growth rate (9.1% CAGR), propelled by stringent EPA regulations and the $1.2 trillion infrastructure bill's emphasis on fire-safe materials. Europe maintains its position as a technology leader, with Germany and France accounting for nearly half of regional demand, particularly in automotive and wire/cable applications. The EU's REACH regulations continue to set the global benchmark for chemical safety standards.

Key Market Drivers and Opportunities

The market is being transformed by converging technological, regulatory, and sustainability trends. Construction applications account for nearly 40% of global demand, fueled by high-rise buildings and smart city projects requiring superior fire protection. The automotive sector is undergoing a materials revolution, with electric vehicle battery compartments driving demand for advanced intumescent solutions that provide 40-60% better fire resistance than conventional options.

Emerging opportunities include graphene-enhanced formulations improving fire resistance duration by 70%, and bio-based intumescent systems meeting circular economy objectives. The wire and cable sector is experiencing particularly strong growth (6.8% CAGR) as telecommunications infrastructure expands globally. These materials are becoming essential for 5G networks and high-voltage power transmission where safety and reliability are paramount.

Major Disruptions

Major disruptions in the market arise from raw material cost volatility, supply chain constraints, and evolving regulatory standards for fire safety and environmental compliance. Increased competition from alternative fire retardant technologies and stringent regional regulations can impact production and market entry. Companies must adapt quickly to supply challenges and compliance requirements to maintain consistent product quality and competitive positioning in this rapidly growing market.

Challenges & Restraints

The market faces several headwinds, notably production costs running 25-40% higher than conventional flame retardants due to specialized phosphorus and nitrogen compounds. Performance limitations persist in extreme conditions above 800°C, slowing adoption in oil & gas and heavy industrial applications. Complex certification processes requiring 12-18 months for industry approvals create significant barriers to market entry and innovation.

Supply chain vulnerabilities have emerged as another challenge, with key raw material production concentrated in specific regions. The industry also contends with a talent shortage, as 35% of manufacturers report difficulty finding qualified formulation scientists with expertise in advanced flame retardant chemistry.

Market Segmentation by Type

-

Phosphorus Nitrogen Intumescent Flame Retardant

-

Intumescent Graphite Flame Retardant

-

Expandable Graphite-based Retardants

-

Others

Market Segmentation by Application

-

Textiles

-

Transportation (Automotive, Aerospace)

-

Wire and Cable

-

Construction (Insulation, Coatings)

-

Others

Market Segmentation and Key Players

-

Clariant International

-

BASF SE

-

Lanxess AG

-

The Dow Chemical Company

-

Celanese Corporation

-

Israel Chemicals Limited

-

RTP Company

-

Albemarle Corporation

-

Italmatch Chemicals

-

Huber Engineered Materials

-

Mitsubishi Engineering Plastics

-

Polyplastics Co., Ltd.

-

Nabaltech AG

Report Scope

This report presents a comprehensive analysis of the global and regional markets for Intumescent Halogen-Free Flame Retardants, covering the period from 2024 to 2032. It includes detailed insights into the current market status and outlook across various regions and countries, with specific focus on:

-

Sales, sales volume, and revenue forecasts

-

Detailed segmentation by type and application

In addition, the report offers in-depth profiles of key industry players, including:

-

Company profiles

-

Product specifications

-

Production capacity and sales

-

Revenue, pricing, gross margins

-

Sales performance

It further examines the competitive landscape, highlighting the major vendors and identifying the critical factors expected to challenge market growth.

As part of this research, we surveyed Intumescent Halogen-Free Flame Retardant companies and industry experts. The survey covered various aspects, including:

-

Revenue and demand trends

-

Product types and recent developments

-

Strategic plans and market drivers

-

Industry challenges, obstacles, and potential risks

About 24chemicalresearch

Founded in 2015, 24chemicalresearch has rapidly established itself as a leader in chemical market intelligence, serving clients including over 30 Fortune 500 companies. We provide data-driven insights through rigorous research methodologies, addressing key industry factors such as government policy, emerging technologies, and competitive landscapes.

-

Plant-level capacity tracking

-

Real-time price monitoring

-

Techno-economic feasibility studies

With a dedicated team of researchers possessing over a decade of experience, we focus on delivering actionable, timely, and high-quality reports to help clients achieve their strategic goals. Our mission is to be the most trusted resource for market insights in the chemical and materials industries.

https://chemicalinsightsforum.blogspot.com/2025/08/metalworking-treating-fluid-market.html

https://chemicalinsightsforum.blogspot.com/2025/08/chemical-flocculant-market-growth.html

https://chemicalinsightsforum.blogspot.com/2025/08/innovation-and-demand-in-iot-devices.html

https://chemicalinsightsforum.blogspot.com/2025/08/rubber-additives-masterbatch-market.html

https://chemicalinsightsforum.blogspot.com/2025/08/methyldiisopropanolamine-market-demand.html

https://chemicalinsightsforum.blogspot.com/2025/08/sulfur-adsorbent-market-size-to-reach.html

Contact Us:

Email: help@24chemicalresearch.com

International: +1(332) 2424 294 | Asia: +91 9169162030

Latest Insights on Executive Summary Diving Tourism Market Share and Size

Latest Insights on Executive Summary Diving Tourism Market Share and Size

Global diving tourism market size was valued at USD 4.03 billion in 2024 and is projected to reach USD 8.34 billion by 2032, with a CAGR of 9.50% during the forecast period of 2025 to 2032.

Diving Tourism Market report presents the best market opportunities available and efficient information with which business can reach towards the growth and success. The industry report offers complete overview of the Diving Tourism Market industry that takes into account various aspects of product definition, market segmentation, and the existing retailer landscape. Statistical and numerical data mentioned in the report is represented with the help of graphs and tables which simplifies the understanding of facts and figures. Moreover, a credible Diving Tourism Market research report incorporates historic data, current market trends, market environment, technological innovation, upcoming technologies and the technical progress in the related industry.

The comprehensive Diving Tourism Market research report is framed by using integrated advancements and latest technology to give the most excellent results. A method of standard market research analysis is put forth while elaborating the studies and estimations that are involved in this market report. Such plentiful information accompanied with deep market insights supports the decision of increasing or decreasing the production of goods depending on the general conditions of market and demand. Diving Tourism Market business report has a lot to offer to both established and new players in the Diving Tourism Market industry with which they can completely understand the market.

Dive into the future of the Diving Tourism Market with our comprehensive analysis. Download now:

https://www.databridgemarketresearch.com/reports/global-diving-tourism-market

Diving Tourism Business Outlook

**Segments**

- *Type:* The diving tourism market can be segmented into categories such as leisure diving, technical diving, and commercial diving. Leisure diving is the most common form, attracting enthusiasts who dive for recreational purposes and to explore marine life. Technical diving involves advanced underwater diving techniques for exploring deep caves, wrecks, or other challenging environments. Commercial diving is related to professional underwater activities such as underwater welding, construction, and salvage operations.

- *Region:* The global diving tourism market can also be segmented by region, including North America, Europe, Asia-Pacific, South America, and Middle East & Africa. Each region offers unique diving experiences, such as tropical coral reefs in the Caribbean for North America, historical shipwrecks in the Mediterranean for Europe, and diverse marine ecosystems in the Asia-Pacific region.

- *Age Group:* Another important segmentation factor is the age group of divers, which can range from young adults to seniors. Different age groups may have varying preferences for diving destinations, levels of physical fitness, and willingness to undertake adventurous diving activities.

**Market Players**

- *PADI (Professional Association of Diving Instructors):* PADI is a leading player in the diving tourism market, offering a range of diving courses, certifications, and travel packages for divers worldwide. The organization has a strong global presence and collaborates with dive centers and resorts to promote safe and sustainable diving practices.

- *SSI (Scuba Schools International):* SSI is another key market player that provides diving education, certifications, and digital learning resources for divers of all levels. The organization focuses on eco-friendly diving practices and works with partners to support marine conservation efforts.

- *Liveaboard Operators:* Liveaboard operators play a significant role in the diving tourism market by offering diving cruises to remote dive sites and marine reserves. These operators provide accommodation, meals, and guided diving excursions onboard specialized dive vessels, catering to divers seeking immersive and adventurous diving experiences.

- *Resort Dive Centers:* Resort dive centers are essential market players that cater to beginner and experienced divers visiting coastal destinations. These centers offer diving courses, equipment rentals, guided dives, and other services to enhance the overall diving experience for tourists.

The global diving tourism market is dynamic and diverse, with a wide range of opportunities for industry players to innovate, collaborate, and expand their offerings to meet the evolving needs of diving enthusiasts worldwide.

The diving tourism market is experiencing significant growth attributed to an increasing interest in underwater activities, awareness about marine conservation, and advancements in diving technologies. As the market continues to evolve, several emerging trends are reshaping the industry landscape. One of the notable trends is the growing popularity of sustainable and eco-friendly diving practices among divers and industry stakeholders. Diving operators and organizations are placing greater emphasis on promoting responsible tourism, supporting marine conservation initiatives, and minimizing the environmental impact of diving activities.

Furthermore, the rise of experiential travel has fueled demand for unique and immersive diving experiences that go beyond traditional leisure diving. Divers are seeking opportunities to explore untouched dive sites, interact with marine wildlife, and participate in conservation projects during their trips. This trend has led to the emergence of specialized dive operators, eco-conscious resorts, and community-based diving initiatives that cater to the desires of experiential travelers.

Another key trend shaping the diving tourism market is the integration of technology in diving education, equipment, and experiences. Digital learning platforms, virtual reality simulations, and underwater drone technology are revolutionizing the way divers learn, explore, and document their underwater adventures. Diving organizations such as PADI and SSI are leveraging technology to offer interactive training programs, online certifications, and digital dive logs to enhance the overall diving experience for enthusiasts.

Moreover, the diversification of diving tourism offerings is driving market players to expand their services and collaborate with stakeholders across the travel and hospitality sectors. From luxury liveaboard cruises to eco-friendly dive resorts, divers now have a plethora of options to choose from based on their preferences, budget, and desired level of customization. This diversification of offerings is creating opportunities for new market entrants, niche operators, and destination marketing organizations to tap into the growing demand for diverse and personalized diving experiences.

In conclusion, the diving tourism market is poised for continued growth and innovation as industry players adapt to changing consumer preferences, environmental concerns, and technological advancements. By capitalizing on emerging trends such as sustainability, experiential travel, and technology integration, market players can differentiate their offerings, attract new audiences, and contribute to the long-term viability of the diving tourism sector. As the market continues to evolve, collaboration, sustainability, and customer-centricity will be essential drivers of success for diving industry stakeholders worldwide.The diving tourism market is a vibrant and evolving industry with a wide array of segments that cater to the diverse interests of diving enthusiasts worldwide. The segmentation of the market based on types such as leisure diving, technical diving, and commercial diving reflects the varied preferences and purposes for which individuals engage in underwater activities. Leisure diving, being the most popular segment, attracts recreational divers who seek to explore marine life and enjoy underwater adventures. On the other hand, technical diving appeals to enthusiasts looking for more challenging and specialized diving experiences in deep and demanding underwater environments. Commercial diving caters to professional divers engaged in underwater tasks such as welding, construction, and salvage operations, highlighting the practical applications of diving skills beyond recreational purposes.

Regional segmentation is another crucial aspect of the diving tourism market, as different geographical regions offer unique diving experiences that attract divers from around the world. North America, Europe, Asia-Pacific, South America, and the Middle East & Africa each boast distinct underwater landscapes and diving opportunities, from tropical coral reefs to historical shipwrecks and diverse marine ecosystems. Understanding the regional preferences and characteristics of diving destinations is essential for industry players to tailor their offerings and marketing strategies to effectively target divers in specific geographical areas.

The segmentation based on age groups also plays a significant role in shaping the diving tourism market, as divers of different age brackets may have varying interests, physical capabilities, and preferences when it comes to diving activities. Tailoring diving packages, training programs, and services to cater to the needs and expectations of different age groups can help diving operators appeal to a broader range of customers and enhance the overall satisfaction of divers participating in underwater experiences.

Market players in the diving tourism industry, such as PADI, SSI, liveaboard operators, and resort dive centers, play vital roles in driving growth, innovation, and sustainability within the market. These key players offer a range of services, certifications, educational resources, and experiential diving opportunities that cater to the diverse needs and preferences of diving enthusiasts worldwide. By leveraging technology, promoting sustainability, and collaborating with industry stakeholders, market players can differentiate their offerings, enhance the diving experience, and contribute to the long-term success and viability of the diving tourism sector.

In conclusion, the diving tourism market's segmentation by type, region, and age group, along with the presence of key market players, underscores the dynamic and multifaceted nature of the industry. By understanding and adapting to these segmentation factors, industry players can identify opportunities for growth, innovation, and collaboration to meet the evolving demands of diving enthusiasts and ensure the sustainability and prosperity of the diving tourism market in the years to come.

Analyze detailed figures on the company’s market share

https://www.databridgemarketresearch.com/reports/global-diving-tourism-market/companies

Diving Tourism Market – Analyst-Ready Question Batches

- What is the base year market size of the Diving Tourism Market?

- What is the compound annual growth rate of the Diving Tourism Market?

- What are the major use cases or applications in this Diving Tourism Market?

- Who are the most influential players in this Diving Tourism Market industry?

- What strategic product launches have occurred recently?

- What geographic breakdown is offered in the Diving Tourism Market report?

- What area is considered a growth hotspot?

- Which nation shows the most promising opportunity?

- Which geographic area dominates revenue generation?

- What macro trends are supporting industry growth for Diving Tourism Market?

Browse More Reports:

Global Bicycle Tires Market

Global Biometric System Market

Global Bortezomib Market

Global Camping Tent Market

Global Car Dashboard Market

Global Cheddar Cheese Market

Global Cinnamon Market

Global Coffee and Tea Shop Market

Global Driveline Market

Global Energy and Nutrition Bars Market

Global Espresso Coffee Market

Global Feed Mycotoxin Modifiers Market

Global Fertility Services Market

Global Food and Agriculture Technology and Products Market

Global Functional Apparel Market

Middle East and Africa Electric Vehicle Heat Shrink Tubing Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

Laptop Recycling and Computer Disposal: Your Guide to Responsible IT Disposal

By hawkinsschool, 2025-08-18

In today’s tech-driven world, upgrading to new devices often leaves us with old laptops and computers that need proper disposal. Laptop recycling and computer disposal are critical for protecting the environment and ensuring data security. At WeeeSouth, we make it easy to recycle laptops, dispose of old computers, and manage IT equipment disposal responsibly. Whether you’re a homeowner, small business, or large organization, our free computer disposal services and local computer recycling options are designed to meet your needs. This guide explores why laptop recycling near me and recycling computers near me are essential, how to do it safely, and the benefits of choosing professional computer disposal services.

Why Laptop Recycling Matters

Old laptops and computers contain hazardous materials like lead, mercury, and cadmium, which can harm the environment if not disposed of properly.

ensures these materials are safely extracted and reused, reducing landfill waste. Additionally, laptop recycling protects your personal data by ensuring secure destruction of hard drives and other storage devices. By choosing recycling laptops near me, you contribute to a circular economy, where valuable components like metals and plastics are repurposed for new devices.

At WeeeSouth, we offer free IT equipment disposal to make the process seamless. Our computer disposal company serves homes, offices, and organizations, providing local computer recycling solutions that prioritize sustainability and convenience.

The Importance of Proper Computer Disposal

Improperly discarding computers can lead to environmental pollution and data breaches. When you dispose of old computers or dispose of laptops, it’s crucial to use a certified computer disposal service to ensure compliance with regulations like WEEE (Waste Electrical and Electronic Equipment). These services dismantle devices, recycle usable parts, and safely dispose of hazardous components.

Our computer disposal recycling process at WeeeSouth guarantees that your devices are handled responsibly. We offer free computer disposal for households and businesses, making it easy to dispose of used computer equipment without added costs. Whether you need to recycle old computers near me or recycle old electronics near me, our team ensures eco-friendly disposal.

How to Recycle Laptops and Computers Near You

Finding laptop recycling near me or recycling computers near me is easier than you think. Here’s a step-by-step guide to responsibly recycle laptops and dispose of old laptops:

- Identify a Certified Recycler: Choose a computer disposal company like WeeeSouth that specializes in computer recycling services. Ensure they follow environmental regulations and offer secure data destruction.

- Schedule a Free Collection: We provide free IT equipment disposal with convenient pickup services for homes and businesses. Simply contact us to arrange a collection time.

- Prepare Your Devices: Back up any important data and remove personal items like USB drives. Our team handles secure data wiping during the

- disposal of old laptops

- process.

- Recycle Responsibly: Once collected, your devices are processed at our certified facility. We sort, recycle, and dispose of components to minimize environmental impact.

By searching for recycling laptops near me or recycle laptops near me, you’ll find WeeeSouth’s hassle-free services tailored to your location.

Commercial Computer Recycling for Businesses

Businesses often face unique challenges when upgrading IT infrastructure. Commercial computer recycling and commercial computer disposal require scalable solutions to handle large volumes of equipment. At WeeeSouth, we work with organizations of all sizes to provide IT equipment disposal companies with tailored services. Our computer disposal services include:

- Bulk Collection: Free pickup for large quantities of laptops, desktops, servers, and other IT equipment.

- Data Security: Certified data destruction to protect sensitive business information.

- Compliance: Adherence to environmental and data protection regulations.

- Sustainability: Eco-friendly recycling to support your organization’s green initiatives.

Whether you’re a small office or a large corporation, our commercial computer disposal services make it easy to dispose of used computer equipment responsibly.

Benefits of Free Computer Disposal Services

One of the biggest advantages of choosing WeeeSouth is our free computer disposal and free IT equipment disposal offerings. Unlike some computer disposal companies, we don’t charge for collection or processing, making it cost-effective to recycle old computers near me. Additional benefits include:

- Convenience: We handle everything from pickup to recycling, saving you time and effort.

- Environmental Impact: Our computer disposal recycling process reduces e-waste and promotes sustainability.

- Data Protection: Secure data wiping ensures your personal or business information is safe.

- Accessibility: Our local computer recycling services are available to homes, offices, and organizations across the region.

By choosing recycling laptops and disposal of old computers with WeeeSouth, you’re making a positive impact on the environment and your community.

Common Questions About Laptop and Computer Recycling

How Do I Find Laptop Recycling Near Me?

Search for laptop recycling near me or recycling computers near me to locate certified recyclers like WeeeSouth. We offer free collection services, making it easy to recycle laptops and dispose of old laptops locally.

Is Computer Disposal Really Free?

Yes, at WeeeSouth, we provide free computer disposal and free IT equipment disposal for all customers. There are no hidden fees, whether you’re a homeowner or a business.

What Happens to Recycled Laptops and Computers?

During laptop recycling and computer disposal recycling, devices are dismantled, and components are sorted. Reusable materials like metals and plastics are recycled, while hazardous substances are safely disposed of. Data storage devices are securely wiped or destroyed.

Can Businesses Benefit from Commercial Computer Recycling?

Absolutely. Our commercial computer recycling services are designed for businesses, offering secure, compliant, and eco-friendly solutions to dispose of used computer equipment.

Why Choose WeeeSouth for Laptop Recycling and Computer Disposal?

WeeeSouth stands out as a trusted computer disposal company due to our commitment to sustainability, convenience, and customer satisfaction. Here’s why you should choose us:

- Free Services: No cost for collection or disposal, making free computer disposal accessible to all.

- Local Expertise: We specialize in local computer recycling, serving communities with tailored solutions.

- Eco-Friendly Approach: Our computer recycling services prioritize sustainability and compliance with environmental standards.

- Secure Data Handling: We ensure all devices undergo secure data destruction during disposal of old laptops and computers.

Take Action: Recycle Your Laptops and Computers Today

Don’t let old laptops and computers clutter your space or harm the environment. With WeeeSouth’s laptop recycling and computer disposal services, you can recycle laptops near me and dispose of old computers with ease. Our free IT equipment disposal and local computer recycling services are designed to make the process simple and sustainable.

Contact WeeeSouth today to schedule your free collection and join the movement for responsible recycling laptops and computer disposal recycling. Together, we can reduce e-waste and protect our planet for future generations.

Comprehensive Study of the Carrageenan Market: Key Insights & Growth Outlook

By dannykinggt, 2025-08-18

"Executive Summary Carrageenan Market Trends: Share, Size, and Future Forecast

"Executive Summary Carrageenan Market Trends: Share, Size, and Future Forecast

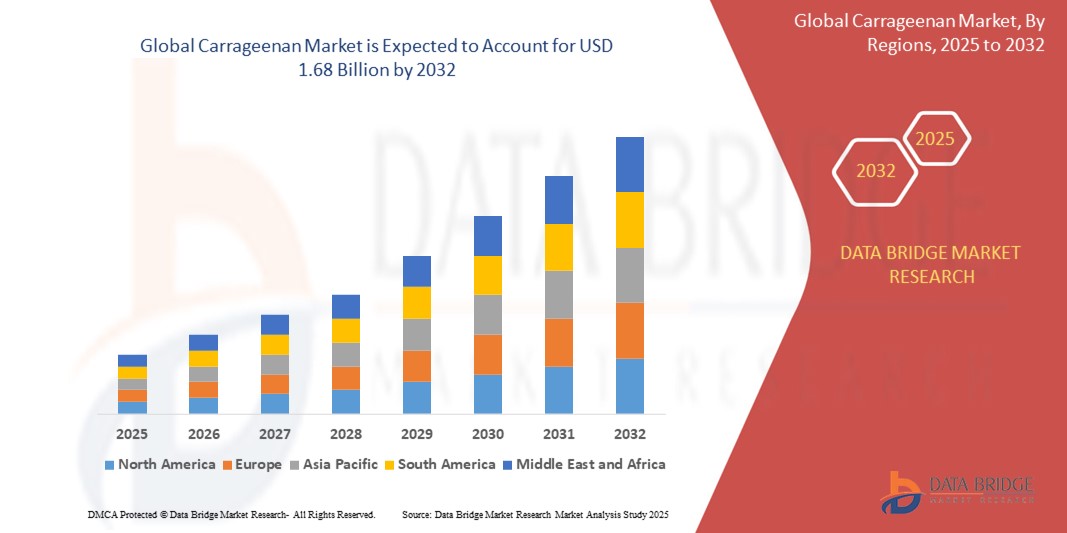

The global carrageenan market size was valued at USD 1.00 billion in 2024 and is expected to reach USD 1.68 billion by 2032, at a CAGR of 6.6% during the forecast period

Being an excellent market research report, Carrageenan Market report serves as a backbone for the business when it is about thriving in the competition. The report is all-embracing global market research report and it identifies, analyses, and estimates the emerging trends along with major drivers, challenges and opportunities in the Carrageenan Market industry along with the analysis of retailers, geographical regions, types, and applications. This industry report studies wide-ranging industry analysis with exact estimates and forecasts that provides complete research solutions with maximum industry clarity. Thus, Carrageenan Market report is the best solution for businesses if they want to stay ahead of the competition in today's rapidly moving business landscape.

The finest Carrageenan Market analysis report provides estimations about the growth rate and the market value based on market dynamics and growth inducing factors. Businesses can get current as well as upcoming technical and financial details of the industry to 2030 with this market research report. The report is mainly distributed to the users in the form of PDF or spreadsheet or PPT (if asked by client). The report also mentions CAGR value fluctuations during the forecast period of 2023-2030 for the market. The winning Carrageenan Market report has been formulated with the best-practice models, comprehensive market analysis and research methodologies so that clients attain perfect market segmentation and insights.

Examine detailed statistics, forecasts, and expert analysis in our Carrageenan Market report. Download now:

https://www.databridgemarketresearch.com/reports/global-carrageenan-market

Carrageenan Sector Overview

**Segments**

- By Type: Kappa Carrageenan, Iota Carrageenan, Lambda Carrageenan

- By Application: Food and Beverages, Pharmaceutical, Cosmetics, Industrial

- By Function: Gelling Agent, Thickening Agent, Stabilizing Agent, Emulsifying Agent

Carrageenan is a widely used ingredient in various industries due to its versatile properties. In terms of type, the market is segmented into Kappa Carrageenan, Iota Carrageenan, and Lambda Carrageenan. Among these, Kappa Carrageenan is the most commonly used type due to its strong gelling properties, making it ideal for applications in the food and pharmaceutical industries. Iota Carrageenan is known for its soft gelling properties, often used in dairy products and toothpaste. Lambda Carrageenan, on the other hand, is primarily used as a thickening agent in products like sauces and desserts.

When it comes to applications, the carrageenan market is segmented into food and beverages, pharmaceutical, cosmetics, and industrial. The food and beverages segment dominates the market, driven by the rising demand for natural and plant-based ingredients in the food industry. Carrageenan is widely used as a stabilizer and gelling agent in various food products such as dairy, meat, and confectionery. In the pharmaceutical industry, carrageenan is utilized for its binding and disintegration properties in tablet formulations. The cosmetic industry also benefits from carrageenan's emulsifying properties, used in products like lotions and creams. Additionally, carrageenan finds applications in the industrial sector, particularly in water-based paints and coatings as a thickening agent.

In terms of function, carrageenan serves as a gelling agent, thickening agent, stabilizing agent, and emulsifying agent. Its versatile nature makes it a valuable ingredient across a wide range of products. As a gelling agent, carrageenan is crucial in creating the desired texture in food products like gummy candies and jellies. In terms of thickening, it enhances the viscosity of liquids, improving the overall mouthfeel of products like yogurt and sauces. Carrageenan's stabilizing properties help maintain the homogeneity of various formulations, while its emulsifying properties aid in creating stable emulsions in cosmetic and pharmaceutical products.

**Market Players**

- Gelymar

- Cargill, Incorporated

- CP Kelco U.S., Inc.

- Marcel Trading Corporation

- ACCEL Carrageenan Corporation

Key players in the global carrageenan market include Gelymar, Cargill, Incorporated, CP Kelco U.S., Inc., Marcel Trading Corporation, and ACCEL Carrageenan Corporation. These companies are actively engaged in product innovations, partnerships, and expansions to strengthen their market presence and meet the evolving needs of consumers across different industries.

The global carrageenan market is experiencing significant growth driven by the increasing demand for natural and plant-based ingredients across various industries. One of the key factors boosting market growth is the growing preference for carrageenan in the food and beverages sector. With consumers becoming more health-conscious and mindful of what they consume, the use of carrageenan as a stabilizer and gelling agent in products like dairy, meat, and confectionery has witnessed a surge. As the food industry continues to innovate and cater to changing consumer preferences, carrageenan's properties make it a valuable ingredient in creating texture, viscosity, and stability in a wide range of food products.

In the pharmaceutical industry, carrageenan's role as a binding and disintegration agent in tablet formulations is driving its adoption. This is particularly important in the development of pharmaceutical products where consistency, quality, and efficacy are paramount. The cosmetic industry is also utilizing carrageenan for its emulsifying properties, enabling the creation of stable formulations in products like lotions and creams. As the demand for natural and sustainable ingredients grows in the cosmetics sector, carrageenan is well-positioned to play a significant role in meeting these requirements.

Moreover, the industrial segment of the carrageenan market is benefiting from the ingredient's use as a thickening agent in water-based paints and coatings. Carrageenan's ability to enhance viscosity and improve the overall performance of industrial products is driving its adoption in this sector. As industries continue to prioritize sustainability and environmentally friendly solutions, carrageenan's natural origin and functional properties position it as a favorable choice for a wide range of applications.

Key players in the global carrageenan market such as Gelymar, Cargill, Incorporated, CP Kelco U.S., Inc., Marcel Trading Corporation, and ACCEL Carrageenan Corporation are focusing on product innovations and strategic partnerships to maintain their competitive edge. By investing in research and development, these companies aim to expand their product portfolios and cater to evolving consumer demands. Additionally, geographical expansions and collaborations with industry stakeholders are key strategies employed by market players to enhance their market presence and reach a wider customer base.

In conclusion, the global carrageenan market is poised for continued growth, driven by the increasing demand for natural and functional ingredients across various industries. With its versatile properties and wide range of applications, carrageenan remains a valuable ingredient that meets the needs of manufacturers and consumers alike. The strategic initiatives undertaken by key market players are expected to further propel the market forward, paving the way for innovation and advancements in carrageenan-based products.The global carrageenan market is experiencing robust growth, driven by the increasing demand for natural and plant-based ingredients across multiple industries. Carrageenan's versatility and functional properties have made it a sought-after ingredient in the food and beverages sector, where it is widely used as a stabilizer and gelling agent in various products such as dairy, meat, and confectionery. The pharmaceutical industry also relies on carrageenan for its binding and disintegration properties in tablet formulations, highlighting its importance in ensuring the quality and efficacy of pharmaceutical products. In the cosmetics industry, carrageenan's emulsifying properties are utilized in products like lotions and creams, catering to the rising consumer preference for natural and sustainable ingredients in personal care products.

Furthermore, the industrial segment of the carrageenan market is witnessing growth as well, with carrageenan's use as a thickening agent in water-based paints and coatings. Its ability to enhance viscosity and improve product performance is driving its adoption in industrial applications, where sustainability and environmentally friendly solutions are becoming increasingly important. Key market players such as Gelymar, Cargill, CP Kelco U.S., Marcel Trading Corporation, and ACCEL Carrageenan Corporation are actively involved in product innovations and strategic partnerships to maintain a competitive edge in the market.

The strategic initiatives undertaken by these market players include investments in research and development to expand their product portfolios and cater to evolving consumer demands. Additionally, geographical expansions and collaborations with industry stakeholders are crucial strategies to enhance market presence and reach a broader customer base. As the global carrageenan market continues to evolve, fueled by the demand for natural and functional ingredients, these key players are expected to drive further innovation and advancements in carrageenan-based products.

In conclusion, the outlook for the carrageenan market remains positive, with growth prospects across various industries driven by the versatility and functionality of carrageenan as a key ingredient. The market's evolution is likely to be shaped by continued innovations, partnerships, and expansions led by key players, ensuring that carrageenan remains a vital component in the formulation of diverse products in the food, pharmaceutical, cosmetic, and industrial sectors. The ongoing focus on sustainability and consumer preferences for natural ingredients is expected to further fuel the demand for carrageenan in the global market, presenting opportunities for market players to capitalize on emerging trends and preferences.

View company-specific share within the sector

https://www.databridgemarketresearch.com/reports/global-carrageenan-market/companies

Strategic Question Sets for In-Depth Carrageenan Market Analysis

- What is the current revenue pool of the Carrageenan Market?

- How is the annualized growth expected to trend?

- What functional segments are analyzed in the Carrageenan Market report?

- Who are the companies with the most aggressive growth plans?

- What recent upgrades have been introduced to leading products?

- What countries are major contributors to global Carrageenan Market demand?

- What region is experiencing structural transformation?

- Which countries are leading exporters of related products?

- Where is product acceptance highest?

- What are the cross-industry trends influencing growth for Carrageenan Market?

Browse More Reports:

Global Glycomics/Glycobiology Market

Global Hyaluronic Acid Market

Global Hydroxypropyl Methylcellulose (HPMC) Market

Global Lupine Seed Market

Global Medical Plastic Market

Global Natural Food Colors Market

Global Orange Juices Market

Global Ornamental Fish Market

Global Phosphate Market

Global Protein Cookie Market

Global Testosterone Replacement Therapy Market

Global Tire Material Market

Global Vermicompost Market

Global Automotive Smart Antenna Market

Global Laminated Tubes Market

Middle East and Africa Long Chain Polyamide Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

Compressed Natural Gas (CNG) Market Overview: Size, Share, Opportunities & Future Projections

By dannykinggt, 2025-08-18

Comprehensive Outlook on Executive Summary Compressed Natural Gas (CNG) Market Size and Share

Comprehensive Outlook on Executive Summary Compressed Natural Gas (CNG) Market Size and Share

The global compressed natural gas (CNG) market size was valued at USD 92.21 billion in 2024 and is expected to reach USD 121.42 billion by 2032, at a CAGR of 3.50% during the forecast period

This competitive era calls for businesses to be equipped with knowhow of the major happenings of the market and Compressed Natural Gas (CNG) Market This Compressed Natural Gas (CNG) Market research report is comprehensive and object-oriented which is structured with the grouping of an admirable industry experience, talent solutions, industry insight and most modern tools and technology. To acquire knowhow of market landscape, brand awareness, latest trends, possible future issues, industry trends and customer behaviour, this finest Compressed Natural Gas (CNG) Market research report is very crucial. This Compressed Natural Gas (CNG) Market report covers all the studies and estimations that are involved in the method of standard market research analysis.

Compressed Natural Gas (CNG) Market report comprises of all the crucial parameters mentioned above hence it can be used for your business. Furthermore, systemic company profiles covered in this report also explains what recent developments, product launches, joint ventures, mergers and acquisitions are taking place by the numerous key players and brands in the market. Compressed Natural Gas (CNG) Market report also endows with company profiles and contact information of the key market players in the key manufacturer’s section. The Compressed Natural Gas (CNG) Market report is provided with the transparent research studies which have taken place by a team work of experts in their own domain.

Access expert insights and data-driven projections in our detailed Compressed Natural Gas (CNG) Market study. Download full report:

https://www.databridgemarketresearch.com/reports/global-compressed-natural-gas-cng-market

Compressed Natural Gas (CNG) Industry Snapshot

**Segments**

- **By Source:** The CNG market can be segmented by source into conventional and unconventional sources. Conventional sources include natural gas reserves that are easily accessible and have been traditionally used for CNG production. Unconventional sources include shale gas, coalbed methane, and biogas, which are being increasingly utilized for CNG production due to environmental concerns and the need for sustainable energy sources.

- **By Distribution:** Distribution of CNG can be segmented into virtual pipelines, cascades, and onsite production. Virtual pipelines involve the transportation of CNG through mobile pipelines via truck or ship to areas lacking pipeline infrastructure. Cascades refer to a series of storage cylinders where CNG is compressed and stored for distribution. Onsite production involves the generation of CNG at the site of consumption, often used by industries and commercial facilities to meet their energy needs.

- **By Application:** The CNG market can also be segmented by application into transportation, industrial, and residential sectors. The transportation sector accounts for the largest share of CNG consumption, with CNG being used as a fuel for vehicles such as buses, trucks, and cars due to its cost-effectiveness and lower emissions compared to traditional fuels. The industrial sector utilizes CNG for heating, power generation, and process applications, while the residential sector uses CNG for cooking, heating, and other household activities.

**Market Players**

- **Some of the key players in the global compressed natural gas (CNG) market include:**

- Exxon Mobil Corporation

- Royal Dutch Shell plc

- TotalEnergies SE

- Chevron Corporation

- BP p.l.c.

- Gazprom

- China National Petroleum Corporation (CNPC)

- Eni S.p.A.

- Equinor ASA

- Rosneft

These market players are actively involved in the exploration, production, distribution, and marketing of compressed natural gas (CNG) to cater to the growing demand for cleaner and more sustainable energy sources. They are also investing in research and development activities to enhance the efficiency of CNG production and promote its widespread adoption across various sectors.

The global compressed natural gas (CNG) market is witnessing significant growth driven by factors such as environmental concerns, government initiatives to reduce greenhouse gas emissions, and the increasing focus on sustainable energy sources. One of the emerging trends in the CNG market is the integration of renewable sources such as biogas into CNG production, offering a more environmentally friendly alternative to traditional fossil fuel-based CNG. This trend aligns with the global push towards decarbonization and achieving net-zero emissions targets. Market players are increasingly exploring opportunities to leverage renewable sources for CNG production to meet the growing demand for cleaner energy solutions.

Another key trend shaping the CNG market is the development of advanced distribution infrastructure and logistics solutions to improve the efficiency of CNG supply chains. Virtual pipelines, for instance, offer a flexible and cost-effective means of transporting CNG to remote or inaccessible areas that lack traditional pipeline infrastructure. By leveraging innovations in transportation technology and logistics, market players are able to enhance the reach and accessibility of CNG as a fuel source across various sectors, including transportation, industrial, and residential.

Furthermore, the increasing adoption of CNG as a transportation fuel is driving innovation in vehicle technology and infrastructure development. With a focus on reducing carbon emissions and improving air quality, government incentives and regulations are supporting the deployment of CNG-powered vehicles in public transportation fleets and commercial sectors. This presents an opportunity for market players to expand their product offerings and collaborate with stakeholders in the automotive industry to promote the use of CNG as a clean and cost-effective alternative to traditional fuels.

Moreover, market players in the CNG industry are actively engaging in strategic partnerships, mergers, and acquisitions to strengthen their market position and expand their presence globally. By investing in research and development initiatives, these players are focused on developing advanced technologies for CNG production, storage, and distribution to meet the evolving needs of the market. Collaboration with key stakeholders, including government entities, regulatory bodies, and technology providers, is essential for driving innovation and accelerating the adoption of CNG as a sustainable energy solution.

In conclusion, the global compressed natural gas (CNG) market is poised for growth as the demand for cleaner and more sustainable energy sources continues to rise. Market players are adapting to evolving market trends by embracing renewable sources, improving distribution infrastructure, and expanding their product portfolios to meet the diverse needs of consumers across different sectors. With strategic investments in research and development and a focus on collaboration and innovation, the CNG market is positioned for significant expansion in the coming years.The global compressed natural gas (CNG) market is experiencing a transformation driven by a combination of factors such as environmental concerns, government regulations promoting sustainable energy, and advancements in technology. Market players are increasingly focusing on integrating renewable sources like biogas into CNG production to offer more eco-friendly alternatives. This shift aligns with the global emphasis on decarbonization and achieving net-zero emissions targets. The utilization of renewable sources not only enhances the sustainability of CNG but also diversifies the energy mix, reducing dependency on traditional fossil fuels.

Another notable trend shaping the CNG market is the evolution of advanced distribution infrastructure and logistics solutions to enhance the efficiency of CNG supply chains. Virtual pipelines, a flexible method of transporting CNG to areas without pipeline infrastructure, are gaining traction for their cost-effectiveness and accessibility. By leveraging technological innovations in transportation and logistics, market players are extending the reach of CNG as a fuel source to various sectors, including transportation, industrial, and residential, thereby expanding the market potential and accessibility of CNG.

The growing adoption of CNG as a transportation fuel is driving innovations in vehicle technology and infrastructure development. Government incentives and regulations aimed at reducing carbon emissions are encouraging the deployment of CNG-powered vehicles in public transportation and commercial sectors. This shift presents an opportunity for market players to diversify their product offerings and collaborate with automotive industry stakeholders to promote the use of CNG as a cleaner and economically viable alternative to traditional fuels, which can positively impact air quality and sustainability efforts.

Moreover, market participants in the CNG industry are actively pursuing strategic partnerships, mergers, and acquisitions to bolster their market positions and global presence. Through investments in research and development, these players are focusing on developing advanced technologies for CNG production, storage, and distribution to meet the evolving demands of the market. Collaboration with various stakeholders such as government bodies, regulatory agencies, and technology providers is crucial for fostering innovation and accelerating the adoption of CNG as a sustainable energy solution.

In conclusion, the global compressed natural gas (CNG) market is poised for substantial growth as the demand for environmentally friendly and sustainable energy sources continues to surge. Market players are adapting to current market trends by embracing renewable sources, enhancing distribution infrastructure, and expanding their product portfolios to cater to diverse consumer needs across different sectors. With strategic investments in research, development, and innovation, the CNG market is poised for significant expansion in the foreseeable future, establishing itself as a vital player in the global shift towards cleaner energy solutions.

Discover the company’s competitive share in the industry

https://www.databridgemarketresearch.com/reports/global-compressed-natural-gas-cng-market/companies

Market Intelligence Question Sets for Compressed Natural Gas (CNG) Industry

- How big is the current global Compressed Natural Gas (CNG) Market?

- What is the forecasted Compressed Natural Gas (CNG) Market expansion through 2032?

- What core segments are covered in the report on the Compressed Natural Gas (CNG) Market?

- Who are the strategic players in the Compressed Natural Gas (CNG) Market?

- What countries are part of the regional analysis in the Compressed Natural Gas (CNG) Market?

- Who are the prominent vendors in the global Compressed Natural Gas (CNG) Market?

Browse More Reports:

Global 5-Aminolevulinic Acid Hydrochloride (ALA) Market

Global Agricultural Nanotechnology Market

Global Air Filters Market

Global Aquaponics Market

Global Artificial Intelligence (AI) Insurtech Market

Global Azelaic Acid Manufacturing for Industrial Use Market

Global Baby Feeding Bottle Market

Global Betanin Market

Global Body Dryer Market

Global Busbar Market

Global Center Pivot Irrigation Systems Market

Global Decorative Laminates Market

Global Digital Market

Global Educational Toys Market

Global Gallium Nitride (GaN) Powered Chargers Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

Divinylbenzene (DVB) Market Trends | 3.9% CAGR Supported By Advancements In Technologies

By AnandLondhe, 2025-08-18

Divinylbenzene (DVB) Market is experiencing steady growth, with its valuation reaching USD 76 million in 2023. According to the latest market analysis, the industry is projected to expand at a CAGR of 3.9%, reaching approximately USD 107.24 million by 2032. This growth is primarily driven by increasing applications in water treatment, electronics, and healthcare sectors, where DVB's unique properties as a cross-linking agent are becoming increasingly valuable.

Divinylbenzene serves as a critical component in polymer manufacturing, enhancing material strength and stability across various industrial applications. Its versatility makes it indispensable for producing ion exchange resins, adhesives, specialty plastics, and pharmaceutical formulations. As industries continue to prioritize performance materials, DVB's role in enabling advanced polymer solutions continues to grow.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/290502/global-divinylbenzene-forecast-market-2025-2032-631

Strategic Recommendations & Effect on Environment and Individuals

Companies in the Divinylbenzene (DVB) market should focus on investing in high-purity DVB production and sustainable polymerization processes. Implementing eco-friendly production techniques can minimize chemical waste and energy consumption, reducing the environmental footprint. For individuals, the use of DVB-based resins and polymers ensures safer, durable, and high-performance materials in applications ranging from water purification to industrial coatings, contributing to improved product reliability and public safety.

Market Overview & Regional Analysis

North America currently dominates the DVB market, accounting for a significant share valued at USD 21.15 million in 2023. The region benefits from advanced water treatment infrastructure, robust electronics manufacturing, and strong pharmaceutical R&D activities. Europe follows closely, with stringent environmental regulations driving demand for high-performance ion exchange resins.

Asia-Pacific emerges as the fastest-growing market, fueled by rapid industrialization and expanding electronics production in China, Japan, and South Korea. While Latin America and Middle East & Africa show promising potential, their growth is tempered by developing industrial infrastructure and varying regulatory landscapes.

Key Market Drivers and Opportunities

The market's growth stems from multiple factors working in tandem. The water treatment industry's expansion accounts for approximately 35% of global DVB demand, as municipalities and industries increasingly adopt ion exchange technologies for purification. Simultaneously, the electronics boom, particularly in semiconductor manufacturing, drives another 25% of consumption, where DVB-derived polymers enable precision components.

Emerging opportunities lie in pharmaceutical applications, where DVB-based drug delivery systems show promising results. Additionally, advanced material research continues to uncover new applications in energy storage and specialty coatings, presenting long-term growth avenues for market players.

Recent Developments

Recent developments in the DVB market include the expansion of production capacities in North America and Asia-Pacific to meet growing industrial demand. Key players are incorporating advanced crosslinking technologies and high-performance resin formulations to enhance product efficiency. Additionally, collaborations between chemical manufacturers and industrial end-users are accelerating research and commercialization of specialized DVB applications, including ion-exchange resins and specialty polymers.

Challenges & Restraints

The DVB market faces several headwinds, including raw material price volatility stemming from petroleum market fluctuations. Environmental regulations present another challenge, particularly in Europe and North America, where chemical production faces increasing scrutiny. Supply chain complexities have also emerged as a concern, with geopolitical factors and logistics disruptions impacting global trade flows.

From a technical standpoint, health and safety considerations require significant investment in handling protocols, adding to operational costs. Smaller manufacturers often struggle with these compliance requirements, potentially limiting market participation.

Market Segmentation by Type

-

High Purity DVB

-

Industrial Grade DVB

-

Custom Formulations

Market Segmentation by Application

-

Ion Exchange Resins

-

Adhesives & Coatings

-

Plastics & Elastomers

-

Pharmaceutical Applications

-

Electronics & Semiconductor

Market Segmentation and Key Players

-

Dow Chemical Company

-

Mitsubishi Chemical Corporation

-

Jiangsu Evergreen New Material Technology

-

Nippon Steel Chemical & Material Co., Ltd.

-

Suzhou DFD Chemical Co., Ltd.

-

Alfa Aesar

-

Tokyo Chemical Industry

-

Hangzhou Bright Chemical

-

Nanjing Lepu Chemical

Major Disruptions

Major disruptions in the DVB market arise from raw material volatility, supply chain bottlenecks, and stringent regulatory standards for chemical handling. Fluctuations in the price and availability of precursors can affect production timelines and cost structures. Furthermore, increasing competition from alternative polymers and synthetic resins introduces market pressure, forcing companies to adapt quickly to maintain supply consistency and competitiveness in industrial applications.

Report Scope

This report provides a comprehensive analysis of the global Divinylbenzene market from 2024 through 2032. The research encompasses detailed examination of:

-

Market size estimations and forecasts across all key segments

-

Competitive landscape analysis featuring market share, strategies, and recent developments

-

Value chain assessment covering raw material suppliers to end-use industries

-

Regulatory framework analysis across major markets

The study also includes in-depth company profiles of market leaders, detailing:

-

Production capacities and operational footprints

-

Product portfolios and specifications

-

Financial performance metrics

-

Strategic initiatives and partnerships

Primary research involved direct interviews with industry executives, while secondary research incorporated analysis of company reports, trade data, and government publications. Analyst insights combine quantitative modeling with qualitative assessments to provide a balanced market perspective.

About 24chemicalresearch

Founded in 2015, 24chemicalresearch has rapidly established itself as a leader in chemical market intelligence, serving clients including over 30 Fortune 500 companies. We provide data-driven insights through rigorous research methodologies, addressing key industry factors such as government policy, emerging technologies, and competitive landscapes.

-

Plant-level capacity tracking

-

Real-time price monitoring

-

Techno-economic feasibility studies

With a dedicated team of researchers possessing over a decade of experience, we focus on delivering actionable, timely, and high-quality reports to help clients achieve their strategic goals. Our mission is to be the most trusted resource for market insights in the chemical and materials industries.

https://chemicalinsightsforum.blogspot.com/2025/08/metalworking-treating-fluid-market.html

https://chemicalinsightsforum.blogspot.com/2025/08/chemical-flocculant-market-growth.html

https://chemicalinsightsforum.blogspot.com/2025/08/innovation-and-demand-in-iot-devices.html

https://chemicalinsightsforum.blogspot.com/2025/08/rubber-additives-masterbatch-market.html

https://chemicalinsightsforum.blogspot.com/2025/08/methyldiisopropanolamine-market-demand.html

https://chemicalinsightsforum.blogspot.com/2025/08/sulfur-adsorbent-market-size-to-reach.html

Thimerosal Market, Global Outlook and Forecast 2025-2032

Contact Us:

Email: help@24chemicalresearch.com

International: +1(332) 2424 294 | Asia: +91 9169162030

Introduction

Welcome to the interesting world of Skyexchange India! If you are seeking out thrilling on-line gaming enjoyment, you've come to the proper area. Skyexchange gives a giant array of video games that cater to each form of participant, whether you’re a seasoned seasoned or just starting out. With its person-pleasant interface and tasty features, getting started is as smooth as clicking a button. So, why wait? Let’s dive in and explore how you may create your account and embark on a thrilling gaming adventure these days!

Benefits of making an account

- Creating an account on Skyexchange opens the door to a world of thrilling possibilities. First, it enhances your gaming enjoyment with personalized functions tailored just for you.

- Once registered, you will benefit from the right of entry to distinct promotions and bonuses.These incentives can substantially improve your gameplay and growth capacity winnings.

- Account holders additionally experience faster transactions. Whether you are depositing or retreating finances, the technique becomes seamless and green.

- Moreover, having an account allows you to tune your development through the years. You can without difficulty screen your wins and losses even by adjusting strategies accordingly.

- Being a part of the Skyexchange community connects you with like-minded players. This fosters interaction and sharing of recommendations that may elevate every body’s sport play revel in.

How to create an account on Skyexchange India

Creating an account on Skyexchange India is a sincere manner.First, visit the dependable internet web site and look for the "Sign Up" button prominently displayed.

Click on it to begin your registration. You’ll need to fill out a form with crucial details like your call, e-mail deal with, and phone variety. Ensure that you offer correct records for clean verification later.

Once you've entered the specified info, create a sturdy password to protect your account. It’s wise to use a combination of letters, numbers, and emblems for added protection.

After filing the form, test your email for a confirmation hyperlink from Skyexchange India. Click on this link to verify your account and the entire setup method.

Steps to login to your account

|

Action |

Details |

|

Visit Website |

Go to the professional Skyexchange internet site. |

|

Find Login Option |

Look for the "Login" button at the homepage. |

|

Enter Credentials |

Provide your registered electronic mail deal with and password. |

|

Password Recovery |

if forgotten, use the "Forgot Password" choice to reset credentials securely. |

|

Click Login |

Press the "Login" button to access your account. |

|

Access Account |

Gain entry for your Skyexchange account and begin exploring. |

Popular games to be had on Skyexchange India

Skyexchange login India boasts an excellent array of games that cater to diverse tastes. From conventional card video games to fashionable slots, there’s something for everyone.

One standout alternative is cricket having a bet, particularly popular among sports lovers. Players can region bets on live suits and tournaments, enhancing the thrill of the game.

For those who enjoy strategy, poker is a must-attempt. Compete against others in interesting codecs while showcasing your abilities and approaches.

Slot machines also function prominently at the platform. With vibrant portraits and attractive subject matters, they provide limitless amusement with a risk to win large prizes.

Additionally, users can discover virtual sports activities like football and basketball simulations. These innovative options provide movement-packed gameplay even when actual games aren't going on.

Skyexch India promises numerous gaming studies designed to preserve gamers engaged and entertained all day long.

Tips for a success gameplay

To excel at Skyexchange, begin with the aid of familiarizing yourself with the video games. Knowledge of guidelines and strategies can notably decorate your overall performance.

Setting a price range is vital. Decide how plenty you’re inclined to spend before diving in. This facilitates manipulation losses and prolongs entertainment.

Play continually however keep away from burnout. Regular sessions preserve talent sharp, while breaks preserve enthusiasm.

Take gain of promotions and bonuses offered at the platform. These can increase your gameplay without extra value.

Stay affected in the course of gameplay. Quick selections might lead to errors, so take time to assess every situation carefully.

Conclusion

Engaging with Skyexchange opens a global of excitement. The platform offers diverse options for users to discover and experience.

Creating an account is step one toward maximizing your level. With only a few clicks, you can get admission to interesting video games that hold gamers on their feet.

Each sport brings its particular vibe, ensuring there is something for everybody. Whether you are into technique or achievement-based totally games, Skyexchange has you blanketed.

Remember to live informed and make use of pointers from pro gamers. This know-how can decorate your gameplay and boom enjoyment.

Dive in these days! Embrace the fun of opposition whilst connecting with others who share comparable pursuits. The adventure awaits at every login, geared up when you are!

FAQ

1.What is Skyexchange?

Sky exchange is a web gaming platform that gives a big selection of sports activities betting and online casino games for customers in India. It's designed to offer a seamless and tasty revel in.

2.Is developing an account on Skyexch unfastened?

Yes, signing up for an account on Skyexch is completely free. You can explore various games without any preliminary charges.

3.How do I reset my password if I neglect it?

If you neglect your password, definitely click on the "Forgot Password" link at the login internet page.Follow the instructions sent on your registered email to reset it.

4.Can I get the right of entry to my account from multiple devices?

Absolutely! Your Sky247 account can be accessed from one of a kind gadgets as long as you've got an internet connection.

5.Are there mobile apps available for Skyexch?

Currently, there may additionally or may not be dedicated cell apps relying on updates from the web page itself; however, the internet site is optimized for mobile use.

Waterproofing is an essential component of construction in Singapore's tropical climate, which is characterized by high humidity and intense monsoon rains. Buildings and infrastructure are vulnerable to deterioration, mold growth, and water damage in the absence of efficient waterproofing solutions. One of Singapore's top waterproofing companies, CWP provides top-notch services meant to shield buildings from the damaging effects of water intrusion. CWP is a well-known brand in the industry for waterproofing solutions for homes, businesses, and industries thanks to its many years of experience and strong performance history.

The Need for Waterproofing in Singapore

For property owners, Singapore's climate presents particular difficulties. High humidity and frequent, heavy rains raise the possibility of water seeping into buildings and causing long-term damage. It is impossible to exaggerate how crucial a trustworthy waterproofing system is; without it, structural integrity may be jeopardized, resulting in expensive repairs and a decline in property value.

Leak prevention is only one aspect of waterproofing. Building longevity, preserving indoor air quality by inhibiting the growth of mold, and establishing a comfortable living or working environment are all important considerations. Waterproofing becomes a crucial factor in both new construction and renovation projects in a city like Singapore, where intense rainfall is typical.

CWP’s Comprehensive Waterproofing Services

In order to satisfy the various needs of its customers, CWP provides a broad range of waterproofing services. We provide specialized solutions to guarantee optimal protection and durability because we recognize that every property has unique needs. CWP provides a number of essential services, such as:

- Roof Waterproofing: Roofs are particularly vulnerable to water damage because they are subjected to the most severe weather. By providing a strong barrier against rainwater, CWP's roof waterproofing services reduce the possibility of structural damage and stop leaks.

- Waterproofing Basements: In Singapore's high-water-table regions, basements are especially susceptible to water seepage. By successfully stopping water intrusion, our basement waterproofing solutions keep your space dry, secure, and functional.

- Waterproofing of Balconies and Terraces: Due to their high exposure to the weather, balconies and terraces are vulnerable to leaks and cracks. To prevent water intrusion and maintain the structural integrity of these outdoor areas, we offer complete waterproofing solutions.

- Waterproofing Toilets and Bathrooms: Toilets and bathrooms are particularly vulnerable to water damage. Over time, CWP's bathroom waterproofing guarantees that these areas stay dry, mold-free, and impervious to water damage.

- Specialized Infrastructure Waterproofing: Specialized Infrastructure Waterproofing CWP provides cutting-edge waterproofing solutions for major projects like tunnels, bridges, and subterranean structures. These solutions are made to endure the stresses and difficulties of these vital infrastructures.

Hypersonic Missiles Market size is expected to be worth around USD 29.9 Billion

By yuvraj modak, 2025-08-18

The Global Hypersonic Missiles Market size is expected to be worth around USD 29.9 Billion By 2034, from USD 8.5 billion in 2024, growing at a CAGR of 13.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.6% share, holding USD 2.9 Billion revenue.

Read more - https://market.us/report/global-hypersonic-missiles-market/

The hypersonic missiles market revolves around the development, production, and deployment of advanced missile systems capable of traveling at speeds greater than five times the speed of sound. These weapons combine speed, maneuverability, and precision, making them extremely difficult to detect and intercept. Countries are actively investing in hypersonic capabilities to gain a strategic defense edge and deter evolving threats. The market includes both hypersonic glide vehicles and cruise missiles, supported by innovations in propulsion, materials, and guidance systems.

The hypersonic missiles market is experiencing rapid expansion, driven by growing geopolitical tensions and the global arms race among leading military powers. There is increasing demand from defense ministries to modernize their missile arsenals and maintain deterrence against emerging adversaries. Countries like the United States, China, and Russia are leading the charge in testing and deploying hypersonic systems, creating competitive pressure on other nations to follow. The demand is particularly strong in regions facing complex security challenges and border conflicts.

One of the key growth drivers for this market is the advancement in scramjet propulsion and heat-resistant composite materials, which are making hypersonic flight more viable. In addition, the increasing use of AI-based targeting systems and satellite navigation technologies has boosted the feasibility of precise, long-range hypersonic attacks. These technologies are being adopted due to their ability to deliver rapid response and enhanced strike capability against high-value targets in contested environments.

The adoption of hypersonic systems is primarily motivated by the need to overcome conventional missile defense networks, penetrate sophisticated shields, and establish rapid strike dominance. Defense agencies also seek to boost national security credibility and technological superiority by investing in next-gen missile platforms. Furthermore, the growing fear of falling behind in defense innovation is prompting several nations to fast-track development and procurement.

Vending Machine Market Analysis – Size, Trends & Strategic Outlook to 2030

By dannykinggt, 2025-08-18

Executive Summary Vending Machine Market Size and Share Forecast

Executive Summary Vending Machine Market Size and Share Forecast

The global Vending Machine market was valued at USD 19.85 billion in 2024 and is expected to reach USD 34.88 billion by 2032.During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.30%, primarily driven by increasing demand for contactless and automated solutions

With a capable and wide-ranging market research study, Vending Machine Market report provides the facts associated with any subject in the field of marketing. This report unearths the common market conditions, trends, preferences, key players, opportunities, geographical analysis and many other parameters that support to drive the business into right direction. With the precise and high-tech information given in the top notch Vending Machine Market report, businesses can know about the types of consumers, consumer’s demands and preferences, their perspectives about the product, their buying intentions, their response to particular product, and their varying tastes about the specific product already active in the market.