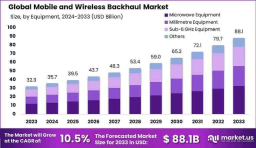

The Global Mobile and Wireless Backhaul Market is projected to grow from USD 32.3 billion in 2023 to USD 88.1 billion by 2033, registering a CAGR of 10.56%. Increasing mobile data traffic, 5G deployment, and rising IoT applications are driving significant demand. In 2023, North America accounted for over 35% of the market share, generating USD 11.3 billion in revenue, reflecting its strong infrastructure and early technology adoption. Demand growth is fueled by urbanization, cloud adoption, and the need for higher network capacity. This expansion highlights the critical role of wireless backhaul in enabling seamless connectivity and next-generation mobile services.

Key Takeaways

Market size in 2023: USD 32.3 billion

Projected market size by 2033: USD 88.1 billion

CAGR (2024–2033): 10.56%

North America market share (2023): 35%+

North America revenue (2023): USD 11.3 billion

Growth driver: 5G deployment & mobile data surge

Dominant Market Position

North America maintained a dominant position in 2023 with over 35% share, supported by robust telecom infrastructure, large-scale 5G rollouts, and significant investments in advanced networking technologies. The region’s early adoption of high-speed internet and extensive cloud integration enhanced its leadership. Asia-Pacific is emerging as the fastest-growing region, driven by massive mobile user bases, government-led digitalization programs, and expanding smart city projects. Europe is witnessing steady growth due to regulatory frameworks supporting 5G spectrum allocation. North America’s established ecosystem of operators, equipment providers, and technology enablers positions it as the market leader, ensuring continued dominance during the forecast period.

Technology Perspective

The mobile and wireless backhaul market is being reshaped by advanced technologies such as fiber-optic integration, millimeter wave (mmWave), microwave solutions, and satellite-based backhaul. The rollout of 5G networks demands ultra-low latency and high throughput, accelerating adoption of small cell backhaul solutions. Software-defined networking (SDN) and network function virtualization (NFV) enhance flexibility, scalability, and cost-efficiency. Edge computing and AI-driven traffic management optimize network performance and reduce congestion. Additionally, hybrid backhaul combining wireless and wired technologies is gaining traction for urban and rural coverage. These technological advancements are critical to meeting future connectivity needs, supporting IoT, AR/VR, and autonomous applications.

Dynamic Landscape

The market is evolving rapidly, driven by exponential data consumption, aggressive 5G rollouts, and demand for high-capacity networks. Competition is intensifying as vendors innovate in spectrum efficiency and low-latency solutions. Partnerships between telecom operators and technology providers are shaping market growth, ensuring adaptability to both urban and remote deployment challenges.

Drivers, Restraints, Opportunities, Challenges

Drivers: 5G deployment, IoT expansion, data traffic growth

Restraints: High infrastructure costs, spectrum limitations

Opportunities: Emerging markets, satellite backhaul, smart city projects

Challenges: Regulatory hurdles, rural connectivity gaps, technology integration complexities

Use Cases

5G small cell backhaul

IoT device connectivity support

Smart city infrastructure networks

Rural broadband expansion

Cloud-based mobile applications

Low-latency AR/VR experiences

Enterprise-grade private networks

Key Players Analysis

The competitive landscape features telecom operators, network equipment manufacturers, and technology innovators competing on performance, scalability, and cost efficiency. Market participants focus on enhancing bandwidth capacity, spectrum utilization, and software-driven backhaul solutions. Strategic partnerships, mergers, and R&D investments drive innovation in fiber-wireless integration and next-gen backhaul systems. Vendors emphasize regional expansion to capture emerging markets, particularly in Asia-Pacific and Latin America. Leading players leverage advanced technologies such as mmWave, SDN, and edge computing to maintain competitiveness. The market is moderately consolidated, with a mix of established giants and emerging firms striving to differentiate through innovation and ecosystem collaborations.

Recent Developments

Deployment of hybrid fiber-wireless backhaul solutions

Expansion of mmWave-based backhaul for dense urban areas

Investments in satellite-enabled backhaul for remote connectivity

Telecom partnerships for 5G infrastructure acceleration

Integration of AI-driven backhaul traffic optimization

Conclusion

The mobile and wireless backhaul market is on a robust growth trajectory, fueled by 5G adoption, rising data traffic, and demand for ubiquitous connectivity. North America remains the market leader, while Asia-Pacific presents the strongest growth potential. Technological innovations in mmWave, satellite, and SDN will define the industry’s future competitiveness.

| No comments yet. Be the first. |