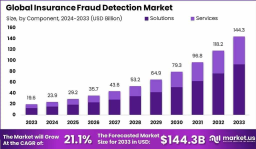

The global insurance fraud detection market was valued at USD 19.6 billion in 2023 and is projected to reach USD 144.3 billion by 2033, growing at a CAGR of 21.1%. Rising fraudulent claims, digital adoption in insurance processes, and stricter regulatory compliance are driving robust demand. The market expansion is fueled by advanced analytics, AI, and machine learning, enabling insurers to minimize losses, improve claim validation, and enhance customer trust. With fraud becoming increasingly sophisticated, investment in real-time detection solutions is accelerating, especially in high-value markets. This rapid growth is expected to significantly impact operational efficiency and profitability.

Key Takeaways

2023 market size: USD 19.6 billion.

2033 projection: USD 144.3 billion.

CAGR (2024–2033): 21.1%.

North America share in 2023: 49.1%.

North America revenue in 2023: USD 9.4 billion.

Rapid adoption of AI/ML in fraud detection.

Increasing global insurance claim volumes.

Regulatory push for fraud prevention technology.

Dominant Market Position

In 2023, North America led the global insurance fraud detection market with a commanding 49.1% share, generating USD 9.4 billion in revenue. This dominance is underpinned by advanced insurance ecosystems, strong regulatory mandates, and early adoption of cutting-edge fraud detection tools. The region benefits from high insurance penetration rates across health, auto, and life segments, creating substantial data volumes for fraud analytics. Additionally, established players headquartered in the region leverage AI, predictive modeling, and blockchain-based verification to prevent fraudulent payouts. Strong collaboration between insurers, technology providers, and government bodies further strengthens North America’s position as the global leader.

Technology Perspective

The insurance fraud detection market is increasingly shaped by AI, machine learning, big data analytics, and blockchain. AI-powered systems enable real-time anomaly detection, flagging suspicious claims before payouts. Machine learning models evolve with new fraud patterns, improving accuracy over time. Big data analytics allows cross-referencing of policyholder histories, geolocation data, and third-party databases for deeper fraud insights. Blockchain technology offers secure, transparent transaction records, reducing document manipulation risks. Cloud-based fraud detection platforms provide scalability and cost-efficiency, supporting remote claim verification. Integration with IoT devices, such as connected cars and health trackers, further strengthens fraud prevention capabilities across insurance segments.

Dynamic Landscape

The market is highly competitive, driven by rapid technological advancements, rising insurance fraud sophistication, and increasing collaboration between insurers and tech vendors. Regional regulations and data privacy laws are shaping solution adoption. Strategic partnerships, AI-driven innovation, and cloud deployment models are transforming the industry landscape.

Drivers, Restraints, Opportunities, Challenges

Drivers: Rising fraud incidents, regulatory compliance, AI adoption.

Restraints: High implementation cost, data privacy concerns.

Opportunities: Blockchain adoption, predictive analytics growth.

Challenges: Evolving fraud techniques, cross-border data sharing limits.

Use Cases

Real-time health insurance claim verification.

Auto insurance telematics fraud detection.

Life insurance identity verification.

Property damage claim assessment automation.

Cross-border fraud data intelligence.

Key Players Analysis

Leading companies in the insurance fraud detection market invest heavily in R&D to deliver AI-powered analytics, predictive modeling, and automated claim review tools. They emphasize integration with insurers’ existing systems, enabling seamless data flow for faster decision-making. Partnerships with regulatory bodies and technology firms are common to enhance fraud intelligence networks. Cloud-based platforms are gaining traction due to scalability and real-time monitoring. These players are also expanding geographically, targeting emerging markets with tailored solutions. Competitive strategies include product innovation, acquisitions, and offering end-to-end fraud prevention suites covering detection, investigation, and compliance reporting capabilities for multiple insurance lines.

Recent Developments

Launch of AI-driven fraud scoring platforms.

Integration of blockchain for secure claim validation.

Expansion of fraud detection solutions into emerging markets.

Strategic insurer–tech firm partnerships.

Deployment of cloud-based fraud monitoring tools.

Conclusion

The global insurance fraud detection market is on an accelerated growth path, driven by technological innovation, regulatory mandates, and rising fraud complexity. North America remains dominant, but emerging regions are rapidly adopting advanced solutions. AI, blockchain, and predictive analytics will continue to reshape fraud prevention, enhancing efficiency and safeguarding insurer profitability.

| No comments yet. Be the first. |