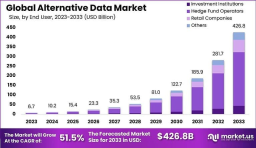

The Global Alternative Data Market was valued at USD 6.7 billion in 2023 and is projected to reach USD 426.8 billion by 2033, exhibiting a staggering CAGR of 51.50% during 2024–2033. This exponential growth is driven by rising demand for non-traditional datasets to enhance investment models, credit scoring, and business decision-making. Alternative data enables competitive insights across industries, profoundly influencing financial, retail, and technology sectors. Demand from hedge funds, asset managers, and corporations is surging, creating new monetization avenues for data vendors and analytics providers.

Key Takeaways:

Market size in 2023: USD 6.7 billion

Estimated market size by 2033: USD 426.8 billion

CAGR (2024–2033): 51.50%

North America market share (2023): 52.7%

North America revenue (2023): USD 3.5 billion

Dominant Market Position:

North America dominates the global alternative data market, accounting for 52.7% of global share in 2023. This leadership stems from the region's advanced fintech ecosystem, early adoption by hedge funds, and strong presence of data aggregators. The U.S., in particular, houses a significant portion of institutional investors and quantitative research firms driving high-value data usage. Regulatory support, technological innovation, and widespread digitization have further cemented North America’s position as the industry hub. Other regions, including Europe and Asia Pacific, are experiencing rapid uptake, but remain secondary markets compared to North America's lead.

Technology Perspective:

The market is powered by technologies like machine learning, natural language processing (NLP), big data analytics, and cloud computing. These tools process vast unstructured data from sources such as satellite imagery, web scraping, credit card transactions, and social media. AI models are increasingly integrated to enhance data contextualization and predictive insights. APIs and platforms delivering real-time data streams are streamlining access for clients. Blockchain is emerging as a tool for data verification and decentralization, ensuring transparency and integrity. Technological advancements will continue reshaping data acquisition and analysis processes over the coming decade.

Dynamic Landscape:

The market is highly fragmented, with evolving datasets, emerging startups, and shifting regulatory conditions. Innovation cycles and acquisition trends are accelerating competition and consolidation.

Drivers, Restraints, Opportunities, Challenges:

Driver: Growing adoption of data-driven decision-making in finance and retail.

Restraint: Data privacy regulations and ethical usage concerns.

Opportunity: Expansion into non-financial sectors like healthcare and agriculture.

Challenge: Integrating and validating unstructured, heterogeneous data sources.

Use Cases:

Hedge fund alpha generation using satellite and shipping data

Retail sales forecasting using geolocation and foot traffic data

Credit risk analysis through utility and transaction data

Supply chain optimization via IoT sensor data

ESG performance tracking using social sentiment analytics

Key Players Analysis:

The alternative data market is characterized by a mix of specialized data providers, analytics firms, and platform aggregators. Key players focus on expanding data coverage, improving accuracy, and developing scalable delivery models. Strategic partnerships and acquisitions help firms broaden capabilities and market access. Providers are integrating AI and ML tools for real-time insights, offering niche datasets, and building APIs for institutional clients. The competitive edge lies in the uniqueness, timeliness, and depth of datasets. Regional players are also emerging, tailoring offerings to local industries and regulatory frameworks, increasing global diversity in data provisioning.

Recent Developments:

Launch of AI-powered platforms for real-time alternative data insights

Strategic acquisitions of niche data providers by larger analytics firms

Expansion into Asia Pacific and LATAM markets

Growing integration of ESG and sustainability datasets

Partnerships with financial institutions to enhance analytics delivery

Conclusion:

The global alternative data market is undergoing transformative growth, driven by institutional demand for unconventional insights. With North America at the forefront, evolving technologies and expanding applications across industries are reshaping data utilization. As regulatory clarity improves and technologies mature, the sector is poised for sustained innovation and global adoption.

| No comments yet. Be the first. |