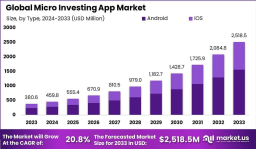

The Global Micro Investing App Market is forecasted to grow from USD 380.6 million in 2023 to USD 2,518.5 million by 2033, at an impressive CAGR of 20.8%. This rapid growth is driven by increasing smartphone penetration, fintech adoption, and a shift toward self-directed investment solutions among millennials and Gen Z. The demand impact is profound, as consumers embrace low-cost, user-friendly digital platforms that allow fractional share investing and automated savings. The market also benefits from improved financial literacy and the popularity of passive investing strategies, enhancing the appeal of micro investing apps as accessible wealth-building tools.

Key Takeaways:

Market to reach USD 2,518.5 million by 2033

CAGR of 20.8% from 2024 to 2033

Over 6x market expansion from 2023 levels

Dominant demand from digitally-savvy millennials and Gen Z

Rising fintech adoption boosts platform usage

High user retention with gamified investing interfaces

Subscriptions and micro-commissions drive revenue

Global retail investing activity fuels adoption

Platforms that lead the market offer superior user interfaces, diversified investment options, and advanced data analytics. North America maintains a dominant position due to robust fintech infrastructure and consumer trust in digital financial services. However, the Asia-Pacific region is emerging as a high-growth area with increasing digital literacy and a younger demographic. Market incumbents benefit from brand trust, AI-powered personalization, and integrations with digital wallets and neobanks. Regulatory compliance, user education, and localized investment options are also critical to sustaining long-term market dominance and competitiveness.

Technological innovation underpins market evolution. AI and ML deliver personalized portfolio recommendations, while robo-advisors automate asset allocation. Cloud infrastructure supports scale and uptime, and blockchain is gaining traction for transparent, real-time investing. Open banking APIs improve fund transfers and identity verification. Additionally, gamification tools boost engagement, and advanced encryption protects user data. Cross-platform compatibility, real-time dashboards, and low-cost trading execution are now baseline expectations. The ability to aggregate financial data across sources has enabled apps to offer 360-degree financial planning, attracting a broader audience.

The micro investing market is fast-moving and shaped by digital innovation, evolving regulations, and consumer demand for financial independence. Agile strategies and user-centric models define the competitive edge in this dynamic ecosystem.

Drivers, Restraints, Opportunities, Challenges:

Drivers include digital inclusion and fintech awareness. Restraints involve cybersecurity and regulatory hurdles. Opportunities are vast in underbanked markets. Challenges include retaining users and ensuring compliance across jurisdictions.

Use Cases:

Round-up investing linked to debit/credit card usage

Goal-oriented savings and investing features

Robo-advised fractional investing in ETFs and stocks

Micro investing in ESG or green portfolios

Parent-managed teen investing tools

Key Players Analysis:

Leading players dominate through data-driven insights, zero-commission trading, and frictionless onboarding. These platforms focus on user education, intuitive app design, and recurring investment features. They often integrate financial planning tools and enable micro-investments across diverse asset classes, including stocks, ETFs, and cryptocurrencies. Strategic partnerships with banks and digital wallets enhance fund flow. Additionally, innovative business models such as freemium subscriptions, loyalty rewards, and gamified financial goals improve customer stickiness. Their global reach, user-centric innovation, and adaptability to regulations position them to capture substantial market share in both developed and emerging economies.

Recent Developments:

Expansion into emerging economies through localized apps

Integration of real-time crypto micro-investing

Regulatory approvals in Europe and Asia for broader services

Launch of AI-driven portfolio balancing features

Teen investing modules with guardian oversight

Conclusion:

The micro investing app market is redefining how individuals engage with wealth building. By combining technology, accessibility, and user engagement, these platforms have transformed investment into a habit for a new generation. Continued innovation and market expansion signal a strong future.

| No comments yet. Be the first. |