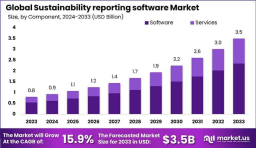

The global sustainability reporting software market is projected to grow from USD 0.81 billion in 2023 to USD 3.5 billion by 2033, registering a CAGR of 15.90% from 2024 to 2033. This growth is driven by increasing demand for ESG transparency, stricter global regulations, and investor pressure for accountability. Organizations across industries are adopting digital solutions to automate sustainability reporting, reduce compliance risk, and align with global disclosure frameworks. This rising demand is not only transforming internal data governance practices but also positioning sustainability reporting tools as critical to long-term strategic planning and competitive advantage.

Key Takeaways:

Market size in 2023: USD 0.81 billion

Estimated market by 2033: USD 3.5 billion

CAGR (2024–2033): 15.90%

North America captured 35%+ of the market in 2023

North America revenue in 2023: USD 0.3 billion

Rapid policy and regulatory changes fueling adoption

Dominant Market Position:

North America led the global market in 2023, accounting for over 35% of total revenue, driven by stringent ESG disclosure regulations and early adoption of digital tools by large corporations. Regulatory bodies in the region, such as the SEC, have increasingly mandated climate and ESG disclosures, prompting organizations to invest in robust reporting infrastructure. Furthermore, the U.S. market benefits from well-established capital markets that value transparency and sustainability. While Europe follows closely due to its leadership in sustainability legislation (e.g., EU CSRD), North America maintains a dominant edge through innovation, high ESG investment inflows, and mature enterprise software adoption.

Technology Perspective:

Modern sustainability reporting platforms utilize advanced technologies such as artificial intelligence, natural language processing, and machine learning to enable real-time data collection, anomaly detection, and predictive ESG analytics. Cloud-based infrastructure ensures scalability, data integrity, and seamless collaboration across global teams. Integration with IoT devices enables accurate environmental data tracking, while blockchain is emerging for verifiable and immutable ESG records. The technology also supports alignment with global standards like GRI, SASB, and TCFD, providing flexibility for multi-standard disclosures. These innovations are streamlining sustainability workflows and reshaping how businesses report, manage, and act on ESG performance.

Dynamic Landscape:

The market is evolving rapidly due to increasing ESG accountability, regulatory developments, and the emergence of integrated ESG-financial reporting platforms. Startups and established players alike are innovating, while M&A activities intensify competition. Customization, regulatory flexibility, and intelligent automation are becoming key differentiators.

Drivers, Restraints, Opportunities, Challenges:

Drivers: Global ESG compliance mandates and investor expectations

Restraints: High upfront costs and complex system integration

Opportunities: Expansion in developing markets and AI-driven platforms

Challenges: Lack of standardized ESG metrics and data inconsistencies

Use Cases:

ESG data collection and audit-ready reporting

Regulatory alignment with CSRD, TCFD, and GRI frameworks

Carbon footprint tracking and emissions monitoring

Sustainability performance benchmarking and risk mitigation

Stakeholder communication through real-time dashboards

Key Players Analysis:

Top market participants are capitalizing on rising ESG priorities by offering advanced, user-friendly platforms with modular architecture. Their solutions address the growing complexity of sustainability data management, compliance tracking, and stakeholder reporting. Through continuous feature updates and global partnerships, they cater to diverse industries, ensuring alignment with both local and international regulatory frameworks. Competitive edges include AI-powered insights, embedded assurance workflows, and integration with enterprise systems like ERP and CRM. These players are also investing in customer success, multilingual interfaces, and analytics-driven dashboards, allowing clients to derive actionable sustainability intelligence and elevate ESG transparency.

Recent Developments:

Launch of AI-driven materiality assessment modules

Integration of ESG tools with enterprise ERP systems

Strategic acquisitions to enhance global reporting capabilities

Enhanced platform features for CSRD and SEC compliance

Real-time emissions data integration from IoT sensors

Conclusion:

The sustainability reporting software market is entering a high-growth phase, driven by ESG imperatives, digital transformation, and mounting stakeholder scrutiny. As regulatory expectations evolve, organizations will increasingly rely on intelligent, compliant, and scalable platforms to manage their sustainability data and reporting obligations efficiently.

| No comments yet. Be the first. |