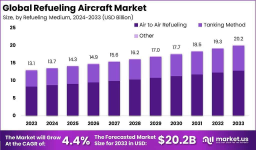

The global refueling aircraft market is projected to grow from USD 13.1 billion in 2023 to USD 20.2 billion by 2033, registering a CAGR of 4.40% during the forecast period. This steady expansion is fueled by rising geopolitical tensions, higher defense allocations, and increased demand for extended-range air operations. The need for advanced airborne refueling capabilities supports global air force modernization efforts and joint military operations. Additionally, the market's growth is influenced by the development of multirole aircraft and next-generation refueling platforms that enhance efficiency, flight endurance, and interoperability across allied forces.

Key Takeaways

Market size in 2023: USD 13.1 billion

Forecasted size by 2033: USD 20.2 billion

CAGR (2024–2033): 4.40%

Growth drivers: defense spending, fleet modernization, multirole aircraft

High demand from North America and Asia-Pacific regions

Dominant Market Position

North America leads the refueling aircraft market due to its mature defense infrastructure, fleet modernization programs, and advanced R&D capabilities. The U.S. Department of Defense heavily invests in next-generation tanker aircraft, driving both domestic demand and global influence. Europe follows with joint initiatives like NATO's Multinational MRTT Fleet. Meanwhile, Asia-Pacific is rapidly catching up, propelled by military expansion in countries such as India, China, and Japan. Strategic alliances, strong air superiority doctrines, and an increasing number of long-range missions bolster these regions' market dominance and investment potential.

Technology Perspective

Technological innovation is transforming aerial refueling operations. Key advancements include boom and probe-and-drogue systems with improved automation, enhanced fuel efficiency, stealth-compatible tankers, and integration with AI-based mission systems. Modular platforms are gaining traction, enabling aircraft to perform both refueling and transport missions. Refueling drones and UAV-to-UAV refueling capabilities are also emerging trends. These innovations improve refueling accuracy, safety, and interoperability with fifth- and sixth-generation fighters. Digital twin and predictive maintenance technologies enhance fleet readiness and lifecycle performance, supporting cost-effective operations.

Dynamic Landscape

The market is shaped by geopolitical shifts, regional tensions, NATO missions, and defense modernization mandates. Competition among global players and international collaborations define procurement strategies and long-term investments.

Driver, Restraint, Opportunity, Challenges

Drivers: Defense spending, multirole tanker adoption

Restraint: High procurement and maintenance costs

Opportunity: Refueling drones and unmanned systems

Challenge: Regulatory constraints and integration with legacy platforms

Use Cases

Strategic military missions across continents

In-flight refueling for fighter jets during combat

Humanitarian aid logistics in remote regions

Force projection in contested airspace

Joint NATO and coalition refueling missions

Key Players Analysis

The market is consolidated with a few major defense contractors dominating refueling aircraft production and service support. These firms possess robust supply chains, defense-specific R&D, and long-term contracts with government agencies. Their competitive advantage lies in operational reliability, technological expertise, and global service networks. Emerging regional firms are gaining attention through collaborations and niche capabilities, such as UAV refueling systems and cost-efficient platforms. Market entry barriers remain high due to stringent defense regulations, high capital intensity, and long development cycles. Strategic partnerships and government defense deals play a pivotal role in shaping competitive dynamics.

Recent Developments

Deployment of autonomous refueling systems in experimental trials

Joint NATO MRTT fleet expansion and deliveries

Contract awards for advanced boom systems by major defense agencies

Integration of stealth-compatible refueling pods into new platforms

Increased R&D in AI-assisted aerial refueling control systems

Conclusion

The refueling aircraft market is on a strong growth trajectory driven by geopolitical needs and operational advancements. With expanding defense budgets and evolving mission demands, the sector is poised for sustained innovation and strategic investment.

| No comments yet. Be the first. |