Report Overview:

The

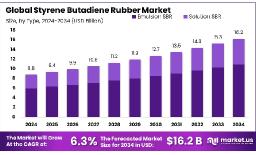

Global Styrene Butadiene Rubber Market is projected to reach approximately

USD 16.2 billion by 2034, rising from an estimated

USD 8.8 billion in 2024. This growth reflects a compound annual growth rate

(CAGR) of 6.3% during the forecast period spanning 2025 to 2034.

The global Styrene Butadiene Rubber (SBR) market is poised for steady growth, driven by rising demand from the automotive, construction, and industrial sectors. With increasing vehicle production and tire consumption worldwide, SBR remains a vital component in tire manufacturing due to its excellent abrasion resistance and durability. Additionally, infrastructure development projects and growing use in adhesives, footwear, and industrial goods continue to boost demand. Innovations in sustainable and high-performance rubber variants are also contributing to the market’s evolution. As industries shift toward greener solutions, SBR’s role is expanding beyond traditional uses, aligning with both performance and environmental expectations.

Key Takeaways:

- Styrene Butadiene Rubber Market size is expected to be worth around USD 16.2 Billion by 2034, from USD 8.8 Billion in 2024, growing at a CAGR of 6.3%.

- Emulsion Styrene Butadiene Rubber (Emulsion SBR) held a dominant market position, capturing more than a 67.3% share in the global SBR market.

- Tire held a dominant market position, capturing more than a 73.9% share in the global Styrene Butadiene Rubber (SBR) market.

- North America stands as the leading region in the global Styrene Butadiene Rubber (SBR) market, commanding a substantial share of approximately 43.8%, equating to a market value of around USD 3.8 billion.

https://market.us/wp-content/uploads/2025/06/Styrene-Butadiene-Rubber-Market.jpg" alt="Styrene Butadiene Rubber Market" width="1216" height="739">

https://market.us/wp-content/uploads/2025/06/Styrene-Butadiene-Rubber-Market.jpg" alt="Styrene Butadiene Rubber Market" width="1216" height="739">

Download Exclusive Sample Of This Premium Report:

https://market.us/report/global-styrene-butadiene-rubber-market/free-sample/

Key Market Segments:

By Type

- Emulsion SBR

- Solution SBR

By Application

- Tire

- Footwear

- Construction

- Polymer Modification

- Adhesive

- Others

Drivers

One of the most influential drivers propelling the growth of the Styrene Butadiene Rubber (SBR) market is the global rise in vehicle production. As economies particularly in Asia-Pacific, Latin America, and parts of Africa continue to urbanize and industrialize, the demand for personal and commercial transportation has surged. According to industry estimates, global vehicle production is projected to cross 100 million units annually by the early 2030s. This directly benefits the SBR market, given that nearly 70% of SBR is used in tire manufacturing, especially in passenger and light truck tires due to its excellent abrasion resistance and aging stability.

In addition to automotive, infrastructure development is another key pillar supporting SBR demand. Countries are investing in roads, bridges, industrial parks, and smart cities. SBR’s application in adhesives, sealants, and asphalt modification makes it a critical material in large-scale construction. For instance, polymer-modified asphalt containing SBR enhances road durability, reducing maintenance costs in high-traffic zones. Another major shift pushing the market forward is the global move toward sustainability.

Consumers and manufacturers alike are increasingly prioritizing materials with lower environmental impact. SBR manufacturers are responding by innovating in bio-based alternatives and optimizing production methods to reduce energy use and emissions. Some companies are also exploring closed-loop systems and green chemistry approaches to produce SBR with fewer petrochemicals. Furthermore, regulatory support for fuel-efficient and low-rolling-resistance tires is growing worldwide. These performance tires often use SBR compounds to meet both safety and sustainability standards, particularly in Europe and North America.

Restraining Factors

The styrene butadiene rubber (SBR) market, despite its steady growth trajectory, faces several restraining factors that could hinder its expansion in the coming years. A primary concern is the fluctuation in raw material prices, particularly styrene and butadiene, which are derived from crude oil. The volatility in global oil markets directly impacts production costs, posing a challenge for manufacturers trying to maintain consistent pricing and profitability. Another significant restraint is the environmental impact associated with synthetic rubber production.

The manufacturing process of SBR involves emissions of volatile organic compounds (VOCs) and other pollutants, leading to increased scrutiny from environmental agencies. As governments around the world tighten regulations on industrial emissions and promote greener alternatives, SBR producers face added compliance costs and potential operational limitations. Moreover, competition from alternative materials such as thermoplastic elastomers (TPEs) and natural rubber is intensifying.

These materials often offer similar or better performance in specific applications while also being more sustainable or easier to recycle. The increasing preference for eco-friendly materials in sectors like automotive and construction is putting pressure on SBR to evolve or risk being phased out in certain use cases. Health and safety concerns also play a role in limiting the growth of SBR. Certain chemicals used in the production process have been flagged for potential health risks, leading to stricter workplace regulations and the need for improved safety measures in manufacturing facilities. Finally, limited recycling infrastructure for synthetic rubbers like SBR adds to environmental burdens and wastes potential value. Unlike some plastics and natural rubbers, SBR lacks efficient large-scale recycling pathways, making it less attractive in a circular economy context.

Opportunities

Beyond its stronghold in tire manufacturing, Styrene Butadiene Rubber (SBR) is finding new avenues for growth in diverse sectors such as adhesives, footwear, and polymer modification. These non-tire applications are steadily expanding and present high-margin opportunities for manufacturers willing to diversify. For example, the global adhesives market is projected to exceed USD 90 billion by 2030, with synthetic rubber-based adhesives forming a key segment. SBR’s properties flexibility, resilience, and adhesion make it a natural fit for pressure-sensitive and construction-grade adhesives.

In the footwear industry, SBR is increasingly used in soles and midsoles due to its cost-effectiveness and cushioning qualities. With sports and casual footwear demand rising particularly in urbanizing economies the opportunity to supply specialty SBR compounds for high-performance shoes is growing. Similarly, in the field of polymer modification, SBR is being blended with plastics and other elastomers to enhance impact resistance and elasticity, a trend gaining traction in consumer goods and automotive components.

A major regional opportunity lies in Asia-Pacific, where rapid industrialization, urban infrastructure development, and a thriving automotive sector continue to fuel rubber demand. Countries like India, China, Vietnam, and Indonesia are not only expanding their domestic production capacities but also attracting foreign direct investment in manufacturing. These markets are also implementing stricter environmental standards, opening the door for eco-friendly SBR grades that meet both regulatory and performance expectations.

Furthermore, as electric vehicle (EV) adoption rises, there is growing demand for energy-efficient tires and lightweight components. This gives SBR producers a chance to develop advanced, low-rolling-resistance formulations tailored to EV requirements. By aligning innovation strategies with evolving industry needs particularly in regions undergoing rapid change manufacturers can establish strong competitive advantages.

Trends

The global styrene butadiene rubber (SBR) market is experiencing several key trends that are reshaping its trajectory. One of the most prominent trends is the rising demand for eco-friendly and sustainable SBR products, especially in regions with tightening environmental regulations. Manufacturers are increasingly investing in green technologies and bio-based alternatives to traditional petroleum-derived rubber. This is particularly evident in the development of low rolling resistance tires, which not only enhance fuel efficiency but also reduce carbon emissions. Another major trend is the increased application of SBR in high-performance tires.

As automotive standards evolve and electric vehicles (EVs) gain popularity, there is greater emphasis on tires that offer durability, noise reduction, and energy efficiency. SBR’s excellent abrasion resistance and flexibility make it a favored material in this segment. Additionally, the adoption of solution SBR (S-SBR), known for better wet traction and wear resistance, is growing rapidly, especially among premium tire manufacturers. Digitalization and automation in manufacturing processes are also gaining ground.

Smart production systems are enabling better quality control, reduced waste, and faster turnaround times, giving companies a competitive edge. At the same time, blending SBR with other synthetic and natural rubbers is becoming more common, allowing customized compounds that meet specific industry requirements such as strength, elasticity, or heat resistance. In parallel, there is a growing use of SBR in non-tire applications such as industrial hoses, gaskets, and polymer modification in asphalt for road construction. This diversification is helping reduce the market’s dependence on the automotive sector and broadening its resilience.

Market Key Players:

- ARLANXEO

- Asahi Kasei Corporation

- China Petrochemical Corporation

- ENEOS Corporation

- Kemipex

- KUMHO PETROCHEMICAL

- LANXESS

- LG Chem

- Sumitomo Chemical Asia Pte Ltd

- Synthos

- Trinseo

- Versalis SpA

Conclusion

Overall, the styrene butadiene rubber (SBR) market is positioned for continued advancement, driven by its widespread use in automotive tires, footwear, adhesives, and construction materials. While traditional segments remain the core contributors to demand, the market is gradually embracing innovation through more sustainable production methods and performance-enhanced formulations. These developments are aligning with global efforts to reduce carbon emissions and improve material efficiency.

Emerging economies, particularly in Asia-Pacific, are playing a pivotal role in shaping the market’s future due to rapid industrialization and infrastructure growth. At the same time, shifting consumer expectations and regulatory pressures are pushing manufacturers to adapt their offerings. As a result, specialty SBR grades with tailored features are gaining popularity in both consumer and industrial sectors. With its broad utility and capacity to evolve alongside industry needs, SBR continues to solidify its importance in the global materials landscape, ensuring relevance and resilience in the decade ahead.

https://market.us/wp-content/uploads/2025/06/Styrene-Butadiene-Rubber-Market.jpg" alt="Styrene Butadiene Rubber Market" width="1216" height="739">