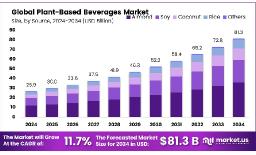

The Global Plant-Based Beverages Market is projected to reach approximately USD 81.3 billion by 2034, up from USD 26.9 billion in 2024. This growth reflects a compound annual growth rate (CAGR) of 11.7% over the forecast period from 2025 to 2034.

The global shift toward plant-based beverages is gaining strong momentum as more consumers prioritize health, sustainability, and dietary preferences. Rising cases of lactose intolerance affecting nearly 65% of the global population, according to the NIH have pushed demand for non-dairy alternatives. At the same time, the growth of vegan and flexitarian lifestyles has expanded the consumer base. Governments across regions, especially in Europe and Asia-Pacific, are actively supporting the sector through subsidies for sustainable farming and funding for plant-based R&D. This supportive ecosystem is accelerating innovation in alternative proteins and making plant-based beverages more accessible and appealing to a global audience.

Key Takeaways:

https://market.us/wp-content/uploads/2025/06/Plant-Based-Beverages-Market.jpg" alt="Plant-Based Beverages Market" width="1216" height="739">

Download Exclusive Sample Of This Premium Report:

https://market.us/report/plant-based-beverages-market/free-sample/

Key Market Segments:

The rapid growth of the plant-based beverages market is largely propelled by a powerful shift in consumer attitudes toward health and environmental sustainability. As more people embrace wellness-driven lifestyles, plant-based drinks have gained popularity due to their perceived health benefits. One of the most prominent drivers is the rising incidence of lactose intolerance and dairy allergies worldwide. According to the National Institutes of Health (NIH), around 65% of the global population experiences some degree of lactose malabsorption, which naturally fuels demand for non-dairy alternatives like almond, soy, oat, and rice milk.

Additionally, the increasing adoption of vegan, vegetarian, and flexitarian diets is transforming beverage consumption. Consumers are opting for plant-based alternatives not only for personal health but also for ethical and environmental reasons. These drinks often come fortified with essential nutrients such as vitamin D, B12, and calcium, making them appealing to health-conscious individuals seeking functionality without sacrificing taste or texture.

Another major growth factor is the surge in low-calorie and sugar-free beverage preferences, especially among millennials and Gen Z. Plant-based options like unsweetened almond milk or oat milk provide a natural, lighter alternative to traditional dairy without added sugars or cholesterol. This aligns with broader efforts to reduce sugar intake, curb obesity, and prevent lifestyle-related diseases such as diabetes and heart conditions.

Despite the rapid growth of the plant-based beverages market, several restraining factors could hinder its full potential in the years ahead. One of the primary challenges is the high production cost of plant-based beverages compared to traditional dairy. Ingredients like almonds and oats often require specialized processing and transportation, which increases overall costs. Additionally, the inclusion of fortified nutrients and clean-label ingredients further raises the price point, making these products less affordable for price-sensitive consumers in developing regions.

Raw material price volatility is another major barrier. Crops such as almonds, oats, and soy are heavily impacted by climate change, water scarcity, and fluctuating agricultural outputs. For example, California one of the world’s leading almond producers has faced repeated droughts in recent years, which directly affects almond milk production and pricing. This unpredictability creates supply chain instability and limits consistent product availability across markets.

Taste and texture differences compared to traditional dairy products also remain a concern for many consumers. While plant-based beverages are gaining ground, some consumers still perceive them as lacking in flavor, creaminess, or overall mouthfeel, especially in hot beverages like coffee or when used in cooking. This sensory gap can reduce repeat purchases among first-time buyers.

Additionally, limited awareness and access in rural or underserved areas continue to restrict market penetration. While urban populations are more likely to experiment with new, health-focused options, many consumers outside metropolitan zones still have limited exposure to or trust in plant-based alternatives.

The plant-based beverages market is poised for significant expansion, driven by untapped opportunities in product innovation and government-backed sustainability efforts. One of the most promising avenues lies in developing flavored and fortified variants to meet evolving consumer expectations. While plain, clean-label products dominate current sales, there is a growing appetite for flavored options such as vanilla, chocolate, and matchaas well as added nutrients like protein, calcium, omega-3s, and vitamins B12 and D. These enhancements not only boost nutritional profiles but also help differentiate products in an increasingly crowded market.

Another opportunity is the rising interest in plant-based beverage concentrates. These are gaining momentum due to their longer shelf life, lower transportation costs, and greater convenience in both B2B and B2C formats. Food service providers and manufacturers can use concentrates as customizable base ingredients, while health-conscious consumers benefit from mix-at-home flexibility. According to recent data, concentrates are expected to see accelerated adoption, especially in emerging markets where storage and distribution infrastructure can be challenging.

Governments and regulatory bodies are also playing a supportive role in fostering industry growth. Public funding for research and development (R&D), subsidies for sustainable agriculture, and policies promoting plant-based nutrition are being implemented in several countries, particularly in Asia and Europe. These initiatives help startups and established companies alike to develop novel plant protein extraction technologies, improve product stability, and scale production more sustainably.

The plant-based beverages market is evolving rapidly, shaped by several key trends that reflect changing consumer preferences and market dynamics. One of the most prominent trends is the dominance of almond as a core ingredient. Almond-based beverages continue to lead the market, accounting for over 44.2% of the global share in 2024, according to recent market data. Consumers perceive almond milk as light, nutritious, and versatile making it a preferred alternative to dairy, especially in North America and Europe. Its naturally mild flavor and low calorie content further enhance its appeal.

Another significant trend is the rising preference for plain, clean-label products. More consumers are reading ingredient lists and opting for beverages with minimal additives, no artificial flavors, and reduced sugar. In fact, plain variants now represent over 58.4% of the product mix, showing that transparency and simplicity in formulation are becoming vital to winning consumer trust. This movement is especially strong among health-conscious demographics seeking functional, natural options that align with their wellness goals.

On the retail front, supermarkets and hypermarkets remain the dominant sales channel, contributing nearly 49.3% of total distribution. These outlets offer visibility, variety, and accessibility that online or specialty stores often lack. In-store promotions, loyalty programs, and the ability to sample new products help drive impulse purchases and foster brand discovery.

Market Key Players:

The plant-based beverages market is undergoing a major transformation, shifting from a niche segment to a mainstream consumer choice across the globe. This growth is being driven by increased health awareness, rising concerns about lactose intolerance, and a broader cultural move toward sustainable and plant-forward lifestyles. Consumers are now seeking functional beverages that not only meet nutritional needs but also align with their ethical and environmental values.

Innovation continues to play a key role in market expansion, with companies focusing on clean-label formulations, nutrient fortification, and a wider variety of flavors and base ingredients. At the same time, support from governments in the form of sustainable agriculture initiatives and research funding is helping build a strong foundation for long-term growth. While there are challenges such as fluctuating raw material costs and taste acceptance, the overall outlook remains positive. Brands that prioritize transparency, affordability, and taste are likely to succeed in this evolving landscape.

| No comments yet. Be the first. |