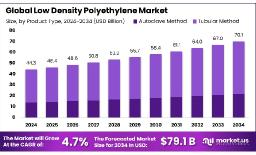

The Global Low Density Polyethylene Market is projected to reach approximately USD 70.1 billion by 2034, up from an estimated USD 44.3 billion in 2024. This growth reflects a compound annual growth rate (CAGR) of 4.7% over the forecast period from 2025 to 2034.

Thanks to its flexibility, moisture resistance, and affordability, Low-Density Polyethylene (LDPE) is widely used in food, pharmaceutical, and e-commerce packaging. Its applications range from lightweight films and pouches to agricultural irrigation liners and construction materials. The global emphasis on hygienic, durable packaging especially in the aftermath of the COVID-19 pandemic has further accelerated demand. However, rising environmental concerns and stricter regulations on single-use plastics are challenging some of LDPE’s traditional roles. In response, the industry is shifting toward sustainable alternatives, including bio-based LDPE made from renewable sources like sugarcane and advancements in recycling technologies. These innovations, along with rising consumption in fast-developing regions such as Asia-Pacific and Latin America, are expected to fuel long-term market growth and align with global sustainability efforts through 2034.

Key Takeaways:

https://market.us/wp-content/uploads/2025/06/Low-Density-Polyethylene-Market.jpg" alt="Low Density Polyethylene Market" width="1216" height="739">

Download Exclusive Sample Of This Premium Report:

https://market.us/report/global-low-density-polyethylene-market/free-sample/

Key Market Segments:

The global Low-Density Polyethylene (LDPE) market is witnessing consistent expansion, largely fueled by the surge in flexible packaging demand across industries such as food, pharmaceuticals, and e-commerce. LDPE’s excellent sealing properties, clarity, moisture resistance, and lightweight characteristics make it ideal for products like pouches, films, wraps, and protective packaging. As consumers increasingly prefer convenience and ready-to-eat food options, LDPE remains a preferred material due to its ability to maintain freshness and product quality. Moreover, the rise of online shopping and doorstep deliveries is amplifying the need for robust and flexible packaging materials, further boosting LDPE usage.

Beyond packaging, LDPE is gaining traction in infrastructure and agriculture, especially in urbanizing and industrializing regions. It is used extensively in applications such as greenhouse covers, pond liners, irrigation tubing, and construction membranes due to its flexibility, chemical resistance, and affordability. Countries like India, China, and others in Southeast Asia are expanding LDPE use to support agricultural productivity and infrastructure enhancements.

Regionally, Asia-Pacific holds the largest share of LDPE consumption, supported by rising middle-class demographics, urban development, and increased manufacturing capabilities. Countries like China and India are not only major consumers but are also enhancing local production capacities to reduce reliance on imports. Additionally, government initiatives focusing on food security, sanitation, and infrastructure continue to drive multi-sector LDPE demand in the region.

Despite its versatility and broad application base, the LDPE market is facing increasing headwinds from environmental and regulatory pressures. A growing number of governments are enforcing bans or restrictions on single-use plastics where LDPE is commonly used in items like plastic bags and films due to concerns over pollution and non-biodegradability. The European Union’s Single-Use Plastics Directive is a prominent example pushing industries toward alternative or more sustainable materials.

Another significant challenge is the relatively low recyclability of LDPE. Although technically recyclable, post-consumer LDPE is often contaminated especially from food packaging making it difficult and costly to process. In many regions, the absence of advanced recycling infrastructure further limits LDPE recovery rates, contributing to its negative environmental perception and limiting its integration into the circular economy.

Moreover, LDPE is under growing competitive pressure from other materials such as High-Density Polyethylene (HDPE), polypropylene (PP), and emerging biodegradable alternatives. These polymers often offer better recyclability or more favorable environmental profiles, making them attractive choices for manufacturers looking to align with stricter sustainability regulations and shifting consumer preferences.

The LDPE market is poised for transformation as sustainability becomes a central theme. In response to rising environmental concerns and regulatory requirements, manufacturers are exploring new avenues to improve LDPE’s eco-friendliness. One major opportunity lies in expanding recycling initiatives particularly in emerging economies like India, where post-consumer LDPE waste is being creatively repurposed into materials for road construction. These innovations not only give LDPE a second life but also contribute to infrastructure development.

Another promising opportunity involves the advancement of bio-based LDPE, made from renewable sources such as sugarcane ethanol. These bio-derived variants offer the same performance as traditional LDPE but with a significantly lower carbon footprint. Adoption is growing, especially in environmentally conscious regions like Europe and Brazil, and as production costs fall, bio-LDPE is expected to see broader application.

Furthermore, expanding end-use sectors such as healthcare, agriculture, and direct-to-consumer (D2C) packaging present strong growth prospects. LDPE is increasingly used in medical-grade products like IV bags, films, and flexible tubing due to its resistance to chemicals and ease of sterilization. In agriculture, it supports food production through mulching films and crop covers. Meanwhile, the boom in e-commerce and D2C retail especially in Asia-Pacific has created a demand for eco-conscious, durable packaging materials, giving rise to new LDPE applications.

The LDPE industry is undergoing dynamic change, shaped by several converging trends that influence production, innovation, and market structure. A key development is the rise in mergers, acquisitions, and strategic alliances, as manufacturers seek to enhance their global presence, strengthen supply chains, and access new technologies. These consolidations help firms streamline operations and improve competitiveness amid global economic volatility.

Simultaneously, LDPE production is becoming increasingly digitalized. Automation, predictive maintenance, and AI-driven optimization are being adopted to improve efficiency, lower emissions, and cut operational costs. These innovations support sustainability goals while enhancing manufacturing responsiveness.

There’s also significant momentum around product innovation. The industry is shifting toward mono-material packaging solutions entirely made from LDPE which simplify recycling processes without compromising functionality. Additionally, manufacturers are introducing high-recycled-content LDPE films in response to circular economy commitments and stricter packaging mandates in North America, Europe, and Asia.

Finally, industries like food and personal care are transitioning to LDPE packaging formats that offer both high performance and sustainability. These shifts ensure that LDPE remains competitive amid the rise of alternative materials. Overall, the LDPE market is aligning with long-term goals of cleaner production, smarter technologies, and sustainable packaging solutions, positioning it for continued relevance and growth.

Market Key Players:

The global Low-Density Polyethylene (LDPE) market is at a critical turning point, where robust demand intersects with rising environmental and regulatory pressures. Its extensive application in flexible packaging, agriculture, construction, and healthcare continues to support growth, particularly across rapidly developing regions such as Asia-Pacific and Latin America. However, mounting concerns over single-use plastics and the material’s relatively low recycling rates are accelerating the industry’s shift toward sustainability.

In response, market players are intensifying efforts in advanced recycling technologies, biodegradable solutions, and the development of bio-based LDPE made from renewable resources like sugarcane ethanol. Innovations such as mono-material packaging and LDPE films with high recycled content are also helping to align the product with circular economy principles. Meanwhile, automation and digitalization in manufacturing are driving greater efficiency and emissions reduction. Despite ongoing challenges, the LDPE market is demonstrating adaptability. With targeted investments, technological innovation, and strong policy alignment, the industry is well-positioned to thrive in a more sustainable future.

| No comments yet. Be the first. |