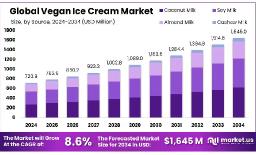

The Global Vegan Ice Cream market is projected to reach approximately USD 1,645.0 million by 2034, up from USD 720.9 million in 2024, growing at a compound annual growth rate (CAGR) of 8.6% between 2025 and 2034.

Key regions driving growth in the vegan ice cream market include North America, Europe, and Asia-Pacific. These regions are witnessing increased consumer preference for plant-based, lactose-free, and allergen-conscious dessert options. Changing dietary habits, rising awareness of animal welfare, and a shift toward sustainable food choices are influencing purchasing decisions. Product innovations using bases such as almond, coconut, oat, and cashew milk are helping brands cater to diverse taste preferences. Additionally, there’s a noticeable shift toward clean-label products, with manufacturers emphasizing natural ingredients, minimal additives, and eco-friendly packaging, aligning with the growing demand for healthier and environmentally responsible indulgences.

Key Takeaways:

https://market.us/wp-content/uploads/2025/06/Vegan-Ice-Cream-Market.jpg" alt="Vegan Ice Cream Market" width="1216" height="737"> Download Exclusive Sample Of This Premium Report:

https://market.us/report/global-vegan-ice-cream-market/free-sample/

Key Market Segments:

The global vegan ice cream market is experiencing robust growth, primarily driven by a shift in consumer behavior toward plant-based diets. Rising awareness about lactose intolerance and dairy-related allergies is one of the most significant contributors to this trend. According to the National Institutes of Health, about 65% of the global population has some level of lactose malabsorption, making dairy alternatives not only preferable but often necessary. Health consciousness has also become a major factor. Consumers increasingly seek products with clean-label ingredients free from artificial additives, preservatives, and excess sugars.

Vegan ice cream, often made from coconut, almond, oat, or cashew milk, appeals to health-focused individuals looking for functional food options without compromising on taste or indulgence. Environmental concerns are also propelling the market forward. A growing base of eco-conscious consumers is opting for sustainable alternatives to conventional dairy. Producing plant-based ice cream typically requires fewer natural resources and generates lower greenhouse gas emissions compared to traditional dairy production, aligning with global climate action goals. Innovation in flavors and formats is another key growth driver.

Beyond the standard vanilla and chocolate, manufacturers are experimenting with ingredients like pistachio, matcha, coffee swirl, and exotic fruits. These premium and artisanal offerings are attracting a more diverse consumer base from vegans and vegetarians to flexitarians and the health-aware. In addition, increased availability through both retail and e-commerce platforms has improved product accessibility. Supermarkets, health stores, and online grocery platforms are expanding their plant-based dessert selections, making vegan ice cream easier to find and buy.

Despite the growing popularity of vegan ice cream, several factors continue to limit its market penetration, particularly in comparison to traditional dairy-based offerings. One of the most significant barriers is the higher cost of production. Plant-based ingredients such as almond, coconut, or cashew milk are more expensive than conventional dairy milk, partly due to their lower yield and more intensive processing requirements.

Additionally, plant-based fats and stabilizers needed to mimic the creamy texture of dairy ice cream further increase manufacturing complexity and cost. As a result, retail prices for vegan ice cream are often 30-50% higher than their dairy counterparts. This price disparity makes it less accessible for price-sensitive consumers, especially in developing markets. For many, vegan ice cream remains an occasional indulgence rather than a staple item, limiting repeat purchases and slowing market expansion.

Flavor and texture limitations also present a challenge. While dairy ice cream has decades of R&D behind it, vegan formulations are still evolving. Some consumers report differences in taste, mouthfeel, and aftertaste when compared to traditional options. Moreover, although the market has seen an increase in innovative flavors, vegan options still lag behind dairy in terms of variety and familiarity in mainstream retail environments.

Cold chain logistics pose another hurdle. Many plant-based ice creams are more sensitive to temperature fluctuations, requiring tight storage controls to prevent crystallization or texture degradation. This adds an additional layer of distribution complexity, particularly in regions with underdeveloped supply chain infrastructure.

The vegan ice cream market is entering a period of rapid expansion, driven by shifts in consumer behavior and the evolving retail landscape. One of the biggest opportunities lies in the growth of modern retail and e-commerce platforms. As more consumers shop online and expect greater variety on supermarket shelves, both channels are increasingly dedicating space to plant-based products, including frozen desserts.

Major grocery chains and specialty health stores alike are expanding their vegan sections, while online retailers and quick-commerce apps are offering home delivery for niche and premium options. This expansion in distribution allows vegan ice cream brands to reach a broader and more diverse customer base, including those in smaller cities or areas previously underserved by specialty health food stores. E-commerce also provides a valuable platform for product education, customer reviews, and trial promotions key drivers in encouraging first-time purchases of alternative products.

Ingredient innovation is another powerful opportunity. Companies are moving beyond soy and almond bases to explore exotic and sustainable options like macadamia, hazelnut, hemp, and even banana or avocado bases. These offer unique flavor profiles and nutritional benefits, catering to consumers who are not only avoiding dairy but also looking for nutrient-rich, additive-free alternatives. In fact, many new product launches now carry claims like “no added sugar,” “fortified with protein,” or “gut-friendly,” appealing to wellness-driven shoppers.

The vegan ice cream market is evolving rapidly, shaped by a mix of consumer preferences, dietary shifts, and product innovation. One of the most notable trends is the rise of clean-label and health-conscious formulations. Today’s consumers, especially millennials and Gen Z, are paying close attention to what goes into their food. Vegan ice cream brands are responding by reducing added sugars, eliminating artificial flavors and stabilizers, and highlighting functional ingredients like probiotics, plant protein, or adaptogens.

Many brands now proudly display claims such as “dairy-free,” “soy-free,” “gluten-free,” and “non-GMO” to meet specific dietary needs. Another strong trend is the diversification of base ingredients. While almond and soy milk were once dominant, the market has expanded to include oat, coconut, cashew, rice, hemp, and even chickpea-based options. Oat milk in particular has gained strong traction, praised for its creamy texture and mild taste.

This diversification allows brands to cater to consumers with allergies or sensitivities while also introducing new textures and flavor experiences. Flavor experimentation is another area seeing strong momentum. Beyond classic chocolate and vanilla, brands are introducing bold and international flavors like matcha green tea, turmeric latte, passionfruit swirl, chai spice, and ube. Limited-time seasonal offerings and collaborations with chefs or influencers are also helping brands maintain excitement and drive trial purchases.

Market Key Players:

Looking ahead, the vegan ice cream market is well-positioned for steady growth, supported by evolving consumer lifestyles and dietary choices. Global demand for plant-based foods continues to rise, with over 30% of consumers globally reporting reduced dairy intake in the past year, according to industry surveys.

As a result, expanding access through supermarkets, health food stores, and e-commerce platforms will be crucial in making vegan ice cream more widely available and convenient. However, manufacturers will also face challenges related to cost management. The prices of plant-based ingredients like almonds, coconut, and cashews have fluctuated due to climate impacts and global supply disruptions. In addition, increasingly complex food labeling and health regulations across North America and Europe could require producers to adapt formulations or manufacturing practices. Brands that prioritize supply chain resilience, innovate with new flavor profiles, and align with sustainability trends are likely to be the ones that stand out in this competitive, fast-moving landscape.

| No comments yet. Be the first. |