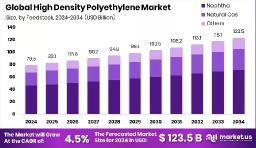

The global high-density polyethylene (HDPE) market is projected to reach approximately USD 123.5 billion by 2034, rising from USD 79.5 billion in 2024, with a steady CAGR of 4.5% between 2025 and 2034. This growth is largely fueled by robust demand from the packaging and construction sectors, particularly in the Asia-Pacific region, which alone is expected to contribute around USD 34.9 billion to the overall market.

The Asia-Pacific region is emerging as a key driver of growth in the global high-density polyethylene (HDPE) market, with its market value expected to reach USD 34.9 billion by 2024. This strong performance is primarily fueled by expanding demand from the packaging and construction industries, supported by rapid urbanization, increasing disposable incomes, and accelerated industrial activity. Nations like China, India, and those across Southeast Asia are making significant investments in infrastructure and consumer product manufacturing both of which rely heavily on durable, cost-efficient materials like HDPE. Moreover, government-backed programs focused on improving sanitation and expanding water supply networks are further boosting HDPE adoption across the region.

Key Takeaways:

https://market.us/wp-content/uploads/2025/06/High-Density-Polyethylene-Market-Size.jpg" alt="High Density Polyethylene Market Size" width="1216" height="706">

Download Exclusive Sample Of This Premium Report:

https://market.us/report/global-high-density-polyethylene-market/free-sample/

Key Market Segments:

The high-density polyethylene (HDPE) market is witnessing consistent expansion, underpinned by robust demand across multiple key sectors including packaging, construction, agriculture, and infrastructure. Thanks to its unique blend of properties such as low weight, strong tensile strength, and resistance to chemicals and moisture, HDPE continues to be a favored material among manufacturers striving for performance and cost efficiency.

Packaging remains a significant growth driver, particularly in food, beverage, pharmaceutical, and e-commerce sectors. HDPE is commonly used in containers, bottles, closures, and films due to its safety profile, recyclability, and effective barrier properties. As global preferences shift toward portable, hygienic, and pre-packed goods, demand for both rigid and flexible HDPE packaging is surging most notably in the Asia-Pacific region, where consumption trends are rapidly evolving.

In the construction and infrastructure space, HDPE is widely applied in water and gas pipelines, cable protection conduits, and drainage systems, owing to its durability and corrosion resistance. The rise in urbanization and ongoing government investments in public infrastructure are amplifying the need for HDPE-based piping solutions, particularly in fast-developing economies. Similarly, in agriculture, HDPE is increasingly used for irrigation systems, silage wraps, and greenhouse films helping farmers improve water efficiency and crop yields in regions where climate-resilient solutions are essential.

Environmental trends are also supporting market growth. HDPE is fully recyclable, and innovation in bio-based variants, derived from sources like sugarcane, is attracting industries looking for sustainable alternatives with a lower carbon footprint.

Despite its promising outlook, the HDPE market faces notable challenges that could restrict its growth potential. Chief among them is the volatility in raw material costs particularly petroleum-based inputs like ethylene. Because HDPE is derived from fossil fuels, any swings in crude oil or natural gas prices can significantly impact production economics, making cost forecasting difficult for producers and suppliers alike.

Environmental pressures are also increasingly affecting the market landscape. Governments and regulators around the world are introducing strict rules against single-use plastics, including taxes and outright bans. While HDPE is recyclable, inadequate infrastructure and low public awareness often result in poor recycling rates, with a significant portion of HDPE waste still ending up in landfills. These shortcomings hinder its broader acceptance, especially in sectors prioritizing biodegradable or compostable alternatives.

The recycling process itself presents hurdles. In particular, HDPE used in multi-layer packaging or contaminated waste streams is harder to recover and repurpose. Inconsistencies in the quality and availability of recycled HDPE limit its usage in applications that require high material performance.

Competition from alternative materials is growing as well. Polypropylene, bioplastics, and even paper-based composites are emerging as viable substitutes in select applications, offering similar performance but with stronger environmental credentials posing a long-term challenge to HDPE’s dominance.

Several emerging developments are opening up exciting opportunities in the HDPE market. One of the most promising is the growing investment in bio-based HDPE. By using renewable feedstocks like sugarcane-derived ethylene, producers can offer HDPE alternatives with substantially reduced environmental impact an attractive option for sustainability-focused industries. As governments set stricter limits on plastic waste and carbon emissions, demand for greener HDPE variants is expected to rise sharply.

Infrastructure development also represents a lucrative avenue, particularly in water and energy sectors. Countries across Asia, Africa, and Latin America are undertaking massive infrastructure upgrades, including long-distance piping systems for gas and clean water. HDPE especially advanced grades like PE-100 and PE-100 RC is increasingly chosen for these projects due to its crack resistance, lightweight properties, and installation efficiency.

The integration of HDPE into 3D printing is another evolving frontier. Industries such as automotive, packaging, and industrial tooling are exploring HDPE for prototyping and component manufacturing, taking advantage of its strength, chemical resistance, and ease of processing. This application not only boosts material innovation but also enhances circular economy prospects by supporting recycled HDPE inputs.

A wave of transformative trends is reshaping the HDPE market, centered around sustainability, product innovation, and end-use diversification.

The growing push for environmental responsibility is leading many companies to adopt circular economy practices. Advanced recycling techniques both mechanical and chemical are being developed to increase the reuse of HDPE, particularly in high-volume sectors like packaging. Governments in North America and Europe are mandating minimum recycled content in products, spurring demand for recycled HDPE grades.

At the same time, manufacturers are introducing high-performance HDPE variants tailored for specific applications. PE-100 RC, for instance, offers enhanced resistance to stress and cracking, making it highly suitable for demanding infrastructure projects. These innovations are helping HDPE compete in more technically challenging environments.

E-commerce is also shaping material trends. The sector’s rapid expansion has intensified the need for durable, lightweight packaging solutions qualities HDPE naturally offers. From crates and drums to shipping containers and liners, HDPE continues to be the material of choice for companies seeking resilience and cost savings in their supply chains.

Market Key Players:

| No comments yet. Be the first. |