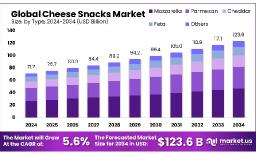

The global cheese snacks market is projected to reach approximately USD 123.6 billion by 2034, up from USD 71.7 billion in 2024, expanding at a compound annual growth rate (CAGR) of 5.6% between 2025 and 2034.

The cheese snacks industry encompasses a wide range of formats, including powders, pastes, liquids, baked crisps, and fried bites, catering to the growing demand for convenient, protein-rich snacks particularly among urban consumers with busy lifestyles. Evolving consumer preferences are driving innovation, with a strong focus on clean-label formulations, artisanal flavor profiles, and health-conscious variants. In 2024, baked cheese snacks accounted for the largest share of the market at 47.1%, while mozzarella-based varieties led the type segment with a 37.9% share, highlighting their appeal for flavor and meltability. This product diversity continues to support steady market expansion globally, across both mature and developing regions.

Key Takeaways:

https://market.us/wp-content/uploads/2025/06/Cheese-Snacks-Market.jpg" alt="Cheese Snacks Market" width="1216" height="740">

Download Exclusive Sample Of This Premium Report:

https://market.us/report/global-cheese-snacks-market/free-sample/

Key Market Segments:

A key driver of the global cheese snacks market is the rising demand for convenient, protein-rich snack options that do not compromise on taste. As urban lifestyles become increasingly fast-paced, traditional meals are giving way to quick, snack-based consumption. Cheese snacks are well-suited to this shift, offering a balance of flavor, nutrition, and ease of use.

The popularity of high-protein diets such as keto, low-carb, and high-protein plans has further bolstered demand for cheese-based snacks. Naturally rich in protein and calcium, these snacks resonate with fitness enthusiasts, working professionals, and health-conscious parents seeking nutritious choices for their children.

Urbanization in developing economies is also reshaping eating habits. In busy city environments where packaged foods are more common, cheese snacks serve as a practical and appealing alternative to sugary or carb-heavy options. The rise in dual-income households has further increased the demand for portion-controlled, ready-to-eat snacks that require minimal preparation.

The market also benefits from a wide range of product formats such as baked crisps, cheese cubes, puffs, string cheese, spreads, and dips which allows for consumption across various occasions, from school lunchboxes to party trays. This versatility appeals to multiple demographics and usage contexts, driving broader market penetration.

Despite strong momentum, the cheese snacks market faces several challenges. Chief among them is the volatility in raw material costs particularly dairy inputs like milk and cream. Fluctuations in milk supply, driven by changes in feed prices, climate conditions, and regulatory factors, can directly impact production costs.

Such cost pressures can affect pricing strategies, especially in cost-sensitive markets, and may lead to reduced consumer purchases if products become too expensive.

Another restraint stems from increasing health scrutiny. Many cheese snacks especially processed or ready-to-eat variants are high in sodium, saturated fats, or artificial additives. As consumers become more health-aware, and as some countries adopt front-of-pack labeling regulations or sugar/fat taxes, manufacturers may face added compliance and marketing challenges.

Environmental and ethical concerns also pose long-term risks. Issues such as the carbon footprint of dairy farming, water usage, and animal welfare are gaining traction, particularly among younger consumers. These factors could influence regulatory landscapes or shift consumer preferences toward alternative snack options.

With rising health awareness, consumers are increasingly reading food labels and seeking products with clean, simple ingredients. This is pushing manufacturers to focus on clean-label cheese snacks that use organic cheese, non-GMO ingredients, and minimal additives. Such products are gaining trust among millennials and families prioritizing health.

There’s also significant potential in cheese snacks tailored to specific dietary needs such as high-protein, low-fat, gluten-free, or lactose-free. These variants appeal to people managing weight, digestive issues, or food sensitivities. For example, lactose-free options are increasingly relevant in regions with high lactose intolerance, like East Asia, offering opportunities for premium positioning.

The plant-based movement presents another promising avenue. Although still niche, dairy-free cheese snacks made from nuts, seeds, or legumes are gaining traction among vegans and flexitarian consumers. As demand for plant-based products grows, this segment is expected to expand steadily.

Emerging markets such as India, China, Indonesia, Brazil, and Mexico offer tremendous growth potential due to their large, young populations, expanding middle class, and growing appetite for Western-style convenience foods. As cheese consumption rises in these regions, so does the appeal of cheese-based snacking.

Innovation is reshaping the cheese snacks landscape. A notable trend is the shift toward portion-controlled packaging, which appeals to health-conscious consumers seeking convenience and calorie moderation. Single-serve and resealable packs are ideal for on-the-go consumption from office drawers to lunchboxes.

Another key trend is functional snacking where products go beyond indulgence to offer added benefits like protein, fiber, or probiotics. These value-added ingredients cater to wellness-focused consumers, particularly millennials and Gen Z.

Premiumization is also gaining ground. High-end cheese snacks made with aged cheddar, smoked gouda, or infused with herbs and spices are increasingly favored by adults seeking gourmet experiences. These products offer differentiation and higher margins in a competitive market.

Finally, there is a strong shift toward baked over fried formats. Baked cheese snacks are perceived as healthier, with reduced fat and fewer empty calories. Many are also gluten-free or keto-friendly, appealing to consumers aiming for guilt-free indulgence.

Market Key Players:

| No comments yet. Be the first. |