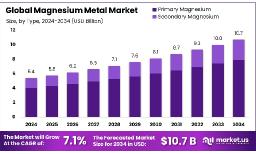

The global magnesium metal market is projected to reach approximately USD 10.7 billion by 2034, up from USD 5.4 billion in 2024. This growth reflects a compound annual growth rate (CAGR) of 7.1% over the forecast period from 2025 to 2034.

The global push for vehicle electrification and fuel economy standards, particularly in North America, Europe, and Asia-Pacific, is accelerating magnesium demand. In electric vehicles (EVs), magnesium contributes to battery enclosures and other lightweight elements that enhance driving range. Meanwhile, advancements in casting technologies and corrosion-resistant coatings have broadened its applicability in challenging environments. Moreover, the aerospace sector favors magnesium for interior structures and brackets due to its favorable strength-to-weight ratio. With manufacturers focused on sustainability and cost efficiency, the magnesium market is poised for sustained, technology-driven growth across multiple high-performance sectors.

Key Takeaways:

https://market.us/wp-content/uploads/2025/06/Magnesium-Metal-Market.jpg" alt="Magnesium Metal Market" width="1216" height="736">

Download Exclusive Sample Of This Premium Report:

https://market.us/report/magnesium-metal-market/free-sample/

Key Market Segments:

The magnesium metal market is gaining strong momentum, primarily driven by a global push for lightweight materials in industries such as automotive and aerospace. Magnesium alloys, being approximately 33% lighter than aluminum and 75% lighter than steel, offer a compelling mix of weight reduction and structural strength. This is increasingly vital as manufacturers seek to meet stringent fuel efficiency and emissions standards, such as U.S. CAFE regulations and the EU’s CO₂ targets.

In aerospace, magnesium’s appeal is rising due to its potential in reducing aircraft weight and emissions. Ongoing innovations in alloy composition and advanced casting techniques have broadened magnesium’s applications, even in challenging environments. Enhanced coating technologies and alloying methods are improving corrosion and heat resistance. Simultaneously, rising production volumes and deeper supply chain integration particularly in China are reducing cost barriers and improving availability for global manufacturers.

Despite its potential, the magnesium market faces key hurdles. A primary concern is the high energy consumption and carbon emissions linked to traditional production methods like the Pidgeon process, which heavily relies on coal. This poses sustainability challenges amid tightening global environmental regulations.

Price volatility is another critical restraint. Magnesium prices are highly sensitive to energy costs, raw material supply, and geopolitical disruptions especially given the concentration of production in a few key countries. Disruptions such as trade restrictions or energy rationing can trigger sudden price fluctuations, creating instability for buyers.

Additionally, the limited supply of high-purity magnesium hampers its adoption in high-tech fields such as aerospace, medical devices, and battery materials. Although technological advances are improving quality, production remains complex and expensive. Technical limitations such as flammability, corrosion risk, and low wear resistance continue to restrict broader use, even as mitigation techniques like coating and alloying drive up costs.

Significant growth potential exists in magnesium recycling and circular economy practices. Recovering magnesium from end-of-life products like vehicles, electronics, and packaging can reduce costs and energy usage recycling requires only 5% of the energy needed for primary production.

Policy support from initiatives such as the EU’s Critical Raw Materials Act is encouraging investment in local recycling and refining infrastructure, especially across Europe. This aims to reduce dependency on external suppliers while promoting sustainable material flows. Secondary magnesium production is a fast-emerging segment, bolstered by new hydrometallurgical and thermochemical techniques capable of recovering high-purity metal from various waste streams.

Emerging markets in Asia-Pacific and Latin America also offer strong prospects. These regions are experiencing rapid industrialization, especially in automotive manufacturing, consumer electronics, and infrastructure sectors that heavily utilize magnesium-based components. With rising demand and government support, these areas are likely to evolve into key production and consumption hubs.

The magnesium market is witnessing a pronounced shift toward sustainability and advanced manufacturing. One major trend is the adoption of closed-loop recycling systems, particularly in the automotive and electronics sectors, aligning with environmental mandates in the EU, North America, and other regions. Recycled magnesium’s minimal energy footprint supports these regulatory goals while cutting production costs.

Magnesium continues to be essential in aluminum alloying and die casting, accounting for nearly half of global usage. Its application in structural automotive parts like engine blocks, steering systems, and transmission housings is critical for achieving weight reduction targets and improving fuel economy.

Technological advancements are improving magnesium’s value chain. High-pressure die casting (HPDC) has enabled more precise, efficient production, making magnesium more competitive for mass manufacturing. Additionally, growing demand for high-purity magnesium is being driven by innovations in electronics, aerospace, and battery technologies.

The magnesium metal market is surpassing earlier projections, with expectations to nearly double in size over the next decade. This growth is fueled by rising industrial demand, supportive regulatory policies, and a global transition toward sustainable manufacturing. Companies investing in magnesium recycling, cleaner production techniques, and capacity expansion particularly in the Asia-Pacific region are strategically positioned to benefit from this upward trend.

Looking forward, consistent investment in infrastructure and advancements in processing and recycling technologies will play a vital role in sustaining momentum. Although challenges such as high energy costs and reliance on a few key suppliers persist, the market outlook remains positive. Magnesium is increasingly viewed as a critical material for the future of environmentally responsible industrial growth.

| No comments yet. Be the first. |