Report Overview:

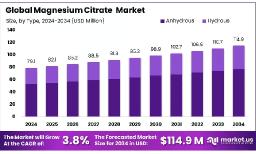

The global magnesium citrate market is projected to reach approximately USD 114.9 million by 2034, rising from an estimated USD 79.1 million in 2024. This growth reflects a compound annual growth rate (CAGR) of 3.8% over the forecast period from 2025 to 2034.

Magnesium citrate, containing approximately 11.3% elemental magnesium, is widely valued for its high solubility and superior bioavailability, making it more effective in delivering magnesium to the body compared to other forms. In pharmaceuticals, it is commonly used as a saline laxative and is included in over-the-counter digestive aids. In the food and beverage sector, it functions as an acidity regulator (E345) and pH stabilizer, improving product stability and shelf life. Its usage extends to personal care products for skin and muscle benefits and even in industrial applications where controlled pH levels are crucial. Its versatility supports growing global demand.

Key Takeaways:

- Magnesium Citrate Market size is expected to be worth around USD 114.9 Million by 2034, from USD 79.1 Million in 2024, growing at a CAGR of 3.8%.

- Anhydrous Magnesium Citrate held a dominant market position, capturing more than a 67.10% share of the total magnesium citrate market.

- Powder held a dominant market position, capturing more than a 38.30% share in the global magnesium citrate market.

- Pharmaceuticals held a dominant market position, capturing more than a 45.10% share in the global magnesium citrate market.

- Indirect Sales/B2C held a dominant market position, capturing more than a 62% share of the global magnesium citrate market.

- Europe emerged as the dominant region in the global magnesium citrate market, accounting for approximately 35.20% of the market share, valued at USD 27.8 million.

https://market.us/wp-content/uploads/2025/06/Magnesium-Citrate-Market.jpg" alt="Magnesium Citrate Market" width="1216" height="736">

https://market.us/wp-content/uploads/2025/06/Magnesium-Citrate-Market.jpg" alt="Magnesium Citrate Market" width="1216" height="736">

Download Exclusive Sample Of This Premium Report:

https://market.us/report/global-magnesium-citrate-market/free-sample/

Key Market Segments:

By Type

By Formulation

- Powder

- Capsules

- Liquid

- Tablets

- Others

By End-use

- Dietary Supplements

- Pharmaceuticals

- Food and Beverage

- Others

By Distribution Channel

- Direct Sales/B2B

- Indirect Sales/B2C

- Supermarkets/Hypermarkets

- Pharmacies and Drug Stores

- Online Retail

- Others

Drivers

One of the strongest engines behind the global magnesium citrate market today is the growing awareness of magnesium deficiency and its impact on health. Roughly 45-54% of the global population doesn’t get sufficient magnesium from diet alone, and deficiencies are known to affect muscle function, bone health, nerve signaling and cardiovascular systems. Healthcare professionals increasingly recommend magnesium citrate favored for its high solubility and absorption over other forms for its gentler and more bioavailable profile.

This preference drives demand across supplements, especially among older adults: up to 30% in seniors in some regions are deficient and more likely to consume forms like citrate In developed regions such as Europe and North America, aging populations and preventive healthcare initiatives compound this effect. Nutrient supplements represent roughly 40-42% of the magnesium citrate market, and prescription or over‑the‑counter pharmaceutical uses form another significant slice (~20‑37%).

There’s also growing interest from sports nutrition and wellness sectors: around 44% of sports supplements now include magnesium citrate for muscle recovery and energy support. Furthermore, public health programs especially in emerging markets are distributing magnesium citrate in form of supplements or fortified foods, particularly in maternal and child health initiatives.

Restraining Factors

First, consumer awareness remains relatively low in many developing regions. In low‑income markets, approximately 42 % of consumers lack awareness of magnesium deficiency and the benefits of supplementation. Only 28 % of healthcare professionals in under‑developed areas recommend magnesium-based supplements, and cultural tendencies toward traditional remedies reduce uptake by around 35 % in rural segments.

Second, production and raw material cost pressures are significant. Price hikes of 26 % in magnesium carbonate a key input combined with overall production cost increases totaling 31 %, have squeezed margins. Rising packaging expenses (up 23 %) and logistic fluctuations further burden smaller manufacturers, affecting 39 % of SMEs and slowing product innovation and expansion.

Third, the supply chain remains vulnerable. China continues to dominate nearly 87 % of global magnesium supply, creating a risk of bottlenecks or export restrictions with broader industry impacts, including on magnesium citrate availability. Historically, supply disruptions have led to downstream production halts across multiple sectors, underscoring the fragility of dependency on one key geography.

Fourth, regulatory inconsistency across markets is a notable barrier. About 31 % of manufacturers face import restrictions or delays in emerging economies due to inconsistent approvals or differing national standards. This regulatory uncertainty can not only delay launch timelines but also complicate global expansion strategies.

Opportunities

Looking forward, several clear opportunities are emerging to fuel growth in the magnesium citrate market. Fastest growth is expected in Asia‑Pacific and Latin America regions projected to grow at CAGR levels of 7-8% (Asia‑Pacific) and attractive mid‑single‑digit rates elsewhere driven by rising middle‑class incomes, urbanization and increased health awareness. Local production remains sparse, making early entry and partnerships especially advantageous.

Brands can expand beyond traditional tablets by launching new consumer‑friendly formats: effervescent powders, stick‑packs, gummies, chewables, and even transdermal sprays. Many new launches (~28-31%) are already featuring these formats, especially targeting pediatric, geriatric and active adult segments where ease of use and taste matter Efforts to improve solubility, dosage customization (e.g. sustained‑release), and clean‑label formulations are also gaining traction these innovations have led to measurable improvements in compliance (e.g. +40%) and new product uptake.

Sustainability is another rising opportunity. Green‑chemistry production processes, waste‑minimization methods, and plant‑based sourcing of citric acid can reduce environmental impact and capture price premiums (8‑12% higher in eco‑sensitive markets) This clean‑label positioning, along with non‑GMO claims and ingredient transparency, resonates well with health‑ and eco‑conscious consumers who now make up roughly 42% of new product launches in this space.

Trends

A defining trend reshaping the magnesium citrate market is the rapid rise of health-conscious behaviors and preventive wellness. Over 45 % of the global population is estimated to suffer from magnesium deficiency, and many consumers now favour magnesium citrate for its superior absorption and gentler digestive profile 61 % of supplement users choose citrate form over other variants. Fashioning itself as a key ingredient in sports and wellness supplements, magnesium citrate is now found in roughly 52 % of performance formulations, particularly to aid muscle recovery and support cardiovascular health.

Another important trend is product diversification and innovation in formats. Powdered forms account for nearly 48 % of total usage, favored for fast dissolution and user convenience . Effervescent tablets and gummies now represent about 31 % of new product launches, while chewables and microencapsulated options are gaining traction efforts that sometimes boost compliance by up to 40 % in pilot studies.

The clean-label and sustainability movement presents another powerful trend. Around 42 % of new supplement launches emphasize clean‑label, vegan or non GMO positioning, and green-chemistry production methods have significantly reduced magnesium citrate’s carbon footprint by around 22 % compared to synthetic alternatives. These eco-conscious advantages allow manufacturers to command a price premium of 8‑12 % in sensitive markets.

Market Key Players:

- Global Calcium PVT LTD

- Adani Pharmachem Private Limited

- Jungbunzlauer Suisse AG

- Gadot Biochemical Industries Ltd.

- Dr. Paul Lohmann

- Penglai Marine

- Lianyungang Dongtai Food Ingredients Co., Ltd

- Foodchem International Corporation

- Anmol Chemicals

- Fengchen Group Co.,Ltd

- American Elements

- Shan Par

- Other Key Players

Conclusion

Magnesium citrate stands out due to its superior bioavailability absorbed significantly better than many other magnesium salts, with absorption rates ranging from 25% to 30% higher than alternatives like magnesium oxide. This makes it a preferred choice in pharmaceuticals, supplements, and fortified food products. Its multifunctionality as a laxative, pH regulator, and nutritional additive broadens its utility across end-use sectors. In 2024, over 45% of magnesium supplements in the U.S. and Europe contained citrate forms.

Public health initiatives across Asia and Africa, including maternal nutrition programs, are accelerating its adoption. Meanwhile, the growing wellness trend has pushed the magnesium citrate market to USD 79.1 million in 2024, projected to reach USD 114.9 million by 2034. Looking ahead, cleaner-label products, cost optimization, and harmonized regulatory frameworks will be crucial. Despite price and supply concerns, magnesium citrate’s value in modern health solutions ensures its expanding role in both preventive care and clinical nutrition strategies.

https://market.us/wp-content/uploads/2025/06/Magnesium-Citrate-Market.jpg" alt="Magnesium Citrate Market" width="1216" height="736">