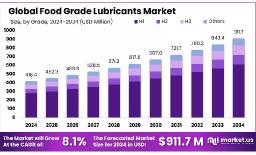

The global food grade lubricants market is projected to grow from USD 418.4 million in 2024 to approximately USD 911.7 million by 2034, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period from 2025 to 2034.

Food grade lubricants specially formulated oils and greases used in food processing machinery must comply with stringent regulations such as FDA 21 CFR 178.3570 and NSF H1 standards to ensure safety and prevent contamination. As global food production scales up, demand for these high-performance, non-toxic lubricants is rising. In 2024, H1-grade lubricants held the largest market share at 67.2%, with mineral-based lubricants accounting for 43.4%, and food-grade oils comprising around 44.5%. The food processing industry alone consumed over 57.5% of these lubricants, while low-viscosity types made up 37.5%. Europe led the market regionally with a 43.2% share.

Key Takeaways:

https://market.us/wp-content/uploads/2025/04/Food-Grade-Lubricants-Market.jpg" alt="Food Grade Lubricants Market" width="1216" height="737">

Download Exclusive Sample Of This Premium Report:

https://market.us/report/global-food-grade-lubricants-market/free-sample/

Key Market Segments:

The food grade lubricants market is being strongly driven by regulatory compliance requirements across the global food processing industry. Agencies like the U.S. Food and Drug Administration (FDA), NSF International, and the European Food Safety Authority (EFSA) have set strict hygiene standards for lubricants that come into direct or incidental contact with food products. These regulations require manufacturers to use H1 or H3-certified lubricants that reduce the risk of food contamination. As food safety awareness grows worldwide, manufacturers are proactively shifting toward lubricants that meet these stringent standards, which is fueling steady demand.

Another key driver is the rise in automation within food and beverage manufacturing facilities. The need for continuous, high-speed operations has created a demand for high-performance lubricants that can withstand extreme temperatures, pressures, and washdowns without breaking down or causing equipment failure. Food grade lubricants that can offer extended lubrication intervals, corrosion resistance, and anti-wear properties are increasingly being adopted to enhance machinery reliability and reduce downtime.

Furthermore, the growing consumption of packaged and processed food, particularly in urban regions, is expanding the production base of food and beverage companies. This expansion brings with it a higher demand for machinery-safe and food-safe lubricants. Equipment used in baking, bottling, dairy, meat, and confectionery production requires different types of lubricants (like oils, greases, sprays), depending on operational needs creating broad product applicability across segments.

Despite a promising growth outlook, the global food grade lubricants market faces several significant restraints that hinder its broader adoption and market maturity, particularly in developing economies and cost-sensitive industries. These challenges create friction points that limit scalability and long-term integration, especially where budgets are tight and awareness is low.

One of the foremost hurdles is the relatively high cost of food grade lubricants when compared to standard industrial lubricants. These specialized lubricants are formulated under strict regulatory frameworks such as NSF H1 certification, FDA 21 CFR 178.3570, or ISO 21469, which necessitate the use of ultra-refined base oils, non-toxic additives, and hygienic production conditions. As a result, manufacturing costs rise substantially, and this cost burden is ultimately passed on to food producers.

For many small- and mid-sized enterprises (SMEs) in the food processing industry especially in emerging markets these costs are a significant barrier. Operating on limited budgets, many of these businesses tend to prioritize immediate cost savings over long-term reliability or safety. In regions like Southeast Asia, Sub-Saharan Africa, and Latin America, where maintaining competitive pricing is essential, the return on investment from using certified food-safe lubricants often isn’t immediately evident, discouraging adoption. In such scenarios, companies may continue using cheaper, non-compliant lubricants if enforcement is weak, risking both machinery health and consumer safety.

Another constraint arises from the lack of consistent and harmonized regulatory enforcement across global markets. While developed countries such as the United States, Canada, Japan, and those in the European Union maintain well-defined food safety guidelines and trusted certification systems, many developing nations lack similarly robust frameworks. This leads to regulatory fragmentation, where international standards may be adopted on paper but are inconsistently enforced on the ground. In rural or loosely governed industrial areas, food manufacturers may inadvertently or deliberately use lubricants that claim to be food grade but lack legitimate third-party certification.

The most promising opportunities lie in the rapid modernization of food manufacturing infrastructure in emerging economies. Countries such as India, Brazil, Indonesia, and Vietnam are experiencing increased demand for processed food products due to rising incomes, urbanization, and changing dietary patterns. These nations are investing in technologically advanced facilities that require premium, safe, and efficient lubricants. Local manufacturers and international suppliers who align their offerings with regional food safety standards can tap into a large, growing customer base.

There is also a significant opportunity in developing bio-based and biodegradable food grade lubricants, which are derived from renewable resources such as vegetable oils and esters. These products not only meet food safety guidelines but also cater to the rising demand for sustainability in industrial operations. Food processors are increasingly interested in reducing their environmental impact without compromising on lubricant performance, opening the door for eco-friendly alternatives.

Additionally, advancements in synthetic lubricant formulations such as those based on polyalphaolefins (PAOs) and esters offer longer service life and enhanced protection under extreme conditions. This creates room for manufacturers to differentiate based on innovation, efficiency, and extended maintenance intervals. As digitalization and predictive maintenance trends take root in industrial plants, demand will likely grow for high-tech lubricants that can integrate with smart monitoring systems.

The food grade lubricants market is undergoing a transformation, shaped by multiple macro and micro trends. One of the most prominent is the shift toward sustainable, environmentally responsible products. As environmental regulations tighten and companies adopt corporate sustainability goals, there is growing interest in lubricants that are not only food-safe but also biodegradable and non-toxic.

The integration of smart maintenance and IoT-based monitoring in food production equipment is also influencing lubricant demand. These technologies allow for real-time tracking of lubricant condition and performance, leading to more informed decisions about reapplication and replacement. This trend supports the use of high-performance synthetic lubricants that remain effective over extended periods.

Additionally, consumer pressure for clean-label, chemical-free food production is trickling down to every part of the manufacturing process, including machinery maintenance. Manufacturers are increasingly scrutinized for every component involved in production, and using certified food-safe lubricants has become an important part of brand reputation and consumer trust.

Market Key Players:

In 2024, H1-grade lubricants approved for incidental food contact accounted for the largest market share at 67.2%, reflecting their widespread use in ensuring food safety. Mineral-based lubricants made up 43.4% of the market, while low-viscosity types such as sprays held a 37.5% share, favored for easy application and reduced friction in sensitive equipment. The food processing sector emerged as the leading end-user, consuming more than 57.5% of total lubricant demand due to high reliance on machinery requiring contamination-free operation.

Looking ahead, the market is expected to see significant growth in bio-based and synthetic food-grade lubricants. These eco-friendly alternatives are gaining traction as companies strive to meet sustainability targets without compromising compliance. In emerging markets, rising food production and stricter regulatory oversight are driving the need for safer, more efficient lubricants pushing innovation, cost-effectiveness, and regulatory adaptability to the forefront.

| No comments yet. Be the first. |