Report Overview:

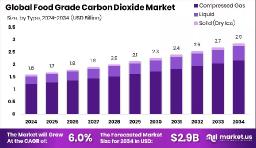

The global Food Grade Carbon Dioxide Market is projected to reach approximately USD 2.9 billion by 2034, rising from USD 1.6 billion in 2024, with a compound annual growth rate (CAGR) of 6.0% between 2025 and 2034. The increasing demand for packaged food is a key driver, particularly in North America, which holds a steady 39.3% market share and continues to be a major contributor to the market’s expansion.

The growth of the food grade carbon dioxide market is primarily fueled by the increasing consumption of packaged and processed foods, along with the rising popularity of carbonated beverages. In 2023, the beverage segment accounted for 47.3% of total CO₂ demand, while freezing and chilling applications held a 53.2% share. Technologies such as modified atmosphere packaging (MAP) and cryogenic freezing are widely used to extend shelf life and preserve product quality across key sectors including meat, dairy, and bakery. The expansion of global cold-chain infrastructure further supports this trend, especially in high-growth regions like Asia-Pacific and Latin America.

Key Takeaways:

- The Global Food Grade Carbon Dioxide Market is expected to be worth around USD 2.9 billion by 2034, up from USD 1.6 billion in 2024, and grow at a CAGR of 6.0% from 2025 to 2034.

- In 2024, compressed gas held a 76.3% share in the Food Grade Carbon Dioxide Market globally.

- Bulk supply mode accounted for 57.4%, dominating the distribution channel in the Food Grade Carbon Dioxide Market.

- Freezing and chilling applications led with 53.2% usage across the Food Grade Carbon Dioxide Market segments.

- The beverages sector represented 47.3% of total demand in the Food Grade Carbon Dioxide Market in 2024.

- The North America market was valued at USD 0.6 billion, showing strong industrial demand.

https://market.us/wp-content/uploads/2024/06/Food-Grade-Carbon-Dioxide-Market-Size-1.jpg" alt="Food Grade Carbon Dioxide Market Size" width="1216" height="706">

https://market.us/wp-content/uploads/2024/06/Food-Grade-Carbon-Dioxide-Market-Size-1.jpg" alt="Food Grade Carbon Dioxide Market Size" width="1216" height="706">

Download Exclusive Sample Of This Premium Report:

https://market.us/report/food-grade-carbon-dioxide-market/free-sample/

Key Market Segments:

By Type

- Compressed Gas

- Liquid

- Solid (Dry Ice)

By Mode of Supply

- Bulk

- Cylinder

- On-site Generation

By Application

- Freezing and Chilling

- Carbonating

- Packaging

By End-use

- Beverages

- Dairy and Dairy Products

- Meat, Poultry, and Seafood

- Grains, Fruits, And Vegetables

- Bakery and Confectionery

- Others

Drivers

The global food grade carbon dioxide market is experiencing notable growth, driven by a range of industry-level and consumer-centric factors that are reshaping the way food is processed, stored, and consumed. One of the most significant forces propelling market expansion is the increasing consumption of processed, chilled, and packaged food across both developed and developing economies. As more people shift towards urban lifestyles with limited time for home cooking, the reliance on ready-to-eat meals, frozen foods, and pre-packaged snacks has risen sharply.

In this context, food-grade carbon dioxide plays a pivotal role, especially through its application in modified atmosphere packaging (MAP). This technique replaces the oxygen inside packaging with a protective gas mix often rich in CO₂ to slow microbial growth and extend product shelf life. It’s particularly important in categories like bakery items, meats, seafood, and dairy products. With modern consumers expecting longer shelf stability without compromising freshness or food safety, the adoption of MAP using food-grade CO₂ has become a core strategy among food processors.

This trend is especially strong in Asia-Pacific and North America, where high urbanization rates and evolving dietary preferences are pushing demand for convenient and longer-lasting food options. Another powerful growth driver is the sustained rise in carbonated beverage consumption around the world. Carbon dioxide is fundamental to the carbonation process, responsible not only for the fizzy sensation but also for enhancing taste, aroma, and product preservation. In 2023, the beverage sector accounted for a substantial 47.3% share of the total food-grade CO₂ market, underlining its dominance.

The demand is largely fueled by the widespread popularity of soft drinks, sparkling water, flavored seltzers, energy drinks, and even carbonated alcoholic beverages like beer and cider. Moreover, changing consumer preferences are giving rise to sugar-free, low-calorie, and functional beverages that still depend on CO₂ for their signature texture and refreshing feel.

Restraining Factors

Despite the promising growth trajectory of the food grade carbon dioxide market, several key restraints continue to challenge its expansion and operational efficiency. One of the most critical limitations is the need to adhere to stringent purity and safety regulations across global markets. Food-grade CO₂ must comply with frameworks such as the FDA’s Code of Federal Regulations in the United States and the European Union’s E290 additive standards, which mandate high purity levels, absence of contaminants, and detailed traceability throughout production and distribution.

Achieving and maintaining these standards involves advanced purification processes including multiple filtration stages, moisture control, and routine quality testing. For small- and mid-sized producers, these quality assurance demands often translate into high operational costs and technological burdens, limiting scalability and flexibility in competitive markets. In addition to quality-related challenges, transportation and storage represent significant logistical hurdles.

The delivery of food-grade CO₂, whether in compressed gas, liquid, or solid (dry ice) form, requires specialized infrastructure such as high-pressure cylinders, cryogenic tanks, or insulated storage containers. Bulk delivery, which dominates the market with a 57.4% share, is the preferred method for large-scale operations due to its volume efficiency. However, it demands a well-developed logistics network, which is often lacking in remote or underdeveloped areas. This not only increases shipping costs but also restricts market penetration in emerging regions where demand is rising.

Opportunities

The food grade carbon dioxide market is poised for significant expansion, particularly through emerging market opportunities and shifts in food consumption trends. One of the most promising growth avenues lies in the rapid development of emerging economies such as those in Southeast Asia, Latin America, and parts of Africa. These regions are witnessing strong growth in packaged food consumption due to rising disposable incomes, urbanization, and changing dietary habits.

As demand for chilled and processed foods increases, investments in cold storage infrastructure and modern food distribution networks are also accelerating. The development of reliable refrigerated supply chains and cold logistics is opening new doors for CO₂-based preservation methods such as modified atmosphere packaging (MAP) and cryogenic freezing. These technologies are essential for maintaining product quality during storage and transport in warm climates making CO₂ applications highly relevant and valuable in these regions.

Another major opportunity lies in the adoption of on-site CO₂ generation systems and sustainable carbon recovery technologies. Instead of relying on external bulk or cylinder deliveries, more food processors are exploring systems that allow them to produce and purify CO₂ from industrial or natural processes on-site. This shift not only reduces logistical dependency but also offers superior quality control and cost efficiency. In addition, closed-loop systems that capture CO₂ from bio-based sources or fermentation align well with sustainability goals and can be especially advantageous in regions with unreliable supply chains or long distances from major industrial CO₂ sources.

Trends

The food grade carbon dioxide market is evolving rapidly as manufacturers seek more efficient, sustainable, and scalable solutions to meet growing global demand. One of the most prominent trends is the shift toward bulk and on-site CO₂ supply models. Traditionally, compressed gas cylinders were common, but their limited volume and higher per-unit cost have led large food producers to adopt bulk delivery systems, which now account for 57.4% of the market share. Bulk systems offer advantages such as lower transportation costs, continuous supply, and reduced handling complexity.

Additionally, some large-scale manufacturers are investing in on-site generation systems that allow them to extract, purify, and store CO₂ directly within their processing facilities. This not only reduces reliance on third-party supply chains but also ensures consistent gas purity, essential for applications like carbonating beverages or packaging sensitive food items. Another fast-growing trend is the increasing use of dry ice (solid CO₂) in last-mile delivery.

Following the e-commerce boom and rising consumer demand for home-delivered perishables, especially after the COVID-19 pandemic, dry ice has become vital in maintaining cold-chain integrity for frozen foods, dairy, and fresh meat during transport. Urban areas and regional distribution hubs are witnessing higher volumes of solid CO₂ consumption, with food delivery services and retailers prioritizing product freshness over long distances. In parallel, environmental sustainability is reshaping how CO₂ is sourced and used. There is growing investment in closed-loop CO₂ recovery systems, where carbon dioxide is captured from bio-based sources or fermentation processes and repurposed for food-grade applications.

Market Key Players:

- Air Liquide S.A.

- Linde plc

- Air Products and Chemicals, Inc.

- Messer Group

- Nexair LLC

- Continental Carbonic Products, Inc.

- TAIYO NIPPON SANSO CORPORATION

- Coregas

- Ellenbarrie industrial Gases

- IFB Agro Industries Limited

- Sicgil india limited

- WKS Industrial Gas Pte Ltd

- Southern Gas Limited

- Matheson Tri-Gas, Inc.

- POET, LLC

- Massy Group

- Sol Group Corporation

- Reliant BevCarb

- Acail Group

- Other Key Players

Conclusion

The expansion of the food grade carbon dioxide market is driven by rising global consumption of packaged, frozen, and convenience foods, along with increasing demand for carbonated beverages. The freezing and chilling segment commands a leading 53.2% market share, reflecting widespread use of CO₂ in meat, seafood, and ready-meal preservation. The beverage industry follows closely with a 47.3% share, where CO₂ is vital for carbonation and shelf-life stability. In terms of distribution, bulk supply methods dominate with a 57.4% share, offering greater efficiency and cost-effectiveness for large-scale operations.

The rise of e-commerce grocery platforms and cold-chain logistics in regions like Asia-Pacific and Latin America further fuels this momentum. Sustainability-focused innovations, such as on-site CO₂ generation and closed-loop recovery from fermentation or biomass, are gaining traction as businesses aim to lower carbon footprints. Additionally, increasing demand for plant-based and clean-label foods is promoting CO₂ use as a natural, residue-free preservation method across global markets.

https://market.us/wp-content/uploads/2024/06/Food-Grade-Carbon-Dioxide-Market-Size-1.jpg" alt="Food Grade Carbon Dioxide Market Size" width="1216" height="706">