Download Exclusive Sample Of This Premium Report:

https://market.us/report/flow-chemistry-market/free-sample/

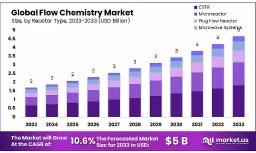

Key Market Segments:

Reactor Type

- CSTR (Continuous stirred-tank reactor)

- Microreactor

- Plug Flow Reactor

- Microwave Systems

- Others

By Purification Method

- Crystallization

- Distillation

- Liquid-Liquid Extraction

- Membrane Filtration

- Others

Application

- Pharmaceuticals

- Academia & Research

- Chemicals

- Petrochemicals

- Others

Drivers

The global surge in pharmaceutical manufacturing and specialty chemical production stands at the heart of flow‑chemistry adoption. Drug makers today face intense pressure to accelerate development timelines, lower costs, and meet ever‑stricter regulatory benchmarks for safety and sustainability. Continuous‑flow reactors are uniquely suited to these challenges: they maintain consistent reaction conditions, allow precise residence‑time control, and minimize the handling of hazardous intermediates. As a result, reactions that once required large safety margins and labor‑intensive oversight in batch vessels can now be executed in compact flow setups, reducing solvent use by up to 50 percent and shortening synthesis times from hours to minutes.1

Emerging economies, particularly India and China, are investing heavily in new Good Manufacturing Practice (GMP) facilities to supply both domestic and export markets. Industry surveys indicate that India alone plans to add more than 300,000 L of continuous reactor capacity by 2027, focusing on active‑pharmaceutical‑ingredient (API) production.2 These green‑field facilities favor modular, skid‑mounted flow systems that can be duplicated quickly across sites, ensuring process standardization and easier technology transfer. The relatively small footprint of a flow module often no larger than a shipping container also helps manufacturers overcome real estate constraints in densely populated industrial zones.

Safety and environmental considerations amplify these economic drivers. Regulators in North America and Europe are imposing tighter limits on worker exposure to highly potent compounds, explosive reagents, and toxic solvents. Continuous‑flow technology, with its sealed architecture and low hold‑up volumes, inherently reduces fugitive emissions and the risk of runaway reactions. In recent case studies, pharmaceutical plants switching from batch nitration to continuous flow cut nitrogen‑oxide emissions by 80 percent and reduced waste acid neutralization costs by 60 percent.3 Such performance aligns with corporate ESG targets and national sustainability frameworks.

Restraining Factors

While flow chemistry offers numerous operational and environmental advantages, several real-world limitations continue to hinder its widespread adoption particularly among small and mid-sized manufacturers. One of the most significant barriers is the entrenched familiarity with batch processing. For decades, batch reactors have served as the standard in chemical production because they are simple to operate, relatively inexpensive to purchase, and versatile across a wide range of reactions. This long-standing reliance creates inertia, making companies hesitant to overhaul systems that are already “good enough,” especially when margins are tight.

Another major restraint is the high upfront cost of implementing flow chemistry systems. Although flow reactors often yield savings over time through reduced energy use, higher yields, and shorter cycle times, their initial setup costs can be significantly higher. Specialized pumps, heat exchangers, reaction coils, control software, and inline sensors are typically required equipment that many traditional facilities are not equipped with. Moreover, flow systems often need dedicated infrastructure, such as closed-loop temperature and pressure control, that batch reactors don’t require. For smaller facilities with limited capital expenditure budgets, these costs represent a substantial hurdle.

A related challenge is the lack of trained personnel familiar with continuous-flow processes. Many chemists and plant operators are trained primarily in batch chemistry. Transitioning to flow chemistry requires new skills, including an understanding of fluid dynamics, residence time distribution, and automated control logic. In regions with limited technical training in chemical engineering or digital automation, this skills gap can slow implementation.

Opportunities

Flow chemistry’s future growth prospects extend well beyond its current pharmaceutical stronghold. The global shift toward decarbonization and circular‑economy principles opens several high‑value avenues. For example, biodiesel and renewable‑diesel plants rely on exothermic esterification and hydrogenation steps that are ideally suited to continuous reactors. Pilot programs in Southeast Asia have demonstrated that switching from batch transesterification to micro‑reactor flow can raise fatty‑acid‑methyl‑ester yields by 8-10 percent while reducing catalyst usage by 20 percent.6 Governments promoting low‑carbon fuels are offering tax credits and capital grants, lowering the payback period for such upgrades to under three years.

The fast‑expanding battery‑materials sector is another fertile area. Cathode‑active materials, electrolyte additives, and binder precursors often involve controlled precipitation or lithiation stages that benefit from precise residence‑time management. Continuous flow enables uniform particle size and narrow distribution both critical for battery performance. A recently commissioned facility in Europe uses plug‑flow reactors to produce next‑generation lithium iron phosphate (LFP) slurry, achieving throughput of 10 tonnes per day on a skid requiring less than 150 m² of floor space.7 As electric‑vehicle demand soars, similar plants are likely to multiply worldwide.

Green‑field chemical complexes are increasingly being designed around modular flow trains. Engineering firms now offer “plug‑and‑play” units that integrate reactors with downstream crystallization, membrane separation, and distillation. Owners can scale capacity by adding parallel lines rather than building larger batch vessels, spreading capital expenditure over time. In petrochemical hubs where land is at a premium, this modularity also reduces plot‑space requirements by up to 40 percent compared with traditional layouts.

Trends

The flow chemistry market is experiencing a dynamic shift, shaped by rapid technological advances and rising demand for sustainability, precision, and flexibility. At the forefront of this evolution is the growing adoption of micro-reactors and millifluidic platforms, which allow unparalleled control over residence time, reaction temperature, and mixing efficiency. These miniaturized systems are increasingly being deployed in academic labs, pilot plants, and even full-scale production facilities especially for energetic, photochemical, or toxic reactions that are difficult to manage safely in batch setups.

Micro-reactors also enable “numbering-up” (parallelization) instead of “scaling-up,” meaning manufacturers can replicate production lines using modular units without redesigning entire process flows. This reduces the risk associated with traditional scale-up methods and ensures faster, more predictable performance. It’s particularly valuable in pharmaceutical, fine-chemical, and semiconductor manufacturing, where consistency and product purity are paramount.

Alongside reactor innovation, another key trend is the integration of modular “plug-and-play” flow systems. These skids come equipped with real-time monitoring tools such as inline spectroscopy (FTIR, UV-Vis, NIR), temperature/pressure sensors, and AI-driven control loops which align with Industry 4.0 standards. The advantage here is not only precision but also remote operability, predictive maintenance, and automated recipe switching. In a post-pandemic world where remote process control is increasingly valued, these features are pushing flow chemistry beyond traditional labs into mainstream industrial manufacturing.

Market Key Players:

- Am Technology

- CEM Corporation

- Milestone Srl

- Biotage AB

- Syrris Ltd.

- Vapourtec Ltd.

- ThalesNano Inc.

- Hel Group

- Uniqsis Ltd.

- Chemtrix BV

- Ehrfeld Mikrotechnik BTS

- Future Chemistry Holding BV

- Corning Incorporated

- Cambridge Reactor Design Ltd.

- PDC Machines Inc.

- Parr Instrument Company

Conclusion

Flow chemistry is evolving from a laboratory curiosity into a mainstream production platform, driven by the need for safer, cleaner, and more flexible chemical synthesis. Its ability to deliver continuous output, tighter reaction control, and reduced waste makes it attractive for pharmaceuticals, fine chemicals, and sustainable fuels.

Although higher initial investment and competition from batch alternatives remain hurdles, ongoing advances in modular design, real‑time analytics, and government support for green manufacturing are steadily lowering barriers. Over the next decade, flow chemistry is set to become a cornerstone technology for companies seeking efficiency and sustainability in chemical processing.