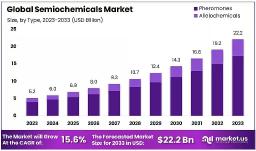

The global Semiochemicals market is projected to reach approximately USD 22.2 billion by 2033, rising from USD 5.2 billion in 2023. This growth represents a compound annual growth rate (CAGR) of 15.6% over the forecast period from 2023 to 2033.

The growth of the semiochemicals market is closely tied to the global movement toward more sustainable farming practices and the broader adoption of integrated pest management (IPM). With both consumers and farmers looking for safer, environmentally friendly alternatives to chemical pesticides, semiochemicals such as pheromones and allelochemicals offer a targeted and residue-free way to manage pest populations. This aligns well with the increasing demand for organic produce and the need for more ecologically responsible crop protection methods. North America, particularly the United States, currently leads the market, accounting for approximately 30–36% of the global share. This leadership is driven by strong regulatory frameworks, a rise in organic farming, and significant investment in sustainable agriculture practices. On the other hand, the Asia-Pacific region is emerging as the fastest-growing market, supported by government initiatives promoting eco-friendly farming and a growing public awareness of the risks associated with chemical pesticide use.

Key Takeaways:

https://market.us/wp-content/uploads/2024/03/Semiochemicals-Market-1024x605.jpg" alt="Semiochemicals Market" width="1024" height="605"> Download Exclusive Sample Of This Premium Report:

https://market.us/report/semiochemicals-market/free-sample/

Key Market Segments:

The increasing shift toward sustainable agriculture is a major force driving the growth of the semiochemicals market. With rising concerns over the harmful effects of synthetic pesticides on human health, biodiversity, and soil integrity, there's a growing need for safer, eco-friendly alternatives. Semiochemicals chemical signals such as pheromones and allelochemicals used by insects to communicate offer an effective, highly targeted approach to pest control. These natural compounds help manage pests without harming non-target organisms or polluting the environment.

Global support for Integrated Pest Management (IPM) strategies is also contributing to market expansion. Governments and agricultural bodies are promoting biological solutions as part of eco-conscious farming practices, where semiochemicals fit naturally. The rising popularity of organic food and chemical-free farming, particularly in Europe, North America, and parts of Asia, is further boosting adoption. Additionally, growing consumer focus on food safety especially in the wake of the pandemic has encouraged producers and retailers to consider gentler, more transparent pest management options like semiochemicals.

Despite its promise, the semiochemicals market faces several obstacles. Cost remains one of the biggest challenges. Compared to traditional pesticides, semiochemicals can be expensive to produce and apply. Their specialized use like pheromone traps or mating disruption dispensers requires tailored implementation, which can be difficult for small or resource-limited farmers. Awareness and education also pose issues. In many regions, farmers lack familiarity with how semiochemicals work or how to use them correctly, limiting wider adoption.

Additionally, while semiochemicals are precise, this very specificity can be a drawback. Different pests require different chemical cues, making the broad-scale use of a single solution challenging. Regulatory barriers also persist. Because these products are relatively new to the market, approval and registration processes vary across countries and can be slow. Aligning and simplifying regulatory frameworks will be essential to ensure safer and faster entry into global markets.

The semiochemicals market holds tremendous potential, especially in developing regions where modern agricultural practices are on the rise. Countries in Latin America, Africa, and Southeast Asia are increasingly looking for effective pest control tools that are both eco-conscious and economically viable. As awareness of environmental concerns grows, semiochemicals could play a key role in shaping the next generation of crop protection strategies.

Innovation is another promising area. Advances in synthetic biology and biotechnology are enabling the development of cost-efficient and longer-lasting semiochemical products. Companies are working on smart delivery systems like microencapsulation and even drone-based applications that enhance precision and ease of use. These innovations make semiochemicals more appealing and practical for large-scale farming.

There’s also huge potential in digital agriculture. With the rise of precision farming, the integration of semiochemicals with real-time pest monitoring systems could optimize application timing and effectiveness. The growth of online agriculture platforms is expanding access for smaller producers and allowing for better education and distribution. Collaborative efforts between private companies, governments, and NGOs are also increasing awareness, training, and adoption, especially in underserved rural regions.

The semiochemicals industry is evolving alongside the broader trend toward biological and regenerative agriculture. Consumers are becoming more mindful of what goes into their food, prompting brands to seek out supply chains that support clean-label practices. Semiochemicals align well with these values, offering pest control with a minimal environmental footprint.

Ongoing research is also shaping the future of the market. New semiochemical products are being designed to target multiple pests or to complement other biological control methods. Hybrid approaches such as combining pheromones with beneficial insects or microbial agents are emerging as holistic solutions. Partnerships between research institutions, companies, and governments are accelerating these innovations and expanding market reach.

Smart farming tools are another trend to watch. Technologies like remote pest detection and automated sprayers are helping farmers apply semiochemicals more efficiently and reduce waste. Lastly, as climate change alters pest behaviors and increases agricultural unpredictability, semiochemicals are poised to become a vital component in resilient farming systems. Their ability to offer precision control with reduced environmental impact makes them highly valuable in the face of global ecological shifts.

The global semiochemicals market is at a transformative stage as agriculture moves toward more sustainable practices. With growing environmental concerns and rising demand for food that’s free from harmful chemical residues, semiochemicals have emerged as a valuable and eco-conscious alternative to traditional pesticides. These naturally occurring compounds such as pheromones and allelochemicals offer targeted pest control solutions that do not harm beneficial insects or pollute the environment, making them an ideal fit for modern, responsible farming.

What makes semiochemicals especially appealing is their alignment with stricter global regulations and increasing consumer expectations for safe, sustainable food sources. Their compatibility with Integrated Pest Management (IPM) systems is another strong advantage, helping farmers reduce chemical use while maintaining effective pest control. Across both advanced and developing markets, more growers are beginning to understand the long-term value of incorporating biological solutions like semiochemicals. Interest from the organic agriculture sector is also growing rapidly, as these compounds meet organic certification standards and support the clean-label movement that many health-conscious consumers now prioritize.

| No comments yet. Be the first. |