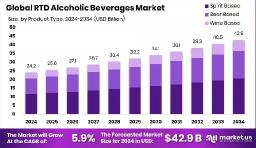

The global Ready-to-Drink (RTD) Alcoholic Beverages market is projected to reach approximately USD 42.9 billion by 2034, rising from an estimated USD 24.2 billion in 2024. This reflects a steady compound annual growth rate (CAGR) of 5.9% over the forecast period from 2025 to 2034. The Asia-Pacific region remains a key driver of this growth, accounting for a significant 37.3% share of the global market, fueled by rising consumer interest in convenient, on-the-go alcoholic options.

The global Ready-to-Drink (RTD) Alcoholic Beverages Market has seen remarkable growth in recent years, driven by changing lifestyles, evolving consumer preferences, and increased demand for convenience. These beverages are pre-mixed and ready for consumption, offering a quick and easy alternative to traditional alcohol options. With no need for bartending or mixing, RTDs have become a favorite among urban professionals, young adults, and social drinkers seeking hassle-free enjoyment.

Key Takeaways:

https://market.us/wp-content/uploads/2025/04/RTD-Alcoholic-Beverages-Market-Size.jpg" alt="RTD Alcoholic Beverages Market Size" width="1216" height="706">

Download Exclusive Sample Of This Premium Report:

https://market.us/report/rtd-alcoholic-beverages-market/free-sample/

Key Market Segments:

The RTD (Ready-to-Drink) alcoholic beverages market is gaining momentum worldwide due to evolving lifestyles and a preference for convenience. With increasingly busy schedules, especially among younger consumers and working adults, there's a growing desire for drinks that are quick, easy to serve, and don’t require any preparation. RTDs meet this need, offering a hassle-free alternative to traditional cocktails or bar-made drinks.

Another contributing factor is the demand for diverse and adventurous flavors. Today’s consumers are eager to try new taste combinations ranging from sweet and fruity to bold and spicy. RTDs provide this variety while also catering to those who prefer lower alcohol content or health-conscious options. The expanding availability of RTD drinks across stores, online platforms, and even delivery services adds to their popularity. Additionally, increased urbanization and disposable incomes in emerging economies are helping fuel consistent growth.

Despite their rising popularity, RTD alcoholic beverages face several challenges. One of the biggest obstacles is the inconsistent regulatory landscape across different countries. Alcohol laws vary widely, which affects everything from labeling to distribution, making global expansion difficult.

Pricing is another issue. High taxes on alcohol, especially spirits, can raise retail prices significantly, potentially making RTDs less affordable in some markets. Moreover, growing health awareness is causing some consumers to reduce or avoid alcohol consumption. Products perceived as high in sugar or calories may struggle in health-focused segments. Lastly, the RTD category must also compete with other drink alternatives both alcoholic and non-alcoholic that may respond more rapidly to shifting consumer demands.

There is ample room for growth in the RTD segment, particularly through innovation and product differentiation. As consumers seek not only convenience but also quality, brands can capitalize by offering craft-style or premium RTD cocktails that mimic high-end bar experiences.

Health and wellness present another major opportunity. Low-calorie, alcohol-free, or reduced-alcohol beverages are in high demand, especially when made with natural ingredients and transparent labeling. Digital channels, especially after the COVID-19 pandemic, have opened new ways to connect directly with consumers. E-commerce platforms allow for easy product discovery, targeted ads, and subscription-based models.

Emerging markets in Asia-Pacific and Latin America are showing strong growth potential, thanks to rising internet penetration and younger, tech-savvy populations. Unique marketing strategies like celebrity collaborations, seasonal launches, and limited-edition products are also proving successful in appealing to younger demographics and building brand loyalty.

Several emerging trends are shaping the future of the RTD alcoholic beverage market. Premiumization is one of the strongest, as more consumers seek bar-quality cocktails in a convenient, portable format. High-end ingredients, unique flavor blends, and visually appealing packaging are becoming standard expectations.

Health-conscious formulations are also gaining ground. From drinks with botanical infusions to versions with functional ingredients like vitamins or adaptogens, RTDs are aligning with the broader wellness movement. Environmentally friendly packaging is another key trend, with brands turning to recyclable materials and reducing their carbon footprint to satisfy eco-aware buyers.

Digital platforms are playing an increasing role in influencing purchases. From influencer promotions to social media campaigns and direct-to-consumer websites, online engagement is helping brands stay connected with their audiences. Creative storytelling, personalized content, and online convenience are proving vital in maintaining interest and boosting customer loyalty in this fast-growing market.

The RTD alcoholic beverages market is thriving on the synergy of convenience, flavor innovation, and premium presentation. As younger consumers continue to drive demand, brands that offer innovative, lower‑alcohol, and craft-quality RTDs will likely perform best.

Asia-Pacific remains the growth engine, but opportunities especially through e-commerce, health-centric product lines, and premium positioning are emerging worldwide. Regulation and tax hurdles exist, but these can be navigated through streamlined packaging and product design. With shifts toward on-the-go lifestyles and experiential consumption, RTDs are well-positioned for sustained growth in the decade ahead.

| No comments yet. Be the first. |