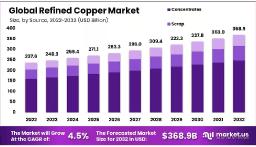

The global refined copper market was valued at approximately USD 237.6 billion in 2022 and is expected to grow to USD 368.9 billion by 2032. This reflects a steady compound annual growth rate (CAGR) of 4.5% over the forecast period from 2023 to 2032, driven by increasing demand across construction, electronics, and energy sectors.

The refined copper market is experiencing consistent growth due to increasing global demand in power transmission, construction, electronics, and clean energy applications. Its excellent electrical conductivity and recyclability make copper a preferred material in emerging technologies like electric vehicles and renewable energy systems. Urbanization and infrastructure development in emerging economies are also key drivers. However, the market faces challenges such as raw material price volatility and environmental concerns from mining. Still, innovation in refining processes and circular economy efforts offer positive prospects.

Key Takeaways:

https://market.us/wp-content/uploads/2019/06/Refined-Copper-Market.jpg" alt="Refined Copper Market" width="1259" height="725">

Download Exclusive Sample Of This Premium Report:

https://market.us/report/refined-copper-market/free-sample/

Key Market Segments:

The global demand for refined copper is strongly driven by its widespread use in critical sectors such as construction, electrical infrastructure, transportation, and renewable energy. Copper’s high conductivity and corrosion resistance make it ideal for wiring, plumbing, and power distribution. As countries expand their urban infrastructure, copper remains a core material in both residential and commercial projects. Additionally, the push for electrification in transportation, including electric vehicles (EVs) and charging stations, significantly boosts copper consumption. Each EV requires substantially more copper than a conventional vehicle, due to extensive wiring, battery connections, and power systems.

Energy transition is another key driver. With solar and wind energy gaining traction, copper demand is climbing, as these renewable systems rely heavily on copper for inverters, transformers, and wiring. Governments around the world are investing in grid modernization, smart grid technologies, and off-grid electrification all of which increase the need for copper-based solutions. These structural shifts in global energy and transport systems are reinforcing long-term demand for refined copper.

Despite positive momentum, the refined copper market faces several constraints. One of the primary challenges is price volatility, influenced by supply-demand imbalances, geopolitical factors, and speculative trading. These fluctuations can affect procurement strategies and slow down investment decisions across industries reliant on copper.

Environmental concerns related to mining activities also create regulatory hurdles. Copper extraction is water- and energy-intensive, often associated with land degradation and pollution risks. As environmental standards become more stringent, mining operations may face higher compliance costs, delays, or even operational shutdowns. This affects both raw material availability and market prices for refined copper. Supply chain disruptions, particularly in mining-intensive regions, pose additional risks. Political instability, labor strikes, and logistical issues can delay production and exports. Furthermore, in some parts of the world, limited access to efficient recycling infrastructure restricts the volume of secondary copper available, placing additional pressure on primary resources.

Opportunities in the refined copper market are closely tied to sustainability, innovation, and resource management. The rise of smart cities and the digital economy presents fresh use cases for copper, especially in telecommunications, IoT infrastructure, and data center development. High-performance copper wiring supports the growing need for reliable connectivity and fast data transmission.

Recycling also presents a major growth avenue. Secondary production of copper (from scrap) is gaining policy support as countries push toward circular economy goals. This reduces environmental stress and energy costs associated with primary mining. Urban mining extracting valuable materials from e-waste is also gaining interest, especially in regions with limited natural resources but high levels of electronic waste. Developing nations offer untapped market potential as they upgrade national infrastructure and expand access to electricity. Copper-intensive solutions will be critical in meeting both industrial and residential demand. Additionally, technological innovation in refining processes is enhancing purity, lowering energy use, and reducing emissions making copper even more attractive to environmentally conscious buyers.

Several major trends are shaping the future of the refined copper market. First is the steady shift toward energy-efficient and low-carbon technologies. As more nations implement net-zero targets, copper’s role in green technologies from electric grids to heat pumps will become even more central. Sustainable building designs and energy-efficient appliances are also increasing copper intensity per unit of output.

Digitalization is another key trend. The growing adoption of automation, AI, and data analytics across industries is boosting demand for copper-based components in smart electronics and industrial automation systems. Emerging tech, including electric aviation, robotics, and 5G infrastructure, could further extend copper’s applications. Finally, Asia-Pacific continues to lead in both consumption and production, driven by rapid urban growth, industrialization, and high investment in clean energy projects. However, other regions such as Latin America and Africa are also emerging as strategic players due to their rich copper reserves and improving refining capabilities.

The refined copper market is poised for steady growth in the coming years, supported by long-term structural changes across industries such as construction, renewable energy, transportation, and digital infrastructure. Copper’s unmatched conductivity and durability make it an essential material for both traditional and emerging technologies. As countries continue to invest in clean energy, smart grids, and electrification of transportation systems, refined copper will remain a key enabler of global modernization. Its role is becoming even more critical as the world transitions toward more sustainable and energy-efficient solutions.

At the same time, the market’s challenges including raw material volatility, environmental concerns, and evolving regulations require a balanced and forward-thinking approach. Increasing focus on recycling, circular economy practices, and technological innovation in refining processes are helping to mitigate some of these pressures. Regions with growing infrastructure needs and policy backing for electrification and industrialization are set to offer new opportunities for copper producers and suppliers. As industries adapt to green transformation and digitalization, refined copper will not only maintain its position but grow in relevance across multiple sectors.

| No comments yet. Be the first. |