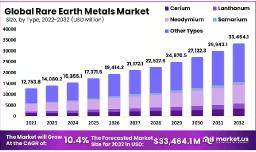

In 2022, the global Rare earth metals market was valued at approximately USD 12.75 billion. It is projected to grow steadily and reach around USD 33.46 billion by 2032, reflecting a strong compound annual growth rate (CAGR) of 10.4% over the forecast period from 2023 to 2032.

The global rare earth metals market is experiencing strong growth due to rising demand in clean energy, electronics, and advanced manufacturing. These elements like neodymium, cerium, and dysprosium are essential for technologies such as electric vehicle motors, wind turbines, smartphones, and military systems. Environmental policies and government incentives are accelerating the use of green technologies, boosting demand for rare earths. At the same time, supply chain vulnerabilities and heavy reliance on a few production countries are prompting investments in domestic mining and recycling. The market is expected to grow steadily through 2032.

Key Takeaways:

https://market.us/wp-content/uploads/2023/08/Rare-Earth-Metals-Market.jpg" alt="Rare Earth Metals Market" width="1216" height="723">

Download Exclusive Sample Of This Premium Report:

https://market.us/report/rare-earth-metals-market/free-sample/

Key Market Segments:

The rare earth metals market is being driven by the global shift towards green technologies and advanced electronics. With electric vehicles (EVs), wind turbines, and solar panels on the rise, demand for elements like neodymium and praseodymium which are vital for permanent magnets is surging.

Additionally, rare earths are integral to smartphones, medical devices, defense systems, and more, giving them a strategic importance beyond economics. Governments around the world are also supporting clean energy transitions, providing subsidies and incentives that indirectly boost rare earth usage. Rapid urbanization and technological advancement especially in developing regions further contribute to market momentum. The healthcare sector’s growing reliance on imaging technologies and lasers has added a new demand channel for specific rare earths. With sustainability and innovation accelerating, rare earth metals are positioned as essential building blocks for future technologies.

Despite the promising outlook, the rare earth metals market faces several notable challenges. A major concern is the concentration of supply most rare earth elements are produced and processed in a few countries, which creates significant supply chain vulnerabilities. Export restrictions or political tensions can lead to disruptions and price volatility.

Environmental issues also restrain the market. The mining and processing of rare earths are associated with high energy consumption, toxic waste, and water usage. In regions with strict environmental regulations, this can delay or block project approvals. The public pushback against mining projects in certain regions adds another layer of complexity. Additionally, the price instability of rare earths due to speculative trading and inconsistent production volumes makes long-term investment risky. High costs of extraction and processing technologies further limit the entry of smaller companies or nations with less capital. Until cleaner, more affordable solutions scale up, these restraints will persist.

The market presents strong opportunities in supply chain diversification. As reliance on a single country for production becomes risky, countries across North America, Europe, and Asia-Pacific are investing in domestic mining and refining projects. This opens up chances for new entrants and regional players to capture a share of the growing demand. Another opportunity lies in recycling and circular economy solutions. Extracting rare earth elements from electronic waste and used batteries not only reduces environmental impact but also creates a secondary supply stream.

Technological advancements in extraction methods like bioleaching and solvent extraction can make processing more efficient and less harmful to the environment. Moreover, as demand for miniaturized and smart electronic devices rises, rare earth elements will see increasing use in sensors, actuators, and microchips. Companies that can innovate in cleaner, more cost-effective refining technologies stand to benefit significantly from both environmental compliance and economic efficiency.

Several key trends are shaping the rare earth metals market. The most prominent is the global investment in decentralized supply chains. Countries are working on establishing local reserves, refining facilities, and strategic stockpiles to reduce dependence on foreign supply. This is creating a growing ecosystem of policy-backed exploration and refining projects.

Another trend is the increasing integration of sustainability practices in mining and processing. Companies are exploring greener extraction methods and waste management strategies to align with ESG (Environmental, Social, and Governance) goals. Innovation in recycling rare earths from discarded electronics and batteries is also gaining momentum.

Moreover, as industries like AI, 5G, electric aviation, and advanced robotics grow, so does the demand for high-performance magnetic and luminescent materials areas where rare earths are indispensable. Finally, partnerships between governments and private firms to secure rare earth availability reflect a growing recognition of their strategic importance in maintaining technological and economic leadership. The most notable is the push for localized and resilient supply chains. Governments are offering incentives and forming strategic alliances to strengthen rare earth access.

The rare earth metals market is entering a significant growth phase, driven by technological progress, clean energy transitions, and global demand for electric vehicles, wind power, and advanced electronics. These metals are vital components in modern manufacturing, healthcare equipment, and defense applications.

As the world continues to pursue sustainability and low-emission alternatives, rare earths will remain crucial for innovation and infrastructure development. Despite the opportunities, the market must navigate challenges such as supply chain concentration, environmental concerns, and regulatory complexities. Investing in domestic production, recycling initiatives, and cleaner processing technologies will be key to ensuring stable, long-term growth.

| No comments yet. Be the first. |